Global Leather Goods Market Overview

- The Global Leather Goods Market is valued at USD 470 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand for luxury and high-quality products, a surge in premium and durable accessories, and the rising trend of sustainable and ethically sourced materials. The market has also experienced a significant shift towards online retailing, which has expanded accessibility and convenience for consumers, further accelerating global demand .

- Key players in this market include countries such as Italy, France, and China, which dominate due to their rich heritage in leather craftsmanship and fashion. Italy is recognized for its luxury brands and artisanal production, France is a hub for high-end fashion houses, and China has become a major manufacturing center, leveraging its vast production capabilities and increasing consumer demand for both domestic and international brands .

- In 2023, the European Union implemented regulations aimed at promoting sustainable practices in the leather industry. These include stricter guidelines on waste management and the use of chemicals in leather production, encouraging manufacturers to adopt eco-friendly processes and materials, thereby enhancing the overall sustainability of the leather goods market .

Global Leather Goods Market Segmentation

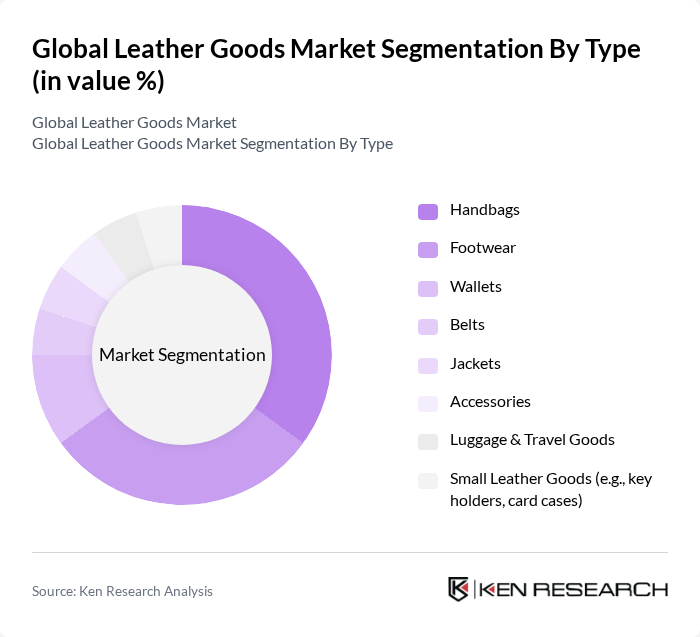

By Type:The leather goods market is segmented into various types, including handbags, footwear, wallets, belts, jackets, accessories, luggage & travel goods, and small leather goods. Among these, footwear and handbags are the most dominant segments, driven by evolving fashion trends, increased consumer spending on premium products, and a preference for stylish yet functional items. Handbags, in particular, have seen a surge in demand due to their dual role as fashion statements and practical accessories .

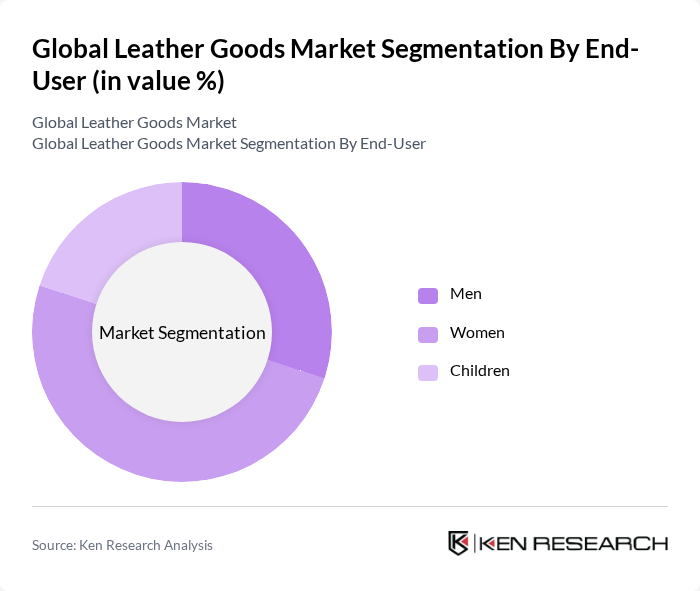

By End-User:The market is segmented by end-user into men, women, and children. Women represent the largest segment, primarily due to higher spending on fashion and accessories. The increasing trend of gender-neutral and unisex fashion is also contributing to the growth of the men's segment, while the children's segment is expanding as parents invest in quality leather goods for their children .

Global Leather Goods Market Competitive Landscape

The Global Leather Goods Market is characterized by a dynamic mix of regional and international players. Leading participants such as LVMH Moët Hennessy Louis Vuitton, Kering S.A., Hermès International S.A., Prada S.p.A., Coach, Inc. (Tapestry, Inc.), Michael Kors Holdings Limited (Capri Holdings Limited), Tapestry, Inc., Burberry Group plc, Fossil Group, Inc., Compagnie Financière Richemont S.A., Samsonite International S.A., Deckers Outdoor Corporation, Mulberry Group plc, Tod's S.p.A., Bally International AG, Wolverine World Wide, Inc., VF Corporation, Adidas AG, Puma SE, and Bata Corporation contribute to innovation, geographic expansion, and service delivery in this space .

Global Leather Goods Market Industry Analysis

Growth Drivers

- Increasing Demand for Sustainable Products:The global leather goods market is witnessing a significant shift towards sustainability, with 60% of consumers in a recent survey indicating a preference for eco-friendly products. This trend is driven by heightened awareness of environmental issues, with the global sustainable fashion market projected to reach $8.5 billion in future. Companies that adopt sustainable practices are likely to capture a larger market share, as consumers increasingly prioritize ethical sourcing and production methods.

- Rising Disposable Income:In future, global disposable income is expected to rise by approximately $1,200 per capita, particularly in emerging markets. This increase is fueling consumer spending on luxury leather goods, with the luxury goods market projected to grow to $1.6 trillion in future. As consumers have more disposable income, they are more inclined to invest in high-quality leather products, driving demand and expanding market opportunities for brands that cater to this demographic.

- Growth of E-commerce Platforms:E-commerce sales in the leather goods sector are projected to reach $120 billion in future, reflecting a 25% increase from the previous year. The convenience of online shopping and the rise of digital marketing strategies are enabling brands to reach a broader audience. This growth is particularly pronounced in regions with increasing internet penetration, where consumers are more likely to purchase leather goods online, thus enhancing overall market accessibility and sales.

Market Challenges

- Fluctuating Raw Material Prices:The leather goods industry faces significant challenges due to the volatility of raw material prices, particularly hides and skins. In future, the price of cowhide is expected to fluctuate between $1.60 and $2.10 per square foot, influenced by supply chain disruptions and changing demand. This unpredictability can lead to increased production costs, impacting profit margins for manufacturers and retailers in the leather goods market.

- Competition from Synthetic Alternatives:The rise of synthetic leather alternatives, which are often cheaper and more versatile, poses a significant challenge to traditional leather goods. In future, the synthetic leather market is projected to reach $35 billion, driven by advancements in technology and consumer preferences for cruelty-free products. This competition forces traditional leather brands to innovate and adapt their offerings to maintain market relevance and consumer interest.

Global Leather Goods Market Future Outlook

The future of the leather goods market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a core value for consumers, brands that prioritize eco-friendly practices are likely to thrive. Additionally, the integration of smart technology into leather products, such as wearable tech, is expected to attract tech-savvy consumers. The market will also benefit from the expansion of e-commerce, allowing brands to reach a wider audience and adapt to changing shopping behaviors.

Market Opportunities

- Growth in Emerging Markets:Emerging markets, particularly in Asia and Africa, present significant growth opportunities for leather goods. With a combined population of over 3.5 billion and rising middle-class income levels, these regions are expected to see a surge in demand for luxury leather products, estimated to increase by 18% annually through future.

- Customization and Personalization Trends:The demand for personalized leather goods is on the rise, with consumers willing to pay up to 25% more for customized products. This trend is driven by the desire for unique items that reflect individual style, presenting an opportunity for brands to differentiate themselves and enhance customer loyalty through tailored offerings.