Region:Middle East

Author(s):Shubham

Product Code:KRAC2204

Pages:84

Published On:October 2025

By Type:The market is segmented into various types of gas turbines, including Heavy-Duty Gas Turbines, Aeroderivative Gas Turbines, Industrial Gas Turbines, Micro Gas Turbines, and Others. Heavy-Duty Gas Turbines dominate the market due to their high efficiency and reliability in large-scale power generation applications. Aeroderivative Gas Turbines are also gaining traction for their flexibility and quick start-up capabilities, making them suitable for peak load and backup applications. The segmental dominance of heavy-duty turbines is reinforced by ongoing investments in large-scale power and water projects .

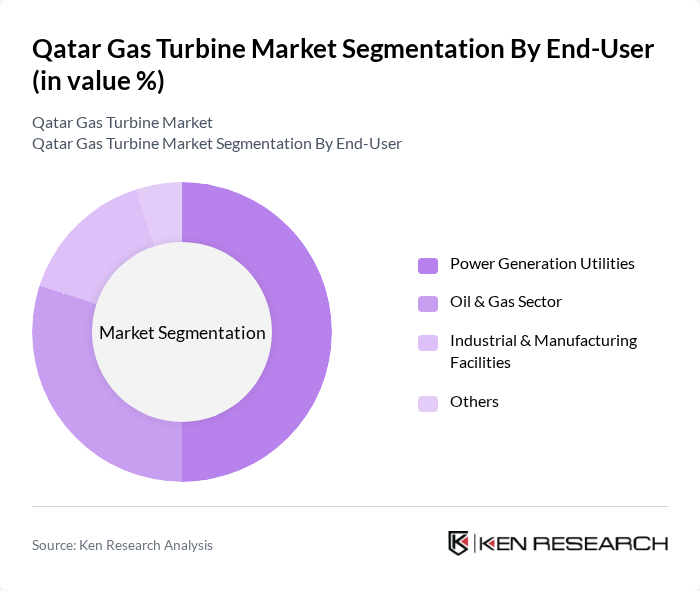

By End-User:The end-user segmentation includes Power Generation Utilities, Oil & Gas Sector, Industrial & Manufacturing Facilities, and Others. Power Generation Utilities are the leading end-users, driven by the need for reliable and efficient energy supply. The Oil & Gas Sector also significantly contributes to the market, utilizing gas turbines for applications such as offshore platforms, gas processing, and enhanced oil recovery. Industrial and manufacturing facilities are increasingly adopting gas turbines to ensure stable and efficient onsite power generation .

The Qatar Gas Turbine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Energy, General Electric (GE), Mitsubishi Power, Ansaldo Energia, Baker Hughes, Rolls-Royce, MAN Energy Solutions, Solar Turbines (Caterpillar Inc.), Doosan Enerbility, Wärtsilä, Kawasaki Heavy Industries, Qatar Electricity & Water Company (QEWC), Mesaieed Power Company, Ras Laffan Power Company, and Nebras Power contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar gas turbine market is poised for significant transformation, driven by the integration of digital technologies and a shift towards sustainable energy solutions. As the government emphasizes renewable energy sources, gas turbines will play a crucial role in balancing energy supply. Furthermore, advancements in turbine design and efficiency will enhance competitiveness, while the expansion of natural gas infrastructure will facilitate market growth. Overall, the future landscape appears promising, with opportunities for innovation and investment.

| Segment | Sub-Segments |

|---|---|

| By Type | Heavy-Duty Gas Turbines Aeroderivative Gas Turbines Industrial Gas Turbines Micro Gas Turbines Others |

| By End-User | Power Generation Utilities Oil & Gas Sector Industrial & Manufacturing Facilities Others |

| By Application | Base Load Power Generation Peak Load Power Generation Combined Heat and Power (CHP) Mechanical Drive Others |

| By Fuel Type | Natural Gas Diesel Dual Fuel Biogas Others |

| By Sales Channel | Direct Sales Distributors EPC Contractors Online Sales Others |

| By Installation Mode | Onshore Offshore Hybrid Others |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Power Generation Sector | 100 | Plant Managers, Energy Analysts |

| Oil & Gas Industry | 80 | Operations Directors, Technical Engineers |

| Manufacturing Applications | 50 | Production Managers, Facility Engineers |

| Research & Development | 40 | R&D Managers, Innovation Leads |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The Qatar Gas Turbine Market is valued at approximately USD 840 million, driven by the increasing demand for efficient power generation solutions and ongoing investments in energy diversification and infrastructure projects within the country.