Region:Global

Author(s):Dev

Product Code:KRAA3017

Pages:92

Published On:August 2025

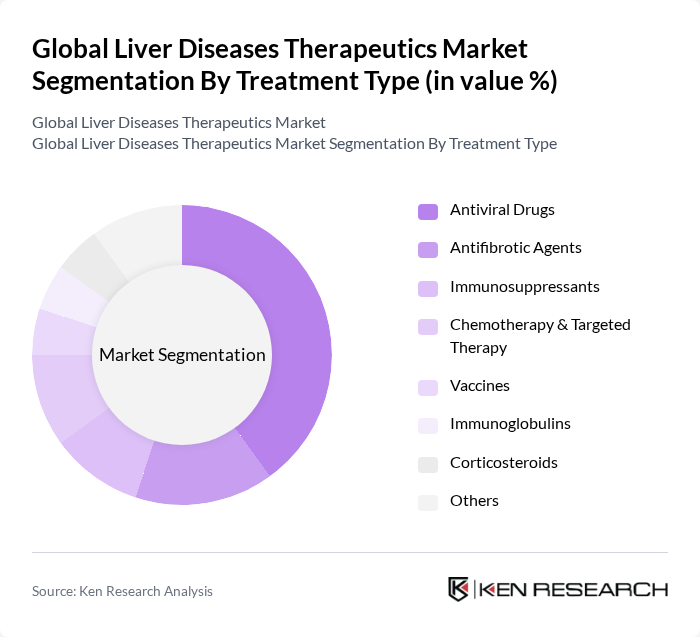

By Treatment Type:The treatment type segmentation includes antiviral drugs, antifibrotic agents, immunosuppressants, chemotherapy & targeted therapy, vaccines, immunoglobulins, corticosteroids, and others. Among these,antiviral drugsare currently leading the market due to their effectiveness in treating viral hepatitis, particularly hepatitis B and C, which remain major causes of liver disease globally. The rising incidence of these infections, coupled with the introduction of novel direct-acting antivirals and combination therapies, has driven demand for these treatments and positioned them as a focal point for pharmaceutical innovation .

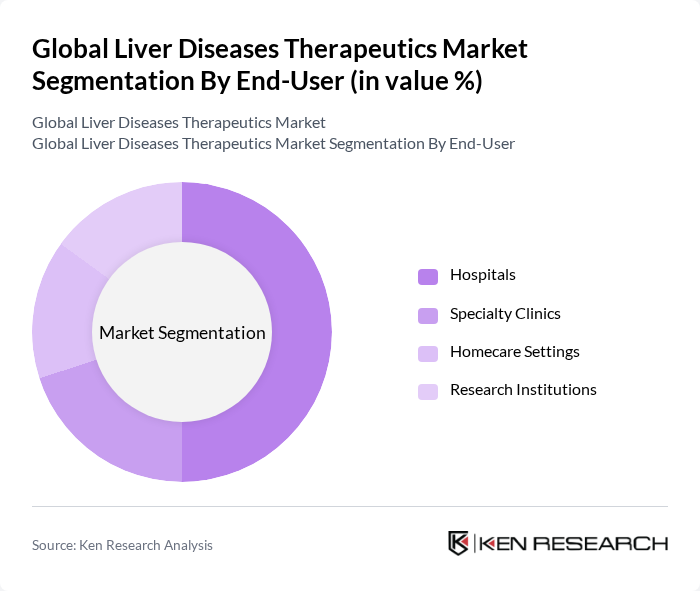

By End-User:The end-user segmentation encompasses hospitals, specialty clinics, homecare settings, and research institutions.Hospitalsare the leading end-user segment, primarily due to their capacity to provide comprehensive care, advanced treatment modalities, and access to specialized liver disease units. The increasing number of hospital admissions for liver-related conditions and the availability of multidisciplinary expertise further contribute to the dominance of this segment .

The Global Liver Diseases Therapeutics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gilead Sciences, Inc., AbbVie Inc., Merck & Co., Inc., Bristol-Myers Squibb Company, Novartis AG, F. Hoffmann-La Roche AG, Johnson & Johnson (Janssen Pharmaceuticals), Amgen Inc., Intercept Pharmaceuticals, Inc., Vertex Pharmaceuticals Incorporated, Dicerna Pharmaceuticals, Inc., Zymeworks Inc., Eiger BioPharmaceuticals, Inc., Hepion Pharmaceuticals, Inc., Galmed Pharmaceuticals Ltd., Madrigal Pharmaceuticals, Inc., Viking Therapeutics, Inc., Alnylam Pharmaceuticals, Inc., CymaBay Therapeutics, Inc., Takeda Pharmaceutical Company Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of liver disease therapeutics in None appears promising, driven by ongoing research and technological advancements. The integration of personalized medicine is expected to enhance treatment efficacy, while digital health solutions will facilitate better patient management. Additionally, the rise of telemedicine is likely to improve access to care, particularly in underserved areas. These trends indicate a shift towards more effective and accessible liver disease management strategies, ultimately improving patient outcomes in the region.

| Segment | Sub-Segments |

|---|---|

| By Treatment Type | Antiviral Drugs Antifibrotic Agents Immunosuppressants Chemotherapy & Targeted Therapy Vaccines Immunoglobulins Corticosteroids Others |

| By End-User | Hospitals Specialty Clinics Homecare Settings Research Institutions |

| By Route of Administration | Oral Injectable Transdermal |

| By Disease Type | Hepatitis (A, B, C, D, E) Non-Alcoholic Fatty Liver Disease (NAFLD) / Metabolic Dysfunction-Associated Steatotic Liver Disease (MASLD) Alcoholic Liver Disease Liver Cancer (Hepatocellular Carcinoma, Cholangiocarcinoma) Autoimmune Liver Diseases (e.g., Autoimmune Hepatitis, Primary Biliary Cholangitis, Primary Sclerosing Cholangitis) Genetic/Metabolic Liver Diseases (e.g., Wilson’s Disease, Hemochromatosis) |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Patient Demographics | Adults Pediatric Geriatric |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hepatitis C Treatment Insights | 60 | Hepatologists, Infectious Disease Specialists |

| Non-Alcoholic Fatty Liver Disease (NAFLD) Management | 50 | Primary Care Physicians, Nutritionists |

| Cirrhosis Patient Care Strategies | 40 | Nurses, Care Coordinators |

| Clinical Trial Participation Feedback | 45 | Clinical Research Coordinators, Patients |

| Market Access and Reimbursement Perspectives | 55 | Pharmaceutical Market Access Managers, Payers |

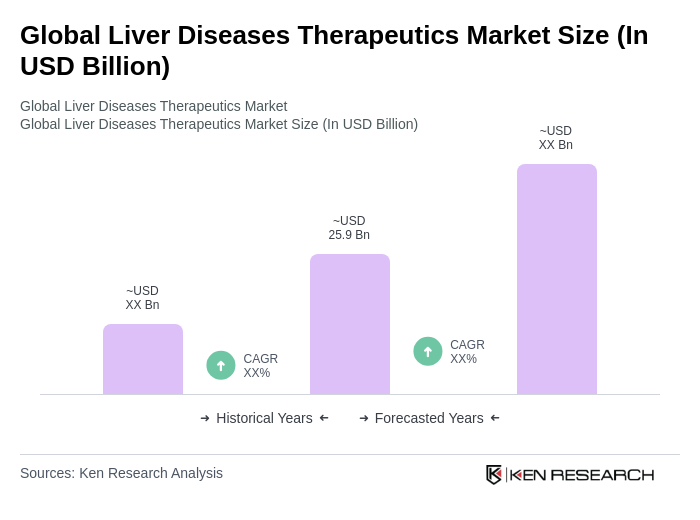

The Global Liver Diseases Therapeutics Market is valued at approximately USD 25.9 billion, driven by the rising prevalence of liver diseases such as hepatitis, non-alcoholic fatty liver disease (NAFLD), and liver cancer, along with advancements in drug development and increased healthcare expenditure.