Region:Asia

Author(s):Rebecca

Product Code:KRAD7498

Pages:82

Published On:December 2025

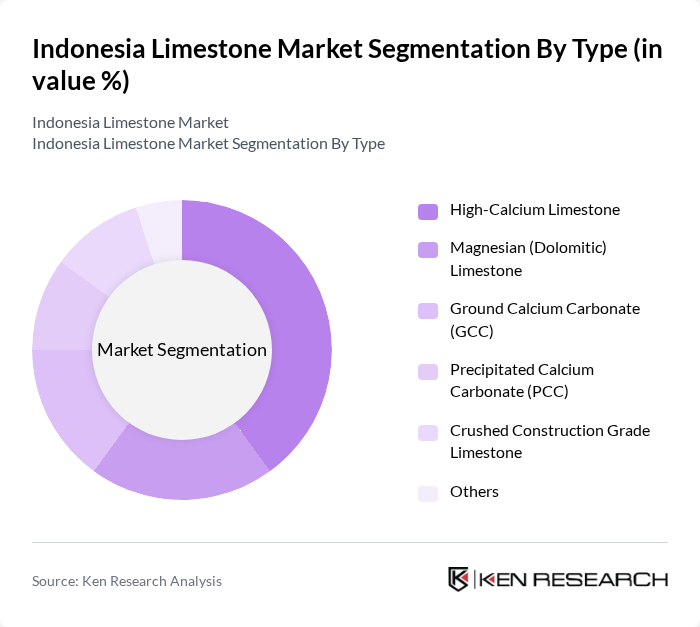

By Type:The limestone market can be segmented into various types, including High-Calcium Limestone, Magnesian (Dolomitic) Limestone, Ground Calcium Carbonate (GCC), Precipitated Calcium Carbonate (PCC), Crushed Construction Grade Limestone, and Others. Among these, High-Calcium Limestone is the most dominant due to its extensive use in cement production and as a filler in various industrial applications, reflecting its position as the largest product segment in Indonesia. The demand for High-Calcium Limestone is driven by the construction industry's growth, robust cement demand, and the increasing need for quality raw materials in building and infrastructure projects.

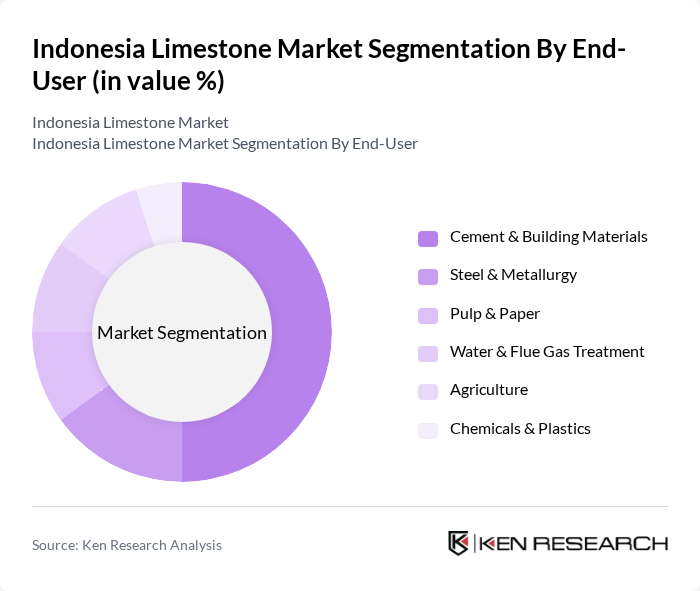

By End-User:The limestone market is segmented by end-user applications, including Cement & Building Materials, Steel & Metallurgy, Pulp & Paper, Water & Flue Gas Treatment, Agriculture, Chemicals & Plastics, and Others. The Cement & Building Materials segment holds the largest share, supported by Indonesia’s significant cement production capacity and ongoing public and private construction programs. The increasing number of infrastructure projects, such as roads, ports, and housing, together with urbanization-driven residential developments, has led to a surge in demand for cement, which in turn drives the need for limestone as a key raw material.

The Indonesia Limestone Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Semen Indonesia (Persero) Tbk, PT Indocement Tunggal Prakarsa Tbk, PT Solusi Bangun Indonesia Tbk (Holcim Indonesia), PT Semen Baturaja (Persero) Tbk, PT Semen Padang, PT Semen Tonasa, PT Holcim Indonesia Operations (Holcim Group), PT Conch Cement Indonesia, PT Batu Gamping Nusantara, PT Harapan Nusantara Lestari, PT Bumi Sari Prima, PT Bukit Batu Semen, PT Dwi Selo Giri Mas, PT Mitra Rimba Raya, PT Tiga Roda Limestone contribute to innovation, geographic expansion, and service delivery in this space.

The Indonesia limestone market is poised for significant growth, driven by increasing construction activities and government infrastructure investments. As urbanization accelerates, the demand for high-quality limestone will rise, particularly in urban centers. However, producers must navigate challenges such as environmental regulations and competition from alternative materials. Embracing sustainable practices and technological advancements will be crucial for market players to thrive in this evolving landscape, ensuring they meet both regulatory requirements and consumer expectations for eco-friendly products.

| Segment | Sub-Segments |

|---|---|

| By Type | High-Calcium Limestone Magnesian (Dolomitic) Limestone Ground Calcium Carbonate (GCC) Precipitated Calcium Carbonate (PCC) Crushed Construction Grade Limestone Others |

| By End-User | Cement & Building Materials Steel & Metallurgy Pulp & Paper Water & Flue Gas Treatment Agriculture Chemicals & Plastics Others |

| By Application | Construction-Based Lime & Aggregates Industrial Lime (Quicklime & Hydrated Lime) Chemical & Refractory Lime Agricultural Lime Fillers & Pigments (GCC/PCC) Others |

| By Distribution Channel | Direct Sales to Cement & Industrial Users Traders & Aggregator Networks Construction Materials Distributors Export Channels Others |

| By Quality Grade | High Purity (Industrial & Chemical Grade) Medium Purity (Construction Grade) Low Purity (Fill & Backfill Grade) Others |

| By Region | Java Sumatra Kalimantan Sulawesi Others (Including Nusa Tenggara, Maluku, Papua) |

| By Market Structure | Integrated Cement & Lime Producers Standalone Quarry & Lime Producers Small-Scale & Informal Operators Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cement Manufacturing Sector | 120 | Production Managers, Procurement Officers |

| Construction Industry | 100 | Project Managers, Site Engineers |

| Agricultural Lime Users | 80 | Farm Managers, Agricultural Consultants |

| Industrial Applications | 70 | Operations Managers, Product Development Heads |

| Environmental and Regulatory Bodies | 50 | Environmental Officers, Policy Makers |

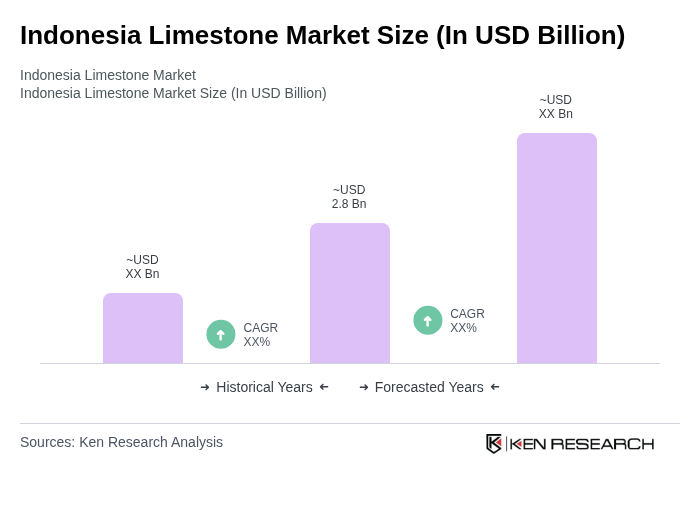

The Indonesia Limestone Market is valued at approximately USD 2.8 billion, driven by increasing demand in construction, cement production, and agriculture, alongside the expansion of infrastructure projects and urbanization in the country.