Region:Global

Author(s):Rebecca

Product Code:KRAB0253

Pages:93

Published On:August 2025

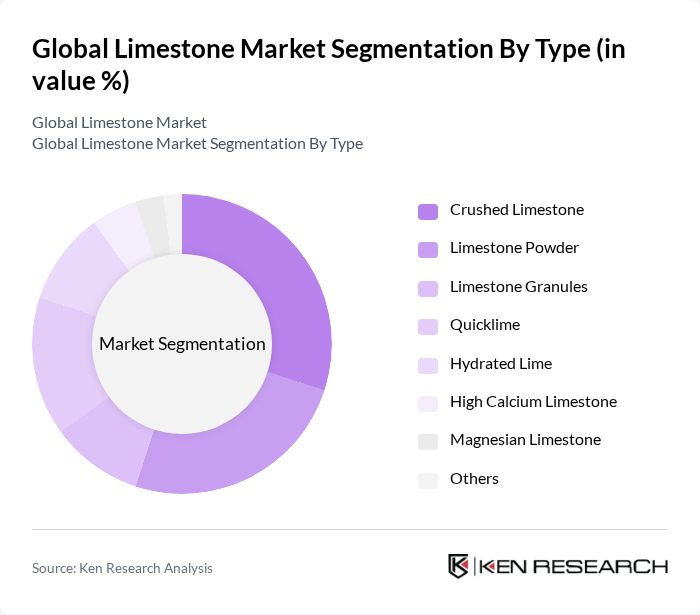

By Type:The limestone market can be segmented into various types, including Crushed Limestone, Limestone Powder, Limestone Granules, Quicklime, Hydrated Lime, High Calcium Limestone, Magnesian Limestone, and Others. Each type serves distinct applications across industries, influencing their market dynamics. Crushed limestone and limestone powder are primarily used in construction and cement manufacturing, while quicklime and hydrated lime serve industrial and chemical applications. High calcium and magnesian limestone are preferred for specific industrial processes and soil conditioning in agriculture .

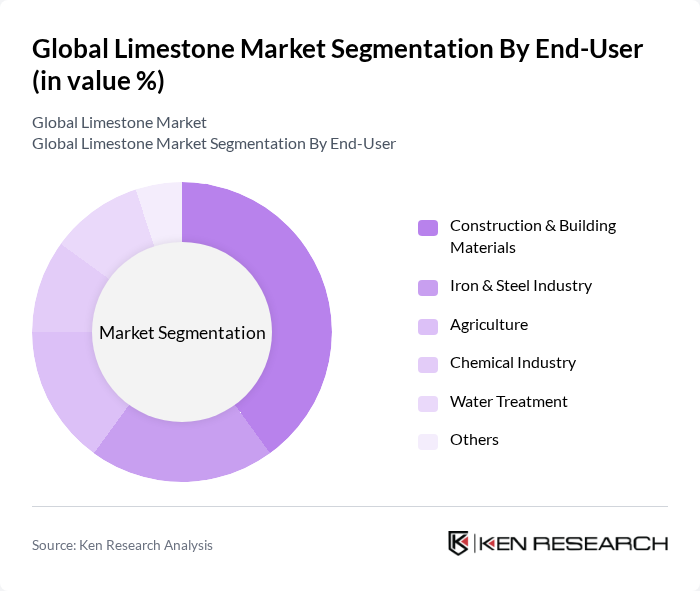

By End-User:The limestone market is also segmented by end-user industries, which include Construction & Building Materials, Iron & Steel Industry, Agriculture, Chemical Industry, Water Treatment, and Others. Construction & building materials account for the largest share, as limestone is essential for cement and concrete production. The iron & steel industry utilizes limestone for fluxing in blast furnaces, while agriculture uses it for soil conditioning and pH regulation. Chemical and water treatment sectors rely on limestone for purification and neutralization processes .

The Global Limestone Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lhoist Group, Carmeuse, Graymont, Heidelberg Materials AG, Martin Marietta Materials, Inc., U.S. Lime & Minerals, Inc., Mississippi Lime Company, Omya AG, Schaefer Kalk GmbH & Co. KG, Tarmac (CRH plc), Aggregate Industries (Holcim Group), CEMEX S.A.B. de C.V., Boral Limited, Sibelco, Imerys S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The limestone market is poised for transformative growth, driven by sustainability trends and technological advancements. As industries increasingly adopt eco-friendly practices, the demand for limestone in carbon capture technologies is expected to rise. Additionally, the integration of digital tools in supply chain management will enhance operational efficiency. These trends indicate a shift towards more sustainable and innovative practices, positioning the limestone market for resilience and adaptability in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Crushed Limestone Limestone Powder Limestone Granules Quicklime Hydrated Lime High Calcium Limestone Magnesian Limestone Others |

| By End-User | Construction & Building Materials Iron & Steel Industry Agriculture Chemical Industry Water Treatment Others |

| By Application | Cement Production Glass Manufacturing Steel Production Soil Stabilization Flue Gas Desulfurization Road Base & Aggregates Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Medium Price High Price |

| By Quality Grade | High Purity Standard Grade Low Grade |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Usage | 100 | Project Managers, Procurement Officers |

| Industrial Applications | 80 | Manufacturing Engineers, Operations Managers |

| Agricultural Sector Demand | 60 | Agronomists, Farm Managers |

| Environmental Impact Studies | 50 | Environmental Scientists, Policy Analysts |

| Export Market Insights | 40 | Export Managers, Trade Analysts |

The global limestone market is valued at approximately USD 79 billion, driven by increasing demand in construction, agriculture, and industrial applications. This valuation is based on a five-year historical analysis of market trends and growth factors.