Region:Middle East

Author(s):Rebecca

Product Code:KRAB7035

Pages:99

Published On:October 2025

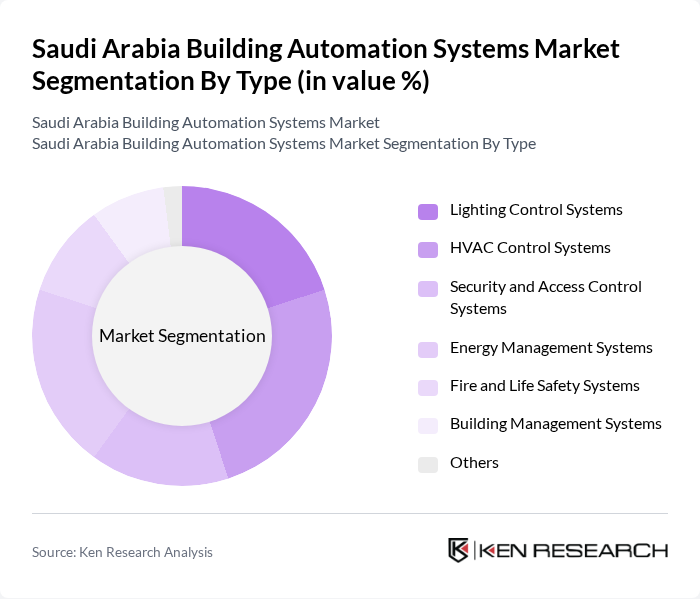

By Type:The market is segmented into various types of building automation systems, including Lighting Control Systems, HVAC Control Systems, Security and Access Control Systems, Energy Management Systems, Fire and Life Safety Systems, Building Management Systems, and Others. Each of these sub-segments plays a crucial role in enhancing the efficiency and safety of buildings.

The HVAC Control Systems segment is currently dominating the market due to the increasing focus on energy efficiency and climate control in buildings. With the rise in temperature and the need for comfortable indoor environments, HVAC systems have become essential in both residential and commercial sectors. Additionally, advancements in smart HVAC technologies, such as IoT integration and automation, are driving their adoption. The growing awareness of energy conservation and sustainability further supports the demand for these systems.

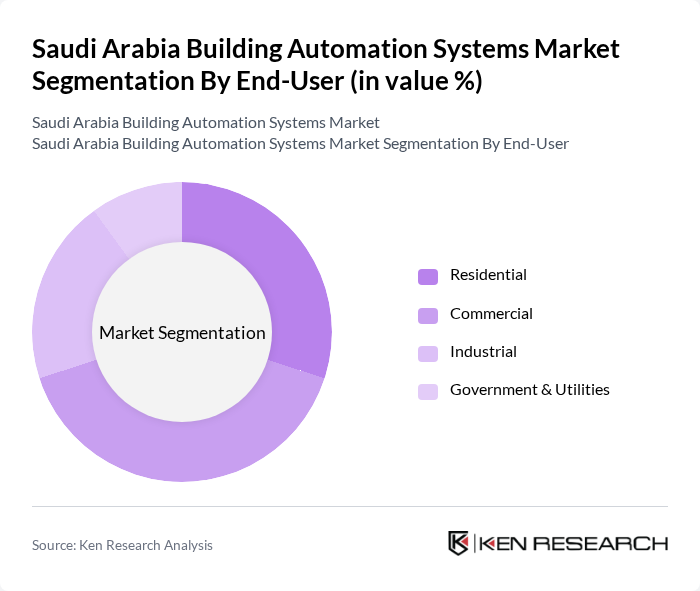

By End-User:The market is segmented by end-user into Residential, Commercial, Industrial, and Government & Utilities. Each segment has unique requirements and applications for building automation systems, driven by the need for efficiency, security, and sustainability.

The Commercial segment is leading the market due to the increasing number of office buildings, retail spaces, and hospitality establishments that require advanced automation systems for energy management and security. The growing trend of smart buildings in urban areas is also contributing to the demand for building automation solutions in commercial settings. Furthermore, the need for enhanced operational efficiency and reduced operational costs in commercial properties is driving the adoption of these systems.

The Saudi Arabia Building Automation Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Honeywell International Inc., Schneider Electric SE, Johnson Controls International plc, ABB Ltd., Trane Technologies plc, Legrand S.A., Lutron Electronics Co., Inc., Delta Controls, Crestron Electronics, Inc., KMC Controls, Ingersoll Rand plc, BuildingIQ, Control4 Corporation, Distech Controls contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia building automation systems market appears promising, driven by technological advancements and government support for smart city initiatives. As urbanization accelerates, the integration of IoT and AI technologies will enhance building management efficiency. Additionally, the focus on sustainability will likely lead to increased investments in energy-efficient solutions. In future, the market is expected to witness significant growth, with a shift towards cloud-based systems and enhanced cybersecurity measures becoming essential for protecting sensitive data and infrastructure.

| Segment | Sub-Segments |

|---|---|

| By Type | Lighting Control Systems HVAC Control Systems Security and Access Control Systems Energy Management Systems Fire and Life Safety Systems Building Management Systems Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Smart Buildings Retail Spaces Healthcare Facilities Educational Institutions |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Retail Distribution Wholesale Distribution E-commerce |

| By Price Range | Low Price Mid Price High Price |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Automation | 100 | Facility Managers, Building Owners |

| Residential Smart Home Solutions | 80 | Homeowners, Real Estate Developers |

| Industrial Automation Systems | 70 | Operations Managers, Plant Engineers |

| Energy Management Systems | 60 | Energy Managers, Sustainability Officers |

| Integration of IoT in Building Management | 90 | IT Managers, Technology Integrators |

The Saudi Arabia Building Automation Systems Market is valued at approximately USD 1.2 billion, driven by the demand for energy-efficient solutions, smart buildings, and government initiatives focused on infrastructure and urban development.