Qatar Luxury Perfume Market Overview

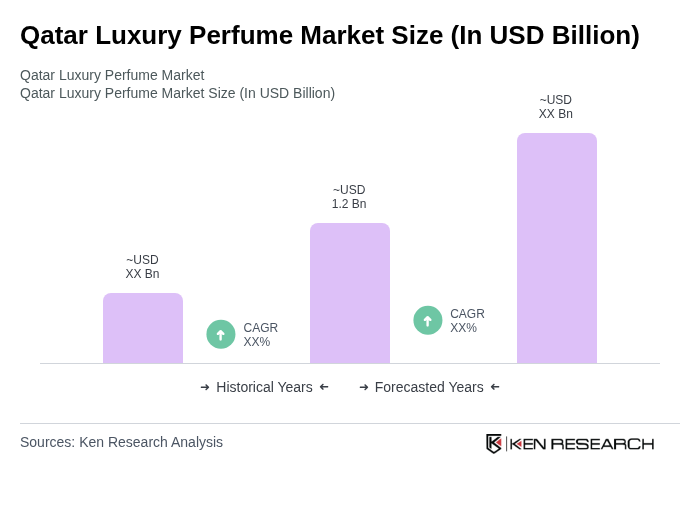

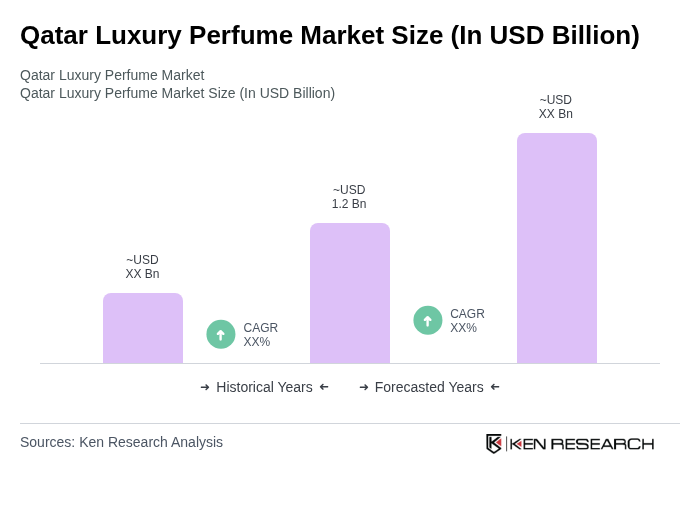

- The Qatar Luxury Perfume Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by increasing disposable incomes, a rising trend in luxury spending, and a growing appreciation for high-quality fragrances. The market has seen a surge in demand for premium and niche fragrances, reflecting a shift in consumer preferences towards unique and personalized scent experiences. The influence of social status, personal branding, and the desire for exclusivity are further accelerating the adoption of luxury fragrances among urban consumers .

- Key cities such as Doha and Al Rayyan dominate the Qatar Luxury Perfume Market due to their affluent populations and vibrant retail environments. Doha, as the capital, serves as a hub for luxury brands and high-end shopping experiences, attracting both local and international consumers. The presence of luxury malls, duty-free shops, and a robust tourism sector further enhances the market's growth in these regions .

- In 2023, the Qatari government implemented regulations to enhance the quality and safety standards of cosmetic products, including perfumes. The “Cabinet Decision No. 26 of 2019 on the Executive Regulations of Law No. 10 of 2016 on the Control of Tobacco and its Derivatives,” as enforced by the Ministry of Public Health, mandates that all imported and locally manufactured perfumes must comply with specific safety assessments and labeling requirements. This ensures consumer protection and promotes the use of high-quality ingredients in fragrance production .

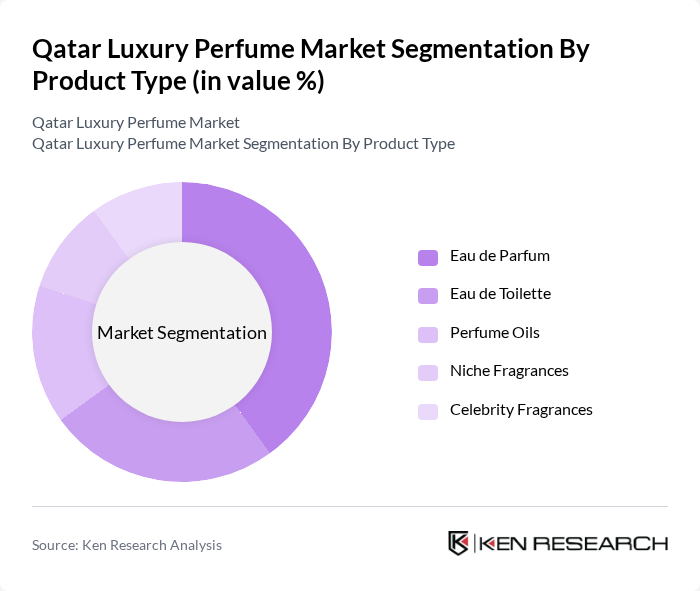

Qatar Luxury Perfume Market Segmentation

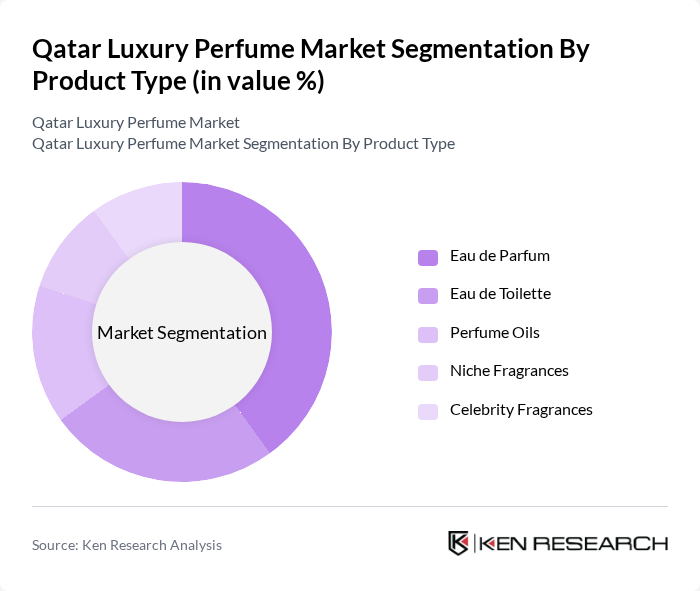

By Product Type:The product type segmentation includes Eau de Parfum, Eau de Toilette, Perfume Oils, Niche Fragrances, and Celebrity Fragrances. Among these, **Eau de Parfum** is the leading sub-segment due to its higher concentration of fragrance oils, appealing to consumers seeking long-lasting scents. The trend towards personalization and unique fragrance experiences has also bolstered the popularity of niche fragrances, while celebrity fragrances continue to attract younger demographics. The growing influence of social media and the desire for signature scents are further shaping product preferences .

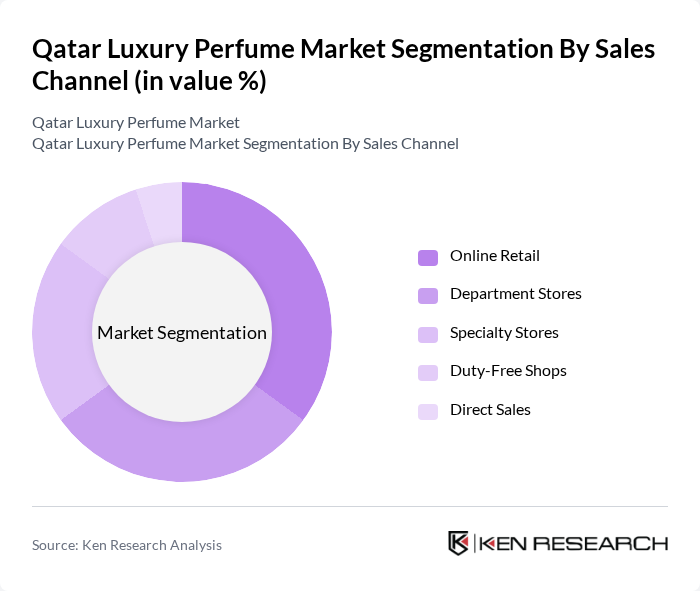

By Sales Channel:The sales channel segmentation includes Online Retail, Department Stores, Specialty Stores, Duty-Free Shops, and Direct Sales. **Online retail** is rapidly gaining traction, driven by the convenience of e-commerce and the growing trend of online shopping among consumers. Duty-free shops also play a significant role, particularly in attracting international travelers looking for luxury fragrances at competitive prices. The expansion of digital platforms and exclusive online offerings are further boosting online sales .

Qatar Luxury Perfume Market Competitive Landscape

The Qatar Luxury Perfume Market is characterized by a dynamic mix of regional and international players. Leading participants such as Chanel, Dior, Gucci, Tom Ford, Creed, Yves Saint Laurent, Versace, Burberry, Montblanc, Al Haramain Perfumes, Ajmal Perfumes, Swiss Arabian Perfumes, Rasasi Perfumes, Abdul Samad Al Qurashi, and Amouage contribute to innovation, geographic expansion, and service delivery in this space.

Qatar Luxury Perfume Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The average disposable income in Qatar is projected to reach approximately QAR 16,500 per month in future, reflecting a 10% increase from 2023. This rise in income allows consumers to allocate more funds towards luxury items, including high-end perfumes. As the economy continues to grow, driven by sectors like tourism and real estate, the purchasing power of Qatari citizens and expatriates is expected to enhance demand for luxury fragrances significantly.

- Rising Demand for Premium Products:The luxury goods market in Qatar is anticipated to grow by QAR 2.5 billion in future, with perfumes being a significant segment. This trend is fueled by a growing consumer preference for premium and niche brands, as evidenced by a 35% increase in sales of high-end fragrances over the past year. The affluent population's desire for exclusivity and quality is driving this demand, positioning luxury perfumes as a key growth area in the market.

- Cultural Significance of Perfumes in Qatar:Perfumes hold a deep cultural significance in Qatari society, with over 85% of the population using fragrances daily. The tradition of gifting perfumes during festivals and special occasions further boosts market demand. In future, the cultural events and celebrations are expected to increase fragrance sales by approximately QAR 600 million, highlighting the integral role of perfumes in social customs and personal expression within the region.

Market Challenges

- Intense Competition from Local and International Brands:The Qatar luxury perfume market is characterized by fierce competition, with over 160 brands vying for market share. Local brands are increasingly innovating to capture consumer interest, while international brands invest heavily in marketing. This competitive landscape can lead to price wars and reduced profit margins, making it challenging for new entrants to establish a foothold in the market.

- Fluctuating Raw Material Prices:The luxury perfume industry is heavily reliant on high-quality raw materials, which are subject to price volatility. In future, the cost of essential fragrance ingredients, such as essential oils and alcohol, is expected to rise by 12% due to supply chain disruptions and geopolitical factors. This fluctuation can significantly impact production costs and pricing strategies for luxury perfume brands, posing a challenge to maintaining profitability.

Qatar Luxury Perfume Market Future Outlook

The Qatar luxury perfume market is poised for continued growth, driven by increasing disposable incomes and a strong cultural affinity for fragrances. As consumers become more discerning, brands that emphasize quality, sustainability, and personalization are likely to thrive. The rise of e-commerce and digital marketing will further enhance brand visibility and accessibility, allowing companies to reach a broader audience. Additionally, collaborations with local artisans may create unique offerings that resonate with both residents and tourists, fostering a vibrant market landscape.

Market Opportunities

- Expansion of Retail Outlets:The number of luxury retail outlets in Qatar is expected to increase by 25% in future, providing greater access to premium perfumes. This expansion will cater to the growing demand from both locals and tourists, enhancing brand visibility and sales opportunities for luxury fragrance companies.

- Customization and Personalization Trends:The trend towards personalized fragrances is gaining traction, with consumers willing to pay up to QAR 1,800 for bespoke scents. This opportunity allows brands to differentiate themselves by offering tailored experiences, appealing to the affluent market segment that values exclusivity and individuality in their fragrance choices.