Region:Middle East

Author(s):Rebecca

Product Code:KRAC4024

Pages:95

Published On:October 2025

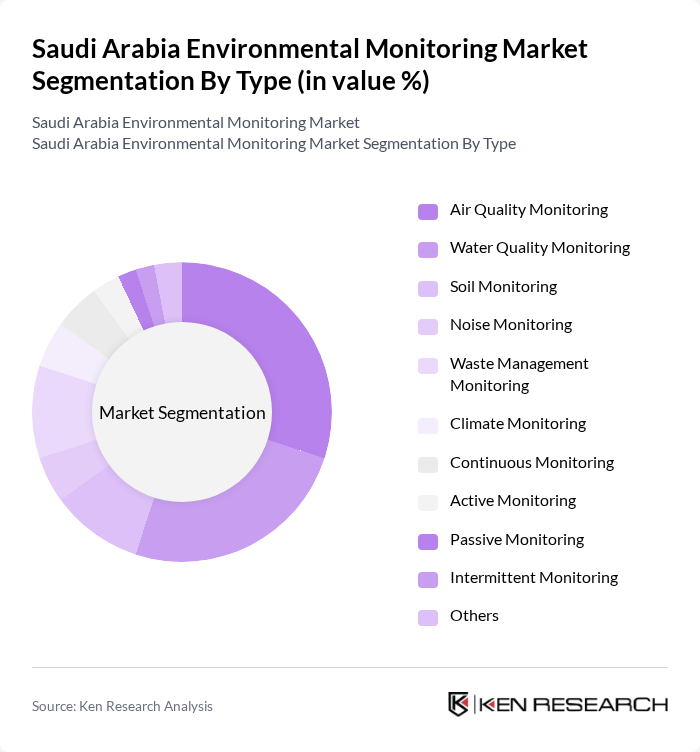

By Type:The market is segmented into various types of environmental monitoring solutions, including air quality monitoring, water quality monitoring, soil monitoring, noise monitoring, waste management monitoring, climate monitoring, continuous monitoring, active monitoring, passive monitoring, intermittent monitoring, and others. Among these, air quality monitoring and water quality monitoring are the most prominent due to increasing pollution levels, stricter emission standards, and the critical need for clean water resources. The adoption of real-time monitoring solutions and integration with digital platforms is accelerating growth in these segments .

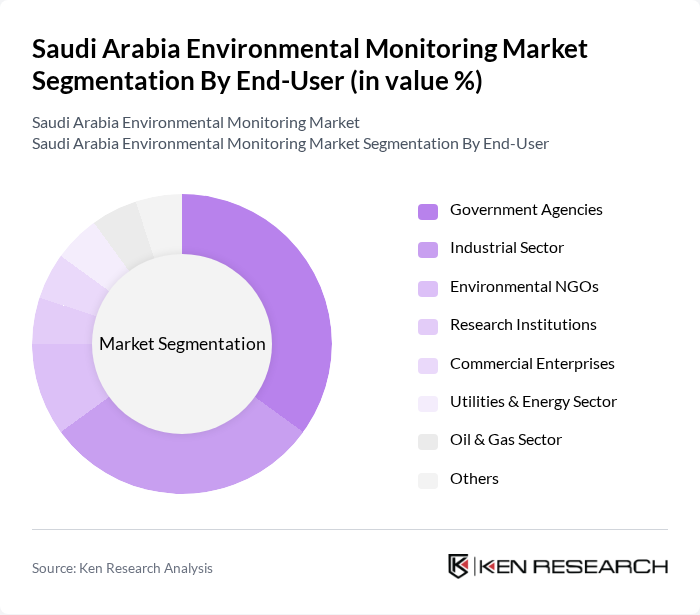

By End-User:The environmental monitoring market is also segmented by end-users, which include government agencies, the industrial sector, environmental NGOs, research institutions, commercial enterprises, utilities and energy sector, oil and gas sector, and others. Government agencies and the industrial sector are the leading end-users, driven by regulatory compliance, sustainability mandates, and the need for robust environmental risk management. The utilities and energy sector, along with oil and gas, are increasingly adopting advanced monitoring systems to address emission controls and resource optimization .

The Saudi Arabia Environmental Monitoring Market is characterized by a dynamic mix of regional and international players. Leading participants such as National Center for Environmental Compliance (NCEC), Saudi Environmental Monitoring Company (SEMC), Al-Falak Electronic Equipment & Supplies Co., Environmental Monitoring Solutions LLC, Saudi Arabian Oil Company (Saudi Aramco), National Water Company (NWC), King Abdulaziz City for Science and Technology (KACST), Saudi Environmental Society, Advanced Environmental Monitoring Systems (AEMS), Environmental Protection Department, Ministry of Environment, Water and Agriculture, Saudi Green Initiative, Saudi Arabian Standards, Metrology and Quality Organization (SASO), Environmental Research Institute, King Abdulaziz University, Arabian Environmental Science Company (ARENSCO), SGS (Société Générale de Surveillance) Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the environmental monitoring market in Saudi Arabia appears promising, driven by ongoing government initiatives and technological advancements. As the nation continues to prioritize sustainability, investments in smart city projects and renewable energy are expected to rise significantly in future. Furthermore, the integration of artificial intelligence and IoT technologies will enhance monitoring capabilities, allowing for more efficient data collection and analysis. This evolving landscape will create new opportunities for businesses to innovate and expand their environmental monitoring solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Air Quality Monitoring Water Quality Monitoring Soil Monitoring Noise Monitoring Waste Management Monitoring Climate Monitoring Continuous Monitoring Active Monitoring Passive Monitoring Intermittent Monitoring Others |

| By End-User | Government Agencies Industrial Sector Environmental NGOs Research Institutions Commercial Enterprises Utilities & Energy Sector Oil & Gas Sector Others |

| By Application | Regulatory Compliance Environmental Impact Assessment Research and Development Public Awareness Campaigns Industrial Emissions Monitoring Wastewater/Effluent Monitoring Others |

| By Investment Source | Government Funding Private Sector Investment International Aid Public-Private Partnerships Others |

| By Policy Support | Subsidies for Monitoring Equipment Tax Incentives for Green Initiatives Grants for Research Projects Regulatory Support for Compliance Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Retail Outlets Others |

| By Technology | Remote Sensing Technology In-Situ Monitoring Technology Mobile Monitoring Solutions Data Analytics Platforms IoT-Based Monitoring Systems Real-Time Monitoring Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Environmental Agencies | 100 | Environmental Policy Makers, Regulatory Officers |

| Industrial Sector Monitoring | 70 | Environmental Compliance Managers, Operations Directors |

| Academic Research Institutions | 50 | Environmental Scientists, Research Professors |

| Technology Providers | 60 | Product Managers, Sales Directors |

| NGOs and Advocacy Groups | 40 | Program Directors, Policy Analysts |

The Saudi Arabia Environmental Monitoring Market is valued at approximately USD 215 million, reflecting a significant growth driven by regulatory requirements, public awareness of environmental issues, and the need for sustainable development practices.