Region:Global

Author(s):Rebecca

Product Code:KRAC4025

Pages:82

Published On:October 2025

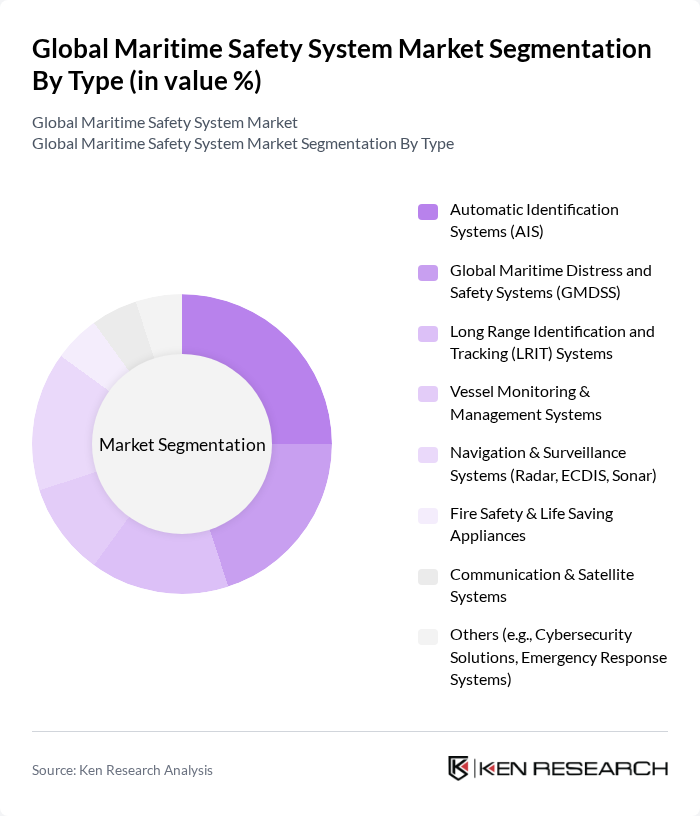

By Type:The market is segmented into various types of safety systems, including Automatic Identification Systems (AIS), Global Maritime Distress and Safety Systems (GMDSS), Long Range Identification and Tracking (LRIT) Systems, Vessel Monitoring & Management Systems, Navigation & Surveillance Systems, Fire Safety & Life Saving Appliances, Communication & Satellite Systems, and Others. These systems are critical for ensuring vessel tracking, emergency response, collision avoidance, and compliance with international maritime safety regulations .

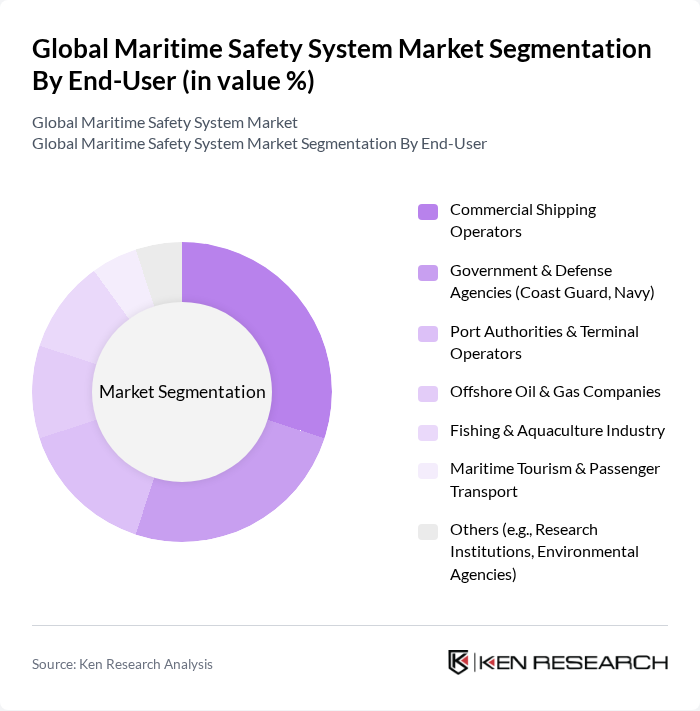

By End-User:The end-user segmentation includes Commercial Shipping Operators, Government & Defense Agencies, Port Authorities & Terminal Operators, Offshore Oil & Gas Companies, Fishing & Aquaculture Industry, Maritime Tourism & Passenger Transport, and Others. These segments reflect the diverse applications of maritime safety systems, from commercial fleet management to national security and environmental monitoring .

The Global Maritime Safety System Market is characterized by a dynamic mix of regional and international players. Leading participants such as Wärtsilä Corporation, ABB Ltd., Siemens AG, Kongsberg Gruppen ASA, Thales Group, Raytheon Technologies Corporation, Northrop Grumman Corporation, Rolls-Royce Holdings plc, BAE Systems plc, Marine Technologies LLC, Inmarsat plc, Furuno Electric Co., Ltd., Navico Group, Vard Group AS, Trelleborg AB, Honeywell International Inc., Saab AB, OSI Maritime Systems Ltd., Smiths Group plc, Elbit Systems Ltd., Westminster Group plc, Raytheon Anschütz GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the maritime safety system market is poised for significant transformation, driven by technological advancements and increasing regulatory pressures. As the industry embraces digitalization, the integration of IoT and AI will enhance safety protocols and operational efficiency. Furthermore, the growing emphasis on environmental sustainability will push for eco-friendly safety solutions. Collaborative efforts among stakeholders will also foster innovation, ensuring that safety systems evolve to meet emerging challenges and opportunities in the maritime sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Automatic Identification Systems (AIS) Global Maritime Distress and Safety Systems (GMDSS) Long Range Identification and Tracking (LRIT) Systems Vessel Monitoring & Management Systems Navigation & Surveillance Systems (Radar, ECDIS, Sonar) Fire Safety & Life Saving Appliances Communication & Satellite Systems Others (e.g., Cybersecurity Solutions, Emergency Response Systems) |

| By End-User | Commercial Shipping Operators Government & Defense Agencies (Coast Guard, Navy) Port Authorities & Terminal Operators Offshore Oil & Gas Companies Fishing & Aquaculture Industry Maritime Tourism & Passenger Transport Others (e.g., Research Institutions, Environmental Agencies) |

| By Application | Port & Vessel Security Search & Rescue Operations Environmental Monitoring & Compliance Cargo & Passenger Safety Navigation & Traffic Management Others |

| By Component | Hardware (Sensors, Transponders, Control Panels) Software (Fleet Management, Analytics, Cybersecurity) Services (Installation, Maintenance, Training, Consulting) |

| By Distribution Channel | Direct Sales Distributors & System Integrators Online Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Compliance Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Shipping Safety Systems | 120 | Fleet Managers, Safety Officers |

| Maritime Regulatory Compliance | 90 | Compliance Managers, Legal Advisors |

| Port Safety Management | 60 | Port Authority Officials, Safety Inspectors |

| Marine Equipment Suppliers | 50 | Sales Managers, Product Development Leads |

| Maritime Training and Certification | 70 | Training Coordinators, Safety Trainers |

The Global Maritime Safety System Market is valued at approximately USD 34 billion, reflecting significant growth driven by increasing maritime trade, stringent safety regulations, and advancements in technology that enhance safety measures at sea.