Region:Global

Author(s):Dev

Product Code:KRAA3029

Pages:84

Published On:August 2025

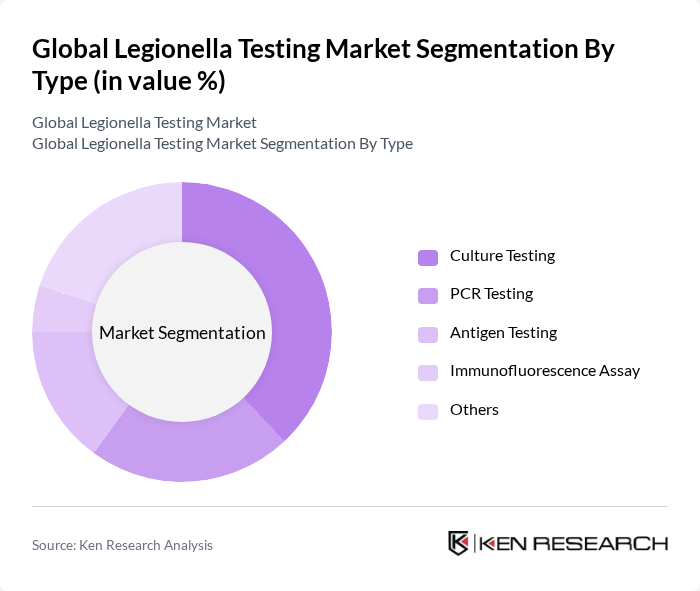

By Type:The Legionella testing market is segmented into various types, including Culture Testing, PCR Testing, Antigen Testing, Immunofluorescence Assay, and Others. Among these, PCR Testing is gaining traction due to its rapid results and high sensitivity, making it a preferred choice in clinical diagnostics and environmental monitoring. Culture-based methods remain widely used for regulatory compliance, while antigen and immunofluorescence assays are utilized for specific detection needs .

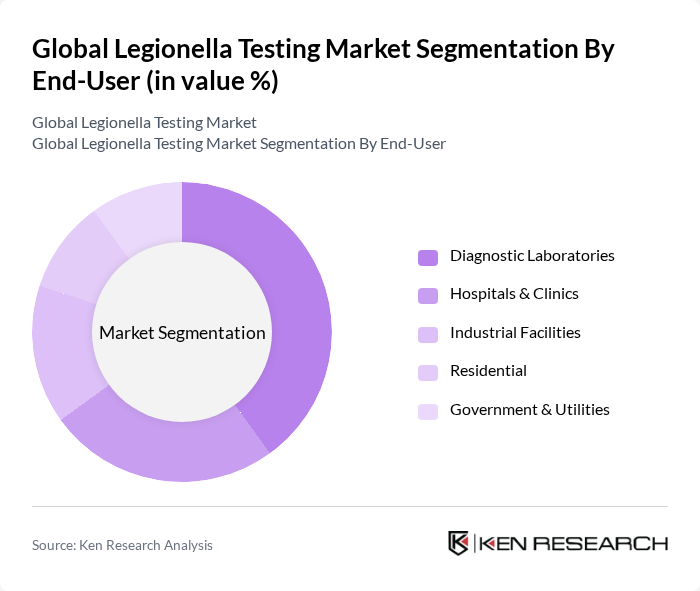

By End-User:The market is further segmented by end-users, including Diagnostic Laboratories, Hospitals & Clinics, Industrial Facilities, Residential, and Government & Utilities. Diagnostic Laboratories are leading the market due to their essential role in disease detection and monitoring, coupled with the increasing number of testing facilities worldwide. Hospitals & Clinics are also significant contributors, especially in outbreak management and patient care .

The Global Legionella Testing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories, Beckman Coulter, Inc., BD (Becton, Dickinson and Company), Bio-Rad Laboratories, Inc., BIOMÉRIEUX S.A., Eiken Chemical Co., Ltd., Hologic, Inc., Pro-Lab Diagnostics Inc., QIAGEN N.V., F. Hoffmann-La Roche Ltd., Takara Bio Inc., Thermo Fisher Scientific Inc., IDEXX Laboratories, Inc., Eurofins Scientific SE, Merck KGaA, Agilent Technologies, Inc., PerkinElmer, Inc., SGS S.A., ALS Limited, Intertek Group plc, Pace Analytical Services, LLC, Neogen Corporation, LabCorp, Charles River Laboratories International, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Legionella testing market appears promising, driven by increasing regulatory scrutiny and technological advancements. As governments enhance water quality standards, the demand for reliable testing solutions will rise. Additionally, the integration of IoT technologies in water monitoring systems is expected to facilitate real-time data collection, improving response times to contamination events. These trends indicate a robust growth trajectory for the market, emphasizing the importance of innovation and compliance in ensuring public health.

| Segment | Sub-Segments |

|---|---|

| By Type | Culture Testing PCR Testing Antigen Testing Immunofluorescence Assay Others |

| By End-User | Diagnostic Laboratories Hospitals & Clinics Industrial Facilities Residential Government & Utilities |

| By Application | Water Testing In Vitro Diagnostics (IVD) Testing Air Testing Surface Testing Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Testing Method | Laboratory Testing On-Site Testing Remote Monitoring Others |

| By Sample Type | Water Samples Biofilm Samples Air Samples Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Facilities Testing | 100 | Infection Control Managers, Laboratory Directors |

| Industrial Water Systems | 60 | Environmental Compliance Officers, Facility Managers |

| Municipal Water Supply | 90 | Public Health Officials, Water Quality Analysts |

| Research Laboratories | 50 | Microbiologists, Research Scientists |

| Educational Institutions | 40 | Lab Instructors, Environmental Science Professors |

The Global Legionella Testing Market is valued at approximately USD 370 million, driven by increasing awareness of waterborne diseases, stringent regulations on water quality, and the rising incidence of Legionnaires' disease.