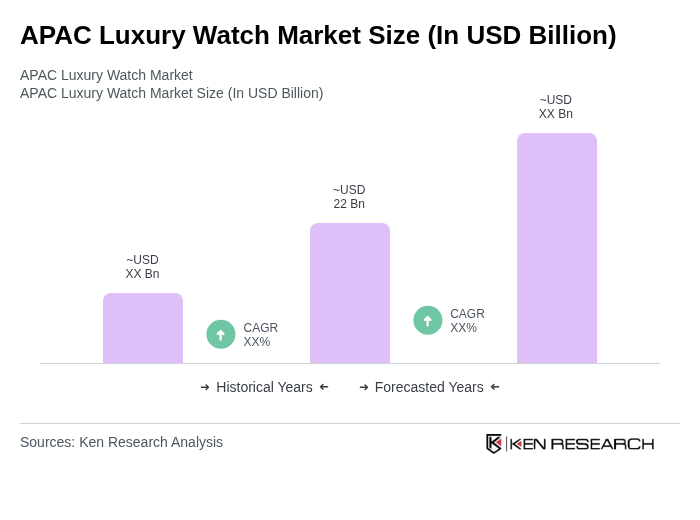

APAC Luxury Watch Market Overview

- The APAC Luxury Watch Market is valued at USD 22 billion, based on a five-year historical analysis. This growth is primarily driven by increasing disposable incomes, a rising number of affluent consumers, and a growing appreciation for luxury goods among younger demographics. The market has seen a significant uptick in demand for high-end timepieces, particularly in urban areas where luxury brands are establishing a stronger presence. The region's luxury watch segment is further fueled by a cultural emphasis on status symbols and gifting, with consumers increasingly viewing luxury watches as both fashion statements and investments .

- Countries such as China, Japan, and India dominate the APAC Luxury Watch Market due to their large populations and expanding middle class. In China, the luxury watch segment has benefited from a cultural shift towards luxury consumption, supported by the growth of duty-free hubs and policies that redirect luxury spending to local channels. Japan's long-standing appreciation for craftsmanship and quality has solidified its position, while India is emerging as a key player, driven by a growing affluent class and increasing brand awareness. China alone accounts for over 45 percent of the region's luxury watch revenue, highlighting its pivotal role in market expansion , .

- In 2023, the Indian government implemented the Production Linked Incentive (PLI) Scheme for the Watch and Clock Industry, aimed at promoting domestic manufacturing of luxury watches. This initiative includes tax incentives for local manufacturers and aims to reduce import dependency, thereby fostering a more competitive environment for homegrown brands. The regulation is expected to enhance the overall growth of the luxury watch sector in the region by encouraging innovation and investment in local production .

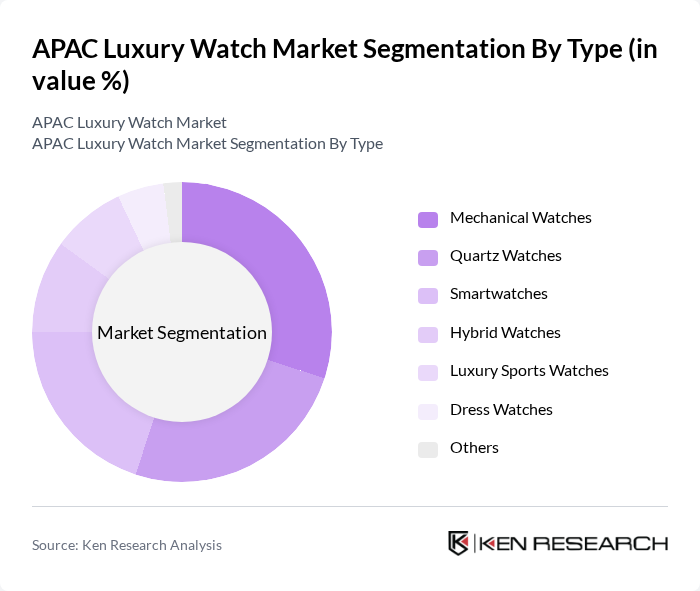

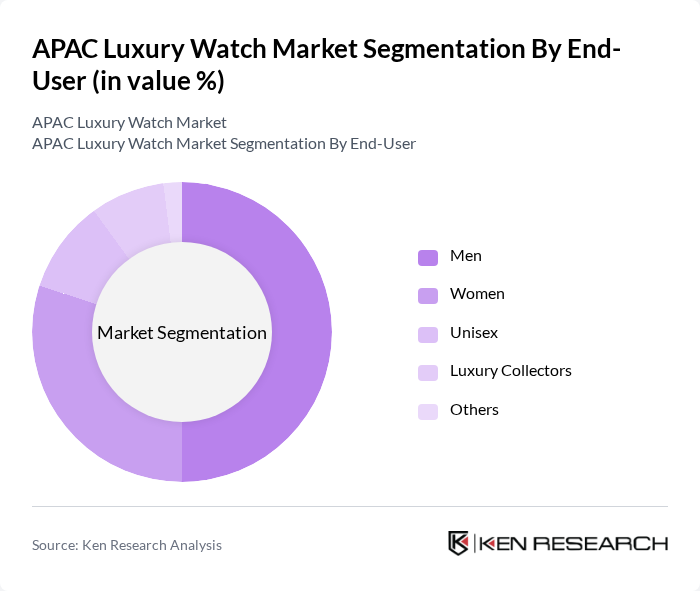

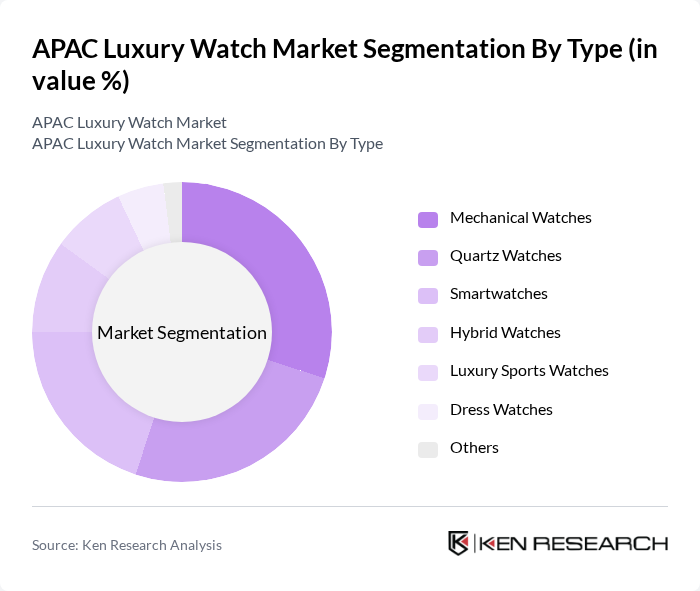

APAC Luxury Watch Market Segmentation

By Type:The luxury watch market can be segmented into various types, including Mechanical Watches, Quartz Watches, Smartwatches, Hybrid Watches, Luxury Sports Watches, Dress Watches, and Others. Among these, Mechanical Watches and Quartz Watches are the most prominent segments, driven by consumer preferences for traditional craftsmanship and modern technology, respectively. The demand for Smartwatches is also increasing, particularly among younger consumers who value functionality alongside luxury. Mechanical watches are the most lucrative segment, registering the fastest growth, while electronic watches (including smart and hybrid) remain the largest revenue-generating segment in the region .

By End-User:The luxury watch market is segmented by end-user into Men, Women, Unisex, Luxury Collectors, and Others. The Men segment dominates the market, driven by traditional purchasing patterns and a strong affinity for luxury timepieces. However, the Women segment is witnessing rapid growth as brands increasingly target female consumers with tailored designs and marketing strategies. Luxury Collectors also represent a significant niche, often driving demand for limited edition and high-value pieces. The women's luxury watch segment is projected to expand at a significant compound annual growth rate, reflecting changing consumer preferences and targeted brand initiatives .

APAC Luxury Watch Market Competitive Landscape

The APAC Luxury Watch Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rolex SA, Omega SA, Patek Philippe SA, Audemars Piguet SA, TAG Heuer (LVMH), Seiko Holdings Corporation, Casio Computer Co., Ltd., Cartier (Richemont), Hublot (LVMH), Fossil Group, Inc., Longines (Swatch Group), Tissot (Swatch Group), IWC Schaffhausen (Richemont), Officine Panerai (Richemont), Bulgari (LVMH) contribute to innovation, geographic expansion, and service delivery in this space.

APAC Luxury Watch Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The APAC region has witnessed a significant rise in disposable income, with countries like China and India reporting increases of 6.5% and 7.0% respectively in future. This economic growth translates to higher purchasing power, allowing consumers to invest in luxury items. According to the World Bank, the middle-class population in Asia is projected to reach 1.5 billion in future, further driving demand for luxury watches as symbols of status and success.

- Rising Demand for Luxury Goods:Emerging markets in APAC, particularly Southeast Asia, are experiencing a surge in demand for luxury goods. In future, luxury goods sales in the region are expected to exceed $100 billion, driven by a growing affluent class. The McKinsey Global Institute reports that the number of high-net-worth individuals in Asia is projected to grow by 20% annually, fueling the luxury watch market as consumers seek exclusive and high-quality timepieces.

- Growth of E-commerce Platforms:The e-commerce sector for luxury watches in APAC is expanding rapidly, with online sales projected to reach $15 billion in future. This growth is supported by increased internet penetration, which is expected to hit 70% across the region. Major platforms like Tmall and JD.com are enhancing their luxury watch offerings, making it easier for consumers to access premium brands. This shift towards online retailing is reshaping consumer purchasing behaviors, favoring convenience and variety.

Market Challenges

- Counterfeit Products:The luxury watch market in APAC faces significant challenges from counterfeit products, which are estimated to account for 20% of the market. This prevalence undermines brand integrity and consumer trust. According to the International Chamber of Commerce, the economic impact of counterfeiting in the luxury sector is projected to reach $1.8 trillion globally in future, prompting brands to invest heavily in anti-counterfeiting measures to protect their reputations.

- Economic Fluctuations:Economic instability poses a challenge to luxury watch sales in APAC. In future, the IMF forecasts a GDP growth slowdown in several countries, including a projected 4.0% growth in China and 5.5% in India. Such fluctuations can lead to reduced consumer spending on non-essential items, including luxury watches. Brands must navigate these economic uncertainties to maintain sales and market share in a competitive landscape.

APAC Luxury Watch Market Future Outlook

The APAC luxury watch market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are expected to innovate with eco-friendly materials and ethical sourcing practices. Additionally, the integration of technology into traditional luxury watches will attract tech-savvy consumers. The rise of the pre-owned luxury watch market will also reshape consumer behavior, offering affordability and exclusivity, thus expanding the market's reach and appeal.

Market Opportunities

- Expansion into Untapped Rural Markets:Luxury watch brands have a significant opportunity to penetrate rural markets in APAC, where rising incomes are creating new consumer bases. With an estimated 300 million people entering the middle class in rural areas in future, brands can tailor their marketing strategies to attract these consumers, potentially increasing sales and brand loyalty in previously underserved regions.

- Customization and Personalization Trends:The demand for personalized luxury watches is on the rise, with consumers increasingly seeking unique products. In future, the customization segment is expected to grow by 15%, driven by consumer desire for individuality. Brands that offer bespoke services can capitalize on this trend, enhancing customer engagement and satisfaction while differentiating themselves in a competitive market.