Region:Middle East

Author(s):Geetanshi

Product Code:KRAB1108

Pages:86

Published On:January 2026

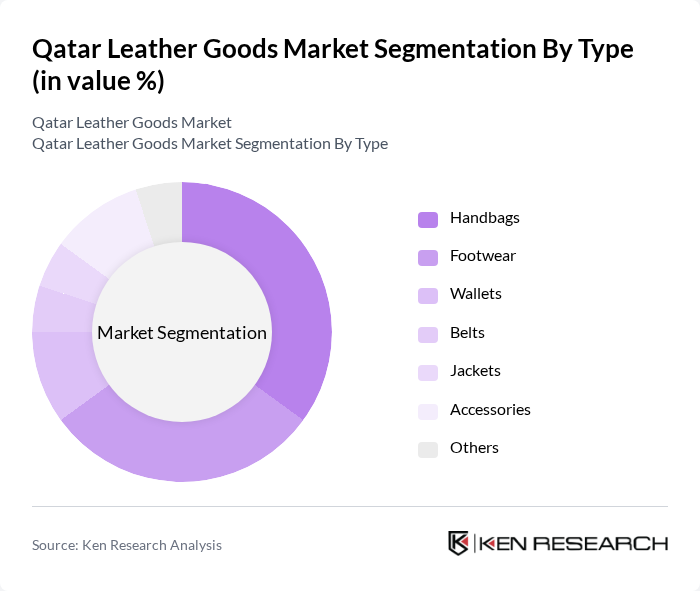

By Type:The leather goods market in Qatar is segmented into various types, including handbags, footwear, wallets, belts, jackets, accessories, and others. Among these, handbags and footwear are the most dominant segments, driven by consumer preferences for stylish and functional products. Handbags, in particular, have seen a surge in demand due to their association with luxury and status, while footwear remains essential for both casual and formal occasions.

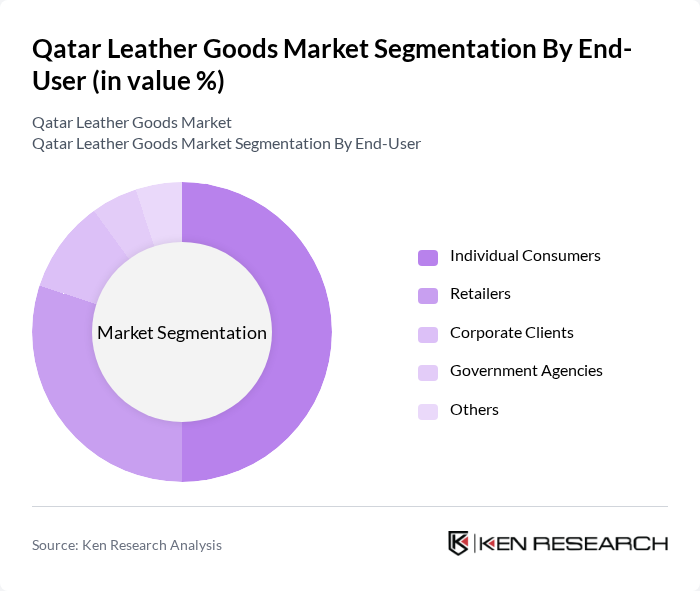

By End-User:The end-user segmentation of the leather goods market includes individual consumers, retailers, corporate clients, government agencies, and others. Individual consumers represent the largest segment, driven by the growing trend of luxury consumption among affluent Qatari citizens and expatriates. Retailers also play a significant role, as they cater to the increasing demand for high-quality leather products in the retail environment.

The Qatar Leather Goods Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Hariri Leather, Al Jazeera Leather Company, Qatar Leather Industries, and Al Mufeed Leather contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar leather goods market appears promising, driven by digitalization and a growing emphasis on sustainability. The country's focus on leveraging technology for retail and e-commerce is expected to enhance market accessibility. Additionally, the increasing consumer awareness regarding sustainable practices will likely push brands to adopt eco-friendly materials and ethical production methods, aligning with global trends. This dual focus on innovation and sustainability will shape the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Handbags Footwear Wallets Belts Jackets Accessories Others |

| By End-User | Individual Consumers Retailers Corporate Clients Government Agencies Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Wholesale Others |

| By Price Range | Luxury Mid-range Budget Others |

| By Material | Genuine Leather Synthetic Leather Recycled Leather Others |

| By Consumer Demographics | Age Group Gender Income Level Others |

| By Occasion | Casual Wear Formal Wear Sports and Outdoor Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Leather Goods | 150 | Fashion-conscious Consumers, General Public |

| Retail Sector Insights | 100 | Store Managers, Retail Buyers |

| Manufacturing Insights | 80 | Production Managers, Quality Control Officers |

| Market Trends and Innovations | 70 | Fashion Designers, Trend Analysts |

| Export and Import Dynamics | 60 | Logistics Managers, Trade Compliance Officers |

The Qatar Leather Goods Market is valued at approximately USD 1.2 billion, reflecting a robust growth trajectory driven by increasing disposable incomes and a rising demand for luxury and premium craftsmanship among consumers.