Region:Global

Author(s):Geetanshi

Product Code:KRAC3001

Pages:85

Published On:October 2025

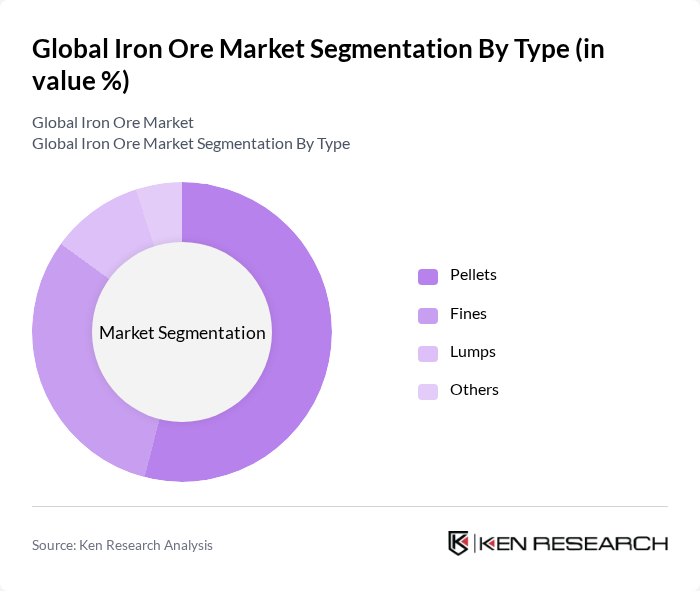

By Type:The iron ore market is segmented into fines, lumps, pellets, and others. Fines are widely used due to their suitability for steel production in blast furnaces, driven by their high iron content and efficiency in smelting operations. However, recent market data indicates that pellets have gained significant market share, reflecting a shift toward higher-grade materials and more energy-efficient steelmaking processes.

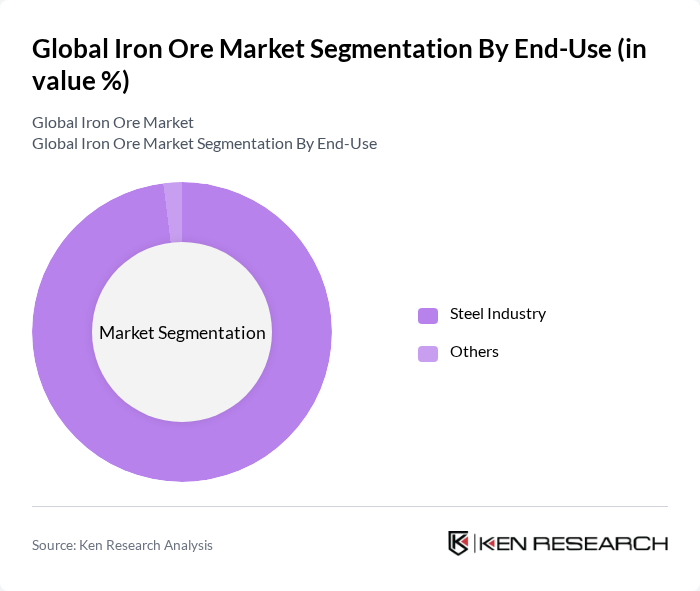

By End-Use:The primary end-use of iron ore remains the steel industry, which consumes the vast majority of global production. Steel manufacturing is essential for construction, automotive, shipbuilding, heavy machinery, and infrastructure development. Other end-uses include the production of alloys and industrial products, but these represent a minor share of total consumption.

The Global Iron Ore Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vale S.A., Rio Tinto Group, BHP Group, Fortescue Metals Group Ltd., Anglo American plc, Cleveland-Cliffs Inc., ArcelorMittal S.A., Ansteel Group Corporation Limited, HBIS Group Co., Ltd., NMDC Limited, JSW Steel Ltd., Steel Authority of India Limited (SAIL), Kumba Iron Ore Ltd., Champion Iron Limited, and Ferrexpo plc contribute to innovation, geographic expansion, and service delivery in this space.

Sources:

The future of the iron ore market appears promising, driven by ongoing demand from steel production and infrastructure development. As emerging economies continue to invest in large-scale projects, the need for iron ore will likely remain robust. Additionally, advancements in sustainable mining practices and technology will enhance operational efficiencies. However, companies must navigate regulatory challenges and price volatility to capitalize on growth opportunities effectively. Strategic investments in innovation and sustainability will be crucial for long-term success in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Fines Lumps Pellets Others |

| By End-Use | Steel Industry Others |

| By Application | Steel Manufacturing Alloy Production Foundries Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Asia-Pacific North America Europe Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Quality Grade | High-Grade Iron Ore Low-Grade Iron Ore Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Iron Ore Mining Operations | 120 | Mining Engineers, Operations Managers |

| Steel Manufacturing Sector | 100 | Production Managers, Supply Chain Directors |

| Logistics and Transportation | 80 | Logistics Coordinators, Freight Managers |

| Market Analysts and Consultants | 60 | Industry Analysts, Economic Consultants |

| Regulatory and Policy Makers | 40 | Government Officials, Environmental Regulators |

The Global Iron Ore Market is valued at approximately USD 275 billion, driven by increasing demand for steel in various sectors, including construction and automotive, alongside urbanization and industrialization, particularly in the Asia Pacific region.