Region:Global

Author(s):Dev

Product Code:KRAD0438

Pages:97

Published On:August 2025

By Type:The luxury perfume market is segmented into various types, including Floral, Woody, Oriental/Amber, Fresh/Citrus, Fruity, Spicy/Aromatic, Gourmand, Oud/Resinous, and Others. Each type caters to different consumer preferences and occasions, influencing purchasing decisions significantly. Floral fragrances are particularly popular among women, while Woody and Oriental scents often appeal to men. The demand for unique and exotic fragrances has led to a rise in the popularity of Oud and Gourmand scents, reflecting changing consumer tastes.

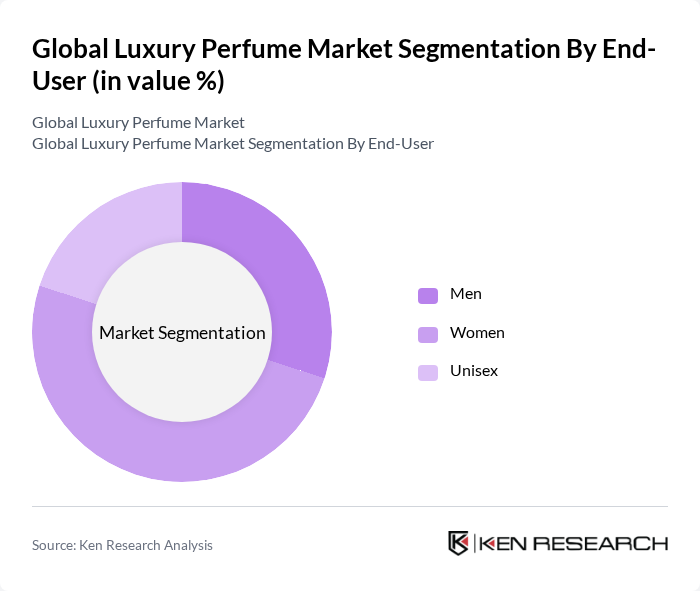

By End-User:The luxury perfume market is categorized by end-users into Men, Women, and Unisex. The women's segment holds a significant share due to the higher spending power and preference for luxury fragrances among female consumers. Men's fragrances are also gaining traction, driven by the increasing acceptance of grooming products among men. Unisex fragrances are emerging as a popular choice, reflecting a shift towards gender-neutral marketing and product offerings.

The Global Luxury Perfume Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oréal Groupe (L'Oréal S.A.), The Estée Lauder Companies Inc., Coty Inc., LVMH Moët Hennessy – Louis Vuitton SE (Parfums Christian Dior, Givenchy, Guerlain), Chanel S.A.S., Hermès International S.A., Puig, S.A., Kering S.A. (Gucci, Yves Saint Laurent Beauté under license), Prada S.p.A., Ralph Lauren Corporation, Giorgio Armani S.p.A., Burberry Group plc, Tom Ford (beauty fragrance under The Estée Lauder Companies), Dolce & Gabbana S.r.l., Byredo (Puig) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luxury perfume market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are increasingly adopting eco-friendly practices, which is expected to resonate with environmentally conscious consumers. Additionally, the integration of augmented reality in marketing strategies is likely to enhance customer engagement, allowing consumers to virtually experience fragrances before purchase, thus driving sales and brand loyalty in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Floral Woody Oriental/Amber Fresh/Citrus Fruity Spicy/Aromatic Gourmand Oud/Resinous Others |

| By End-User | Men Women Unisex |

| By Distribution Channel | Online Retail (Brand.com, Pure-Play E-commerce, Marketplaces) Department Stores Specialty Beauty Retail (e.g., Sephora, Douglas) Travel Retail/Duty-Free Brand Boutiques Others |

| By Price Range | Premium (Approx. USD 80–150) Super Premium (Approx. USD 150–300) Ultra-Luxury/Haute Parfumerie (Above USD 300) |

| By Packaging Type | Glass Bottles Refillable Bottles Limited-Edition/Collector Flacons Gift Sets Others |

| By Fragrance Concentration | Extrait de Parfum/Parfum Eau de Parfum Eau de Toilette Eau de Cologne/Eau Fraîche |

| By Occasion | Everyday Use Special Occasions/Evening Gifting Bridal/Ceremonial Seasonal/Limited Edition |

| By Brand Type | Heritage Luxury Houses Designer Brands Niche/Artisanal Brands Celebrity/Collaboration Lines |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Retail Outlets | 120 | Store Managers, Sales Associates |

| Online Luxury Perfume Sales | 90 | E-commerce Managers, Digital Marketing Specialists |

| Fragrance Development Firms | 70 | Product Development Managers, Perfumers |

| Consumer Insights on Luxury Perfumes | 130 | High-Income Consumers, Luxury Brand Enthusiasts |

| Market Analysts and Consultants | 60 | Market Research Analysts, Industry Consultants |

The Global Luxury Perfume Market is valued at approximately USD 13 billion, driven by increasing consumer spending on premium products and a growing demand for personalized fragrances, particularly among younger generations like Gen Z and millennials.