Region:Global

Author(s):Dev

Product Code:KRAA1501

Pages:82

Published On:August 2025

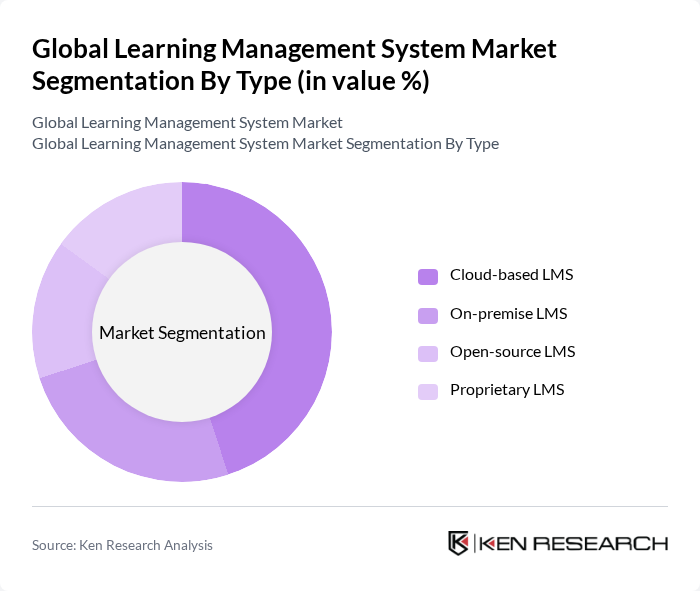

By Type:The market is segmented into various types, including Cloud-based LMS, On-premise LMS, Open-source LMS, and Proprietary LMS. Among these, Cloud-based LMS is currently the leading sub-segment due to its flexibility, scalability, and cost-effectiveness, making it a preferred choice for organizations looking to implement learning solutions without significant upfront investments. The shift to cloud-based platforms is further accelerated by the need for remote access, rapid deployment, and seamless integration with other enterprise systems .

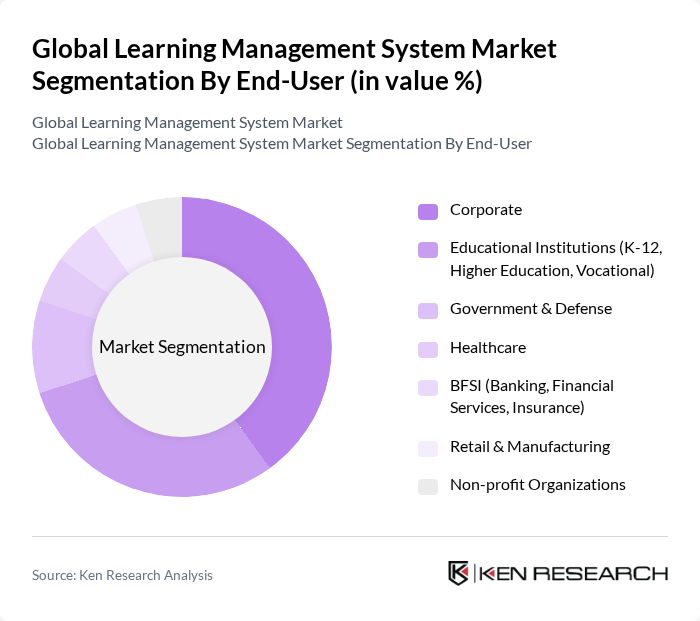

By End-User:The end-user segmentation includes Corporate, Educational Institutions (K-12, Higher Education, Vocational), Government & Defense, Healthcare, BFSI (Banking, Financial Services, Insurance), Retail & Manufacturing, and Non-profit Organizations. The Corporate segment is the most significant contributor to the market, driven by the need for continuous employee training and development in a rapidly changing business environment. This demand is further reinforced by compliance requirements, upskilling initiatives, and the need for scalable training solutions in large enterprises .

The Global Learning Management System Market is characterized by a dynamic mix of regional and international players. Leading participants such as Blackboard Inc., Moodle Pty Ltd., SAP SE, Cornerstone OnDemand Inc., TalentLMS (Epignosis LLC), Docebo Inc., Instructure Inc. (Canvas LMS), Adobe Inc., Saba Software Inc. (now part of Cornerstone OnDemand), LearnUpon Ltd., D2L Corporation (Brightspace), Skillsoft Corporation, Google Classroom, Edmodo (now part of NetDragon Websoft Holdings Limited), Anthology Inc., PowerSchool Holdings, Inc., Oracle Corporation, McGraw Hill LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the learning management system market is poised for significant transformation, driven by technological advancements and evolving learner preferences. As organizations increasingly prioritize personalized learning experiences, the integration of artificial intelligence and machine learning will enhance content delivery and learner engagement. Additionally, the shift towards hybrid learning environments will necessitate the development of more versatile platforms that cater to both in-person and remote training needs, ensuring accessibility and effectiveness in diverse educational settings.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-based LMS On-premise LMS Open-source LMS Proprietary LMS |

| By End-User | Corporate Educational Institutions (K-12, Higher Education, Vocational) Government & Defense Healthcare BFSI (Banking, Financial Services, Insurance) Retail & Manufacturing Non-profit Organizations |

| By Deployment Mode | Public Cloud Private Cloud Hybrid Cloud |

| By Application | Compliance Training Employee Onboarding Professional Development Customer Training Instructor-led Training Distance Learning Blended Learning |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Subscription-based Pay-per-use One-time license fee |

| By User Type | Individual Users Small and Medium Enterprises Large Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| K-12 Education Institutions | 100 | School Administrators, IT Directors |

| Higher Education Institutions | 80 | University Faculty, E-learning Coordinators |

| Corporate Training Programs | 60 | HR Managers, Training and Development Specialists |

| EdTech Startups | 40 | Founders, Product Managers |

| Government Education Departments | 40 | Policy Makers, Educational Consultants |

The Global Learning Management System Market is valued at approximately USD 27 billion, reflecting significant growth driven by the increasing adoption of e-learning solutions across various sectors, including corporate training and educational institutions.