Region:Global

Author(s):Dev

Product Code:KRAA2587

Pages:86

Published On:August 2025

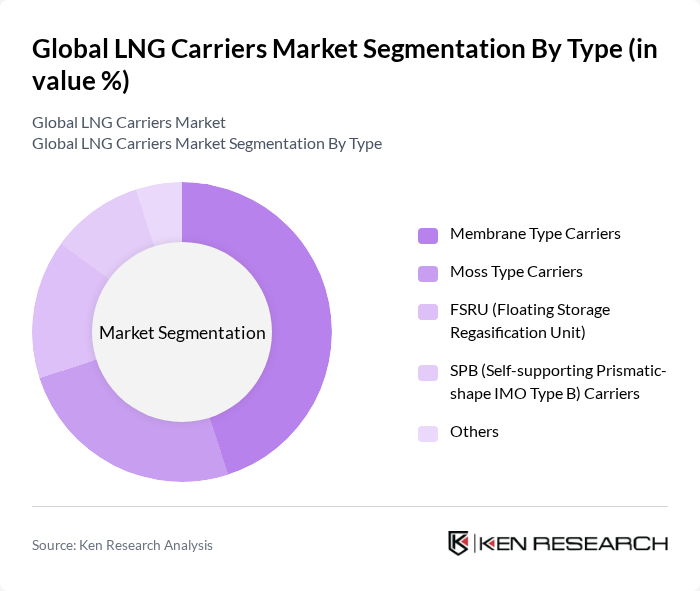

By Type:The LNG carriers market is segmented into various types, including Membrane Type Carriers, Moss Type Carriers, FSRU (Floating Storage Regasification Unit), SPB (Self-supporting Prismatic-shape IMO Type B) Carriers, and Others. Among these, Membrane Type Carriers are leading the market due to their efficient design and ability to maximize cargo capacity while minimizing boil-off gas losses. The trend towards larger vessels and advancements in membrane technology have further solidified their dominance. Recent orders and deliveries have predominantly favored membrane-type vessels, reflecting their operational efficiency and adaptability to evolving emission standards .

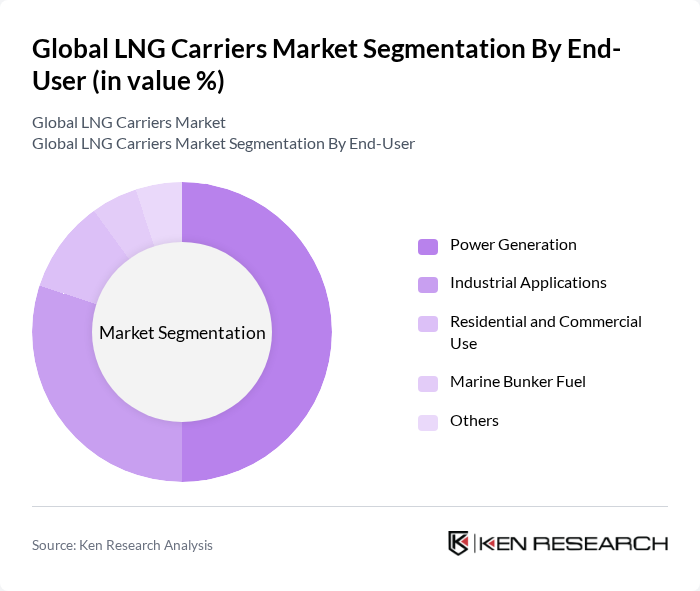

By End-User:The market is further segmented by end-user applications, including Power Generation, Industrial Applications, Residential and Commercial Use, Marine Bunker Fuel, and Others. Power Generation is the leading segment, driven by the global shift towards cleaner energy sources and the increasing reliance on natural gas for electricity generation. This trend is supported by government policies promoting renewable energy and reducing carbon emissions. The expansion of LNG-to-power projects and the role of LNG as a transition fuel have reinforced this segment's dominance .

The Global LNG Carriers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mitsui O.S.K. Lines, Ltd., Teekay Corporation, Golar LNG Limited, Dynagas LNG Partners LP, Nippon Yusen Kabushiki Kaisha (NYK Line), Höegh LNG Holdings Ltd., GasLog Ltd., BW LNG, China LNG Shipping (Holdings) Limited, TGE Marine Gas Engineering GmbH, Kawasaki Kisen Kaisha, Ltd. (K Line), AET Tankers, Qatargas Operating Company Limited, Shell International Trading and Shipping Company Limited (Shell LNG), TotalEnergies SE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the LNG carriers market appears promising, driven by increasing global energy demands and a shift towards cleaner fuels. By future, investments in LNG infrastructure are expected to rise significantly, particularly in emerging markets. Additionally, advancements in carrier technology will enhance operational efficiency and reduce environmental impact. As governments implement stricter emissions regulations, LNG is likely to play a crucial role in the global energy transition, further solidifying its market position.

| Segment | Sub-Segments |

|---|---|

| By Type | Membrane Type Carriers Moss Type Carriers FSRU (Floating Storage Regasification Unit) SPB (Self-supporting Prismatic-shape IMO Type B) Carriers Others |

| By End-User | Power Generation Industrial Applications Residential and Commercial Use Marine Bunker Fuel Others |

| By Region | Asia-Pacific Europe North America Middle East & Africa Latin America |

| By Application | Long-Distance Transportation Short-Distance Transportation Storage and Regasification Floating LNG Production Others |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships (PPP) Others |

| By Policy Support | Tax Incentives Grants for Infrastructure Development Regulatory Support for LNG Projects Others |

| By Distribution Mode | Direct Sales Distributors Online Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Global LNG Shipping Companies | 100 | CEOs, Fleet Managers, Operations Directors |

| Port Authorities and Terminal Operators | 80 | Port Managers, Infrastructure Development Heads |

| Energy Policy Makers | 50 | Government Officials, Regulatory Analysts |

| LNG Vessel Manufacturers | 60 | Product Development Managers, Sales Directors |

| Market Analysts and Consultants | 40 | Industry Analysts, Research Directors |

The Global LNG Carriers Market is valued at approximately USD 14.4 billion, driven by the increasing demand for liquefied natural gas (LNG) as a cleaner energy source and the expansion of LNG infrastructure worldwide.