Region:Global

Author(s):Shubham

Product Code:KRAA3112

Pages:85

Published On:August 2025

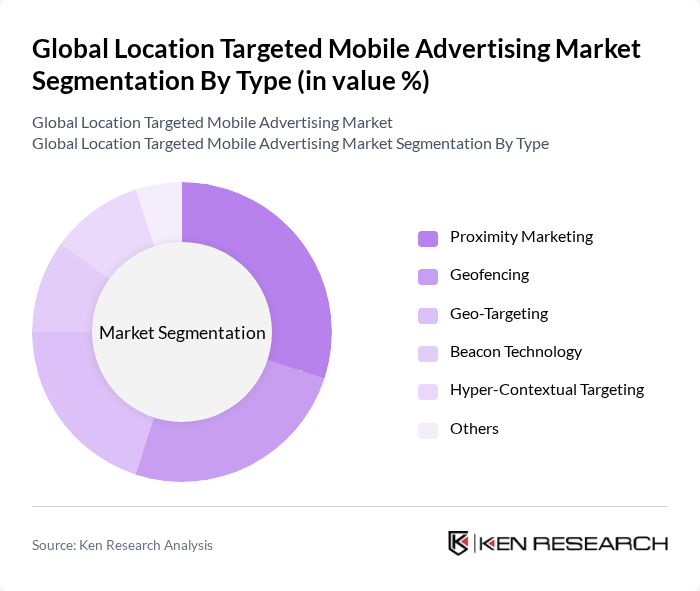

By Type:The market is segmented into various types, includingProximity Marketing, Geofencing, Geo-Targeting, Beacon Technology, Hyper-Contextual Targeting, and Others. Each of these sub-segments plays a crucial role in how advertisers reach their target audiences based on location data. Proximity Marketing is particularly dominant due to its ability to engage consumers in real-time as they enter specific locations, making it a preferred choice for retailers and service providers. Geofencing and geo-targeting are widely adopted for their ability to deliver contextually relevant messages based on user movement and location boundaries, while beacon technology enables hyperlocal engagement within physical venues.

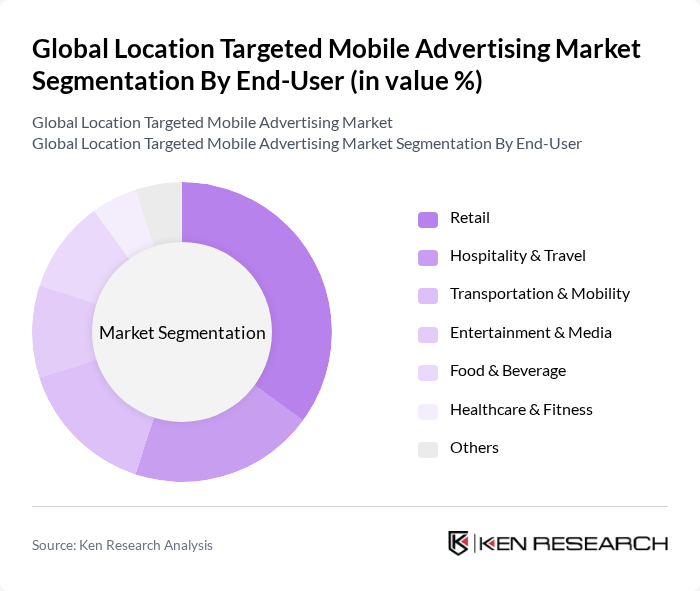

By End-User:The end-user segmentation includesRetail, Hospitality & Travel, Transportation & Mobility, Entertainment & Media, Food & Beverage, Healthcare & Fitness, and Others. The Retail sector is the leading end-user, as businesses increasingly adopt location-targeted advertising to drive foot traffic and enhance customer engagement through personalized offers and promotions based on consumer location. Hospitality & Travel and Transportation & Mobility sectors are also significant adopters, leveraging location data to deliver timely and relevant information to travelers and commuters.

The Global Location Targeted Mobile Advertising Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google LLC, Meta Platforms, Inc. (Facebook), Apple Inc., AdColony, Inc., Foursquare Labs, Inc., GroundTruth, Inc., Verve Group, Inc., InMobi Pte Ltd., PlaceIQ, Inc., Snap Inc., Waze Mobile Ltd., Yext, Inc., Blis Global Ltd., AdTheorent, Inc., SITO Mobile, Ltd., Amazon.com, Inc., Uber Technologies, Inc. (Uber Advertising), The Trade Desk, Inc. contribute to innovation, geographic expansion, and service delivery in this space. The market exhibits high concentration among a few major players, with Google, Meta Platforms, and Amazon controlling a combined market share exceeding 60%, driven by their extensive user data and advanced targeting capabilities. Continuous innovation in ad formats and targeting techniques, along with significant mergers and acquisitions, shape the competitive dynamics of the sector.

The future of location-targeted mobile advertising appears promising, driven by technological advancements and evolving consumer preferences. As augmented reality and AI integration become more prevalent, advertisers will have new tools to create immersive and personalized experiences. Additionally, the expansion into emerging markets, where smartphone penetration is rapidly increasing, presents significant growth potential. Companies that adapt to these trends and prioritize user privacy will likely thrive in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Proximity Marketing Geofencing Geo-Targeting Beacon Technology Hyper-Contextual Targeting Others |

| By End-User | Retail Hospitality & Travel Transportation & Mobility Entertainment & Media Food & Beverage Healthcare & Fitness Others |

| By Advertising Format | Display Ads Video Ads Native Ads Sponsored Content Search Ads Social Media Ads Others |

| By Device Type | Smartphones Tablets Wearable Devices Connected Vehicles Others |

| By Campaign Type | Brand Awareness Lead Generation Customer Retention Store Visits/Footfall Campaigns Others |

| By Sales Channel | Direct Sales Online Platforms Third-Party Agencies Ad Exchanges/Networks Others |

| By Pricing Model | Cost Per Click (CPC) Cost Per Impression (CPM) Cost Per Acquisition (CPA) Cost Per Visit (CPV) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Advertising Agencies | 60 | Marketing Directors, Campaign Managers |

| Retail Brands Utilizing Location Targeting | 50 | Brand Managers, Digital Marketing Specialists |

| Mobile App Developers | 40 | Product Managers, User Experience Designers |

| Consumers Engaged with Location-Based Ads | 100 | General Consumers, Tech-Savvy Users |

| Advertising Technology Providers | 40 | Sales Executives, Technical Support Managers |

The Global Location Targeted Mobile Advertising Market is valued at approximately USD 40 billion, driven by the increasing smartphone penetration, demand for personalized advertising, and advancements in location-based services.