Region:Global

Author(s):Geetanshi

Product Code:KRAC0160

Pages:88

Published On:August 2025

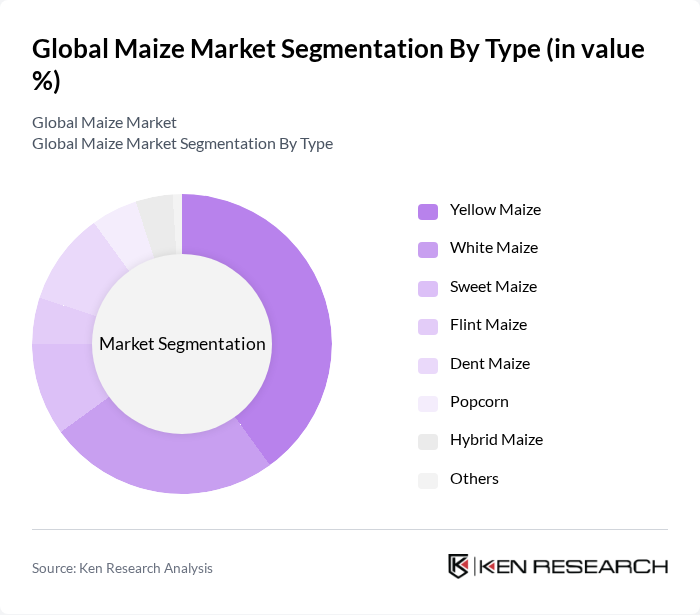

By Type:The maize market is segmented into Yellow Maize, White Maize, Sweet Maize, Flint Maize, Dent Maize, Popcorn, Hybrid Maize, and Others. Yellow maize is primarily used for animal feed and industrial applications, while white maize is more commonly consumed as food in certain regions. Sweet maize and popcorn are mainly used for direct human consumption. Flint and dent maize are valued for their processing characteristics, and hybrid maize varieties are increasingly adopted for their higher yields and disease resistance.

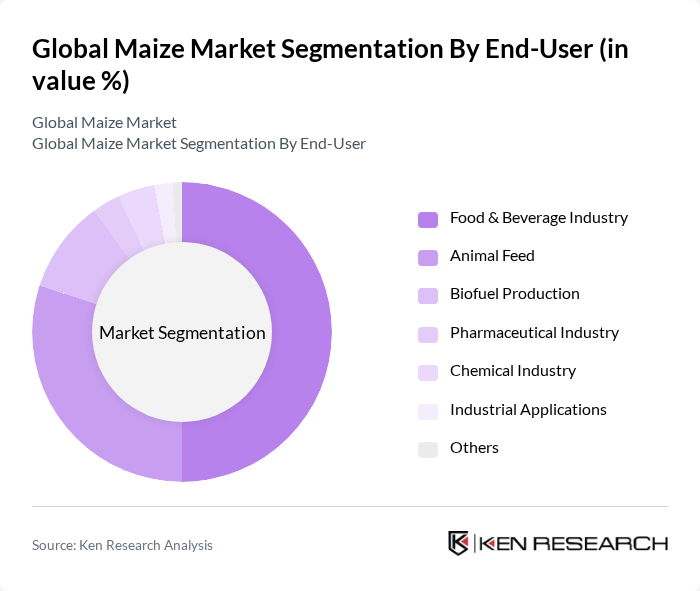

By End-User:The maize market is also segmented by end-user applications, including the Food & Beverage Industry, Animal Feed, Biofuel Production, Pharmaceutical Industry, Chemical Industry, Industrial Applications, and Others. The Food & Beverage Industry utilizes maize for products such as starch, sweeteners, and cereals. Animal Feed remains the largest segment, reflecting the crop’s critical role in livestock and poultry nutrition. Biofuel production is a growing segment, especially in North and South America, driven by blending mandates and renewable energy policies. The Pharmaceutical and Chemical industries use maize derivatives for various formulations and industrial processes.

The Global Maize Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill, Inc., Archer Daniels Midland Company, Bunge Limited, DuPont de Nemours, Inc., Syngenta AG, Bayer AG, Corteva Agriscience, Olam International Limited, CHS Inc., Land O'Lakes, Inc., GrainCorp Limited, Wilmar International Limited, COFCO Corporation, Louis Dreyfus Company, Nutrien Ltd., KWS SAAT SE & Co. KGaA, Limagrain Group, AGCO Corporation, China National Seed Group Co., Ltd., and UPL Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the maize market is poised for transformation, driven by technological advancements and shifting consumer preferences. As sustainability becomes a priority, farmers are increasingly adopting eco-friendly practices, which are expected to enhance productivity while minimizing environmental impact. Additionally, the demand for organic and non-GMO maize products is anticipated to rise, reflecting consumer trends towards healthier and more sustainable food options. These developments will shape the market landscape significantly in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Yellow Maize White Maize Sweet Maize Flint Maize Dent Maize Popcorn Hybrid Maize Others |

| By End-User | Food & Beverage Industry Animal Feed Biofuel Production Pharmaceutical Industry Chemical Industry Industrial Applications Others |

| By Region | North America South America Europe Asia-Pacific Middle East & Africa Others |

| By Application | Food Products Animal Feed Starch Production Sweeteners Bioplastics Others |

| By Investment Source | Private Investments Government Funding International Aid Others |

| By Policy Support | Subsidies Tax Incentives Research Grants Others |

| By Distribution Channel | Direct Sales (B2B) Retail Outlets (B2C) Online Sales Wholesale Distributors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Maize Farmers | 100 | Smallholder Farmers, Commercial Growers |

| Agrochemical Distributors | 60 | Sales Managers, Product Specialists |

| Food Processing Companies | 50 | Procurement Managers, Production Supervisors |

| Animal Feed Manufacturers | 40 | Operations Managers, Quality Control Officers |

| Research Institutions | 40 | Agricultural Researchers, Policy Analysts |

The Global Maize Market is valued at approximately USD 310 billion, reflecting a significant growth driven by increasing demand for maize in food products, animal feed, and biofuel production, alongside advancements in agricultural technology.