Region:Middle East

Author(s):Rebecca

Product Code:KRAD2873

Pages:85

Published On:November 2025

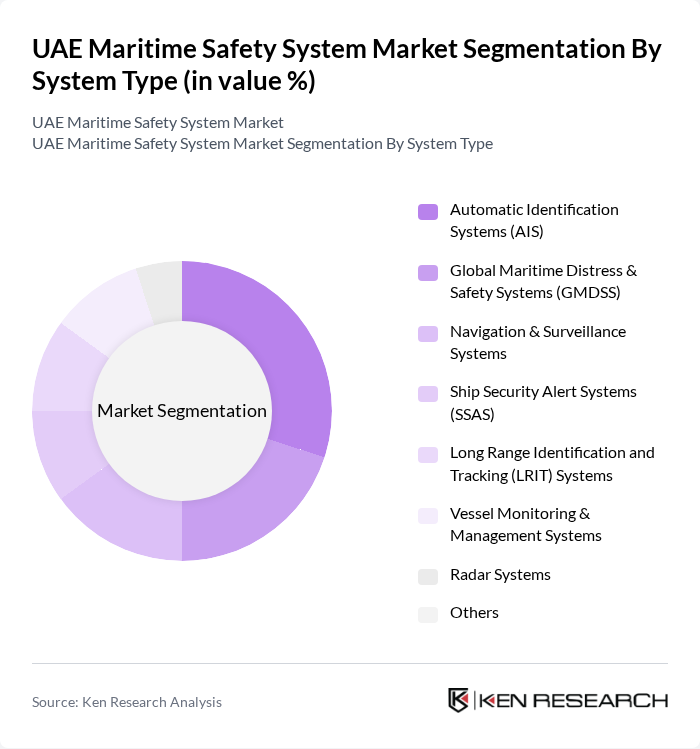

By System Type:The market is segmented into various system types, including Automatic Identification Systems (AIS), Global Maritime Distress & Safety Systems (GMDSS), Navigation & Surveillance Systems, Ship Security Alert Systems (SSAS), Long Range Identification and Tracking (LRIT) Systems, Vessel Monitoring & Management Systems, Radar Systems, and Others. Among these,Automatic Identification Systems (AIS)is the leading subsegment due to its critical role in enhancing vessel tracking, collision avoidance, and real-time situational awareness, which are essential for maritime safety .

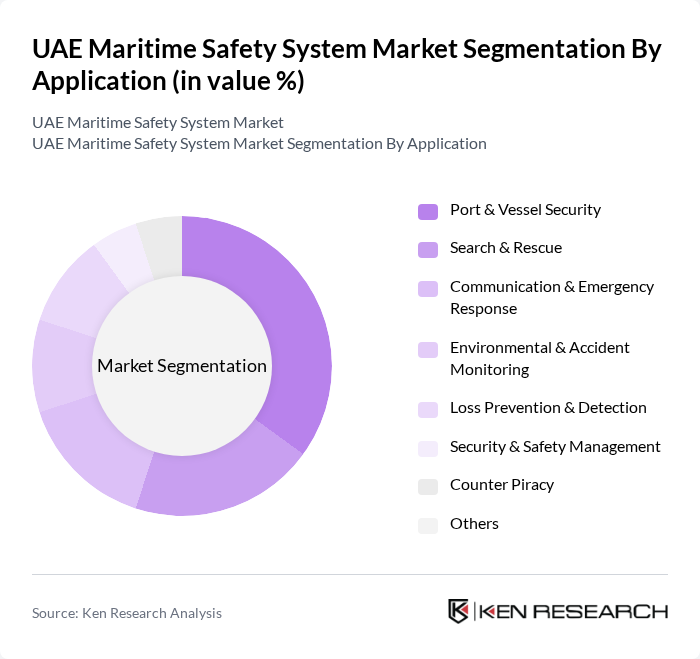

By Application:The applications of maritime safety systems include Port & Vessel Security, Search & Rescue, Communication & Emergency Response, Environmental & Accident Monitoring, Loss Prevention & Detection, Security & Safety Management, Counter Piracy, and Others. ThePort & Vessel Securityapplication is the most significant due to the increasing need for safeguarding maritime assets, managing high vessel traffic, and ensuring the safety of vessels in major UAE ports .

The UAE Maritime Safety System Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi Ports, Dubai Maritime City Authority, Gulf Navigation Holding PJSC, Emirates Classification Society (TASNEEF), Abu Dhabi Marine Operating Company (ADNOC Offshore), Dubai Maritime Authority, National Marine Dredging Company, International Maritime Organization (IMO), Marine Safety Services LLC, Al Seer Marine Supplies & Equipment Company PJSC, Abu Dhabi Ship Building PJSC, Wärtsilä UAE LLC, L3Harris Technologies UAE, Elcome International LLC, and Marakeb Technologies LLC contribute to innovation, geographic expansion, and service delivery in this space .

The future of the UAE maritime safety system market is poised for significant transformation, driven by technological advancements and a growing emphasis on sustainability. The integration of IoT and data analytics into safety systems is expected to enhance operational efficiency and risk management. Furthermore, as the UAE continues to expand its maritime tourism sector, the demand for innovative safety solutions will likely increase, fostering a more secure maritime environment while promoting economic growth and international collaboration.

| Segment | Sub-Segments |

|---|---|

| By System Type | Automatic Identification Systems (AIS) Global Maritime Distress & Safety Systems (GMDSS) Navigation & Surveillance Systems Ship Security Alert Systems (SSAS) Long Range Identification and Tracking (LRIT) Systems Vessel Monitoring & Management Systems Radar Systems Others |

| By Application | Port & Vessel Security Search & Rescue Communication & Emergency Response Environmental & Accident Monitoring Loss Prevention & Detection Security & Safety Management Counter Piracy Others |

| By End-User | Commercial Shipping Naval Forces & Coast Guards Oil & Gas (Offshore) Port Authorities Fishing Industry Maritime Tourism Government Agencies Others |

| By Component | Hardware Software Services |

| By Vessel Type | Cargo Ships Passenger Ships Fishing Vessels Tankers Offshore Support Vessels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Shipping Safety Practices | 100 | Safety Managers, Fleet Operators |

| Port Authority Safety Regulations | 80 | Port Managers, Compliance Officers |

| Maritime Safety Equipment Suppliers | 60 | Sales Directors, Product Managers |

| Training and Certification Programs | 50 | Training Coordinators, Safety Instructors |

| Emergency Response Protocols | 70 | Emergency Response Managers, Safety Consultants |

The UAE Maritime Safety System Market is valued at approximately USD 510 million, reflecting a significant growth driven by increased maritime trade activities and advancements in safety technologies.