Region:Global

Author(s):Dev

Product Code:KRAB0510

Pages:89

Published On:August 2025

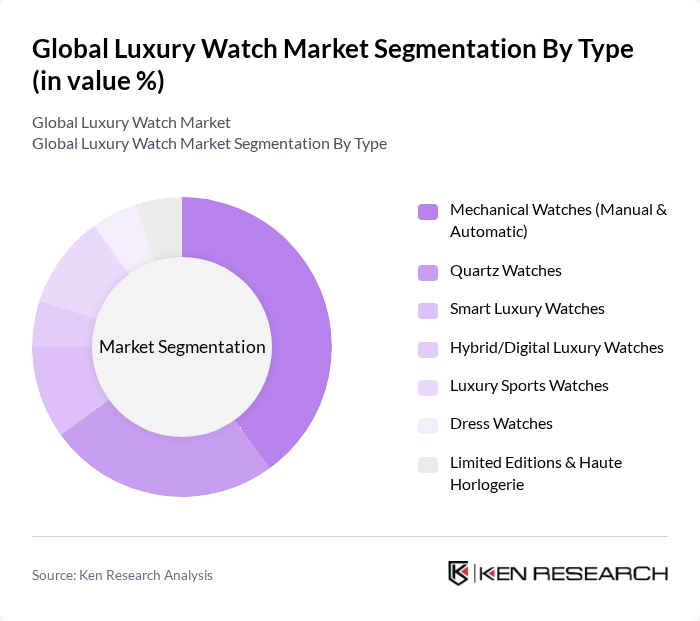

By Type:The luxury watch market is segmented into various types, including Mechanical Watches (Manual & Automatic), Quartz Watches, Smart Luxury Watches, Hybrid/Digital Luxury Watches, Luxury Sports Watches, Dress Watches, and Limited Editions & Haute Horlogerie. Among these, Mechanical Watches, particularly automatic ones, dominate the market due to their craftsmanship and status as a symbol of luxury. Consumers are increasingly drawn to the intricate engineering and heritage associated with these timepieces, and demand for steel sports models and limited haute horlogerie references has reinforced mechanical leadership within luxury price bands.

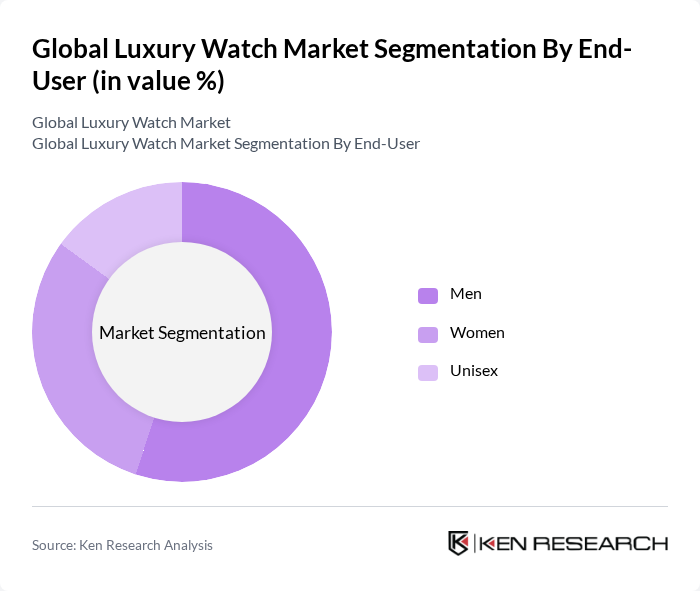

By End-User:The luxury watch market is segmented by end-user into Men, Women, and Unisex. The men's segment holds a significant share, driven by the traditional association of watches with masculinity and status. However, the women's segment is rapidly growing as brands increasingly cater to female consumers with stylish and sophisticated designs, reflecting changing societal norms and preferences.

The Global Luxury Watch Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rolex SA, Patek Philippe SA, Audemars Piguet Holding SA, Omega SA, TAG Heuer SA, Cartier (Richemont), Hublot SA, Jaeger?LeCoultre (Richemont), IWC Schaffhausen (Richemont), Officine Panerai (Richemont), Breitling SA, Chopard SA, Breguet (Swatch Group), Longines (Swatch Group), Seiko Watch Corporation, Vacheron Constantin (Richemont), A. Lange & Söhne (Richemont), Richard Mille, Grand Seiko Corporation of America, Ulysse Nardin (Kering) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luxury watch market appears promising, driven by technological advancements and evolving consumer preferences. As smart luxury watches gain traction, brands are likely to innovate by integrating technology with traditional craftsmanship. Additionally, the increasing focus on sustainability will push brands to adopt eco-friendly practices, appealing to environmentally conscious consumers. These trends suggest a dynamic market landscape where luxury watches will continue to evolve, catering to diverse consumer needs while maintaining their prestigious status.

| Segment | Sub-Segments |

|---|---|

| By Type | Mechanical Watches (Manual & Automatic) Quartz Watches Smart Luxury Watches Hybrid/Digital Luxury Watches Luxury Sports Watches Dress Watches Limited Editions & Haute Horlogerie |

| By End-User | Men Women Unisex |

| By Price Range | $1,000–$4,999 $5,000–$9,999 $10,000–$24,999 $25,000–$99,999 $100,000 and Above |

| By Distribution Channel | Online Mono-brand Boutiques Multi-brand Authorized Retailers Department Stores & Duty-Free Direct-to-Consumer |

| By Material | Stainless Steel Gold (Yellow/White/Rose) Titanium Ceramic Precious Metals & Gem-set |

| By Brand Positioning | High-End Luxury & Haute Horlogerie Core Luxury Accessible Luxury & Premium |

| By Occasion | Casual Wear Formal Wear Sports/Professional Gifting & Collectibles |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Watch Retailers | 120 | Store Managers, Sales Executives |

| High-Net-Worth Individuals | 100 | Luxury Consumers, Collectors |

| Luxury Watch Manufacturers | 80 | Product Development Managers, Brand Strategists |

| Market Analysts | 60 | Industry Analysts, Economic Researchers |

| Luxury Watch Enthusiasts | 70 | Bloggers, Influencers, Community Leaders |

The Global Luxury Watch Market is valued at approximately USD 55 billion, reflecting sustained demand driven by strong Swiss exports and the resilience of the premium segment, particularly in emerging markets like Asia and the Middle East.