Region:Global

Author(s):Rebecca

Product Code:KRAD2351

Pages:86

Published On:January 2026

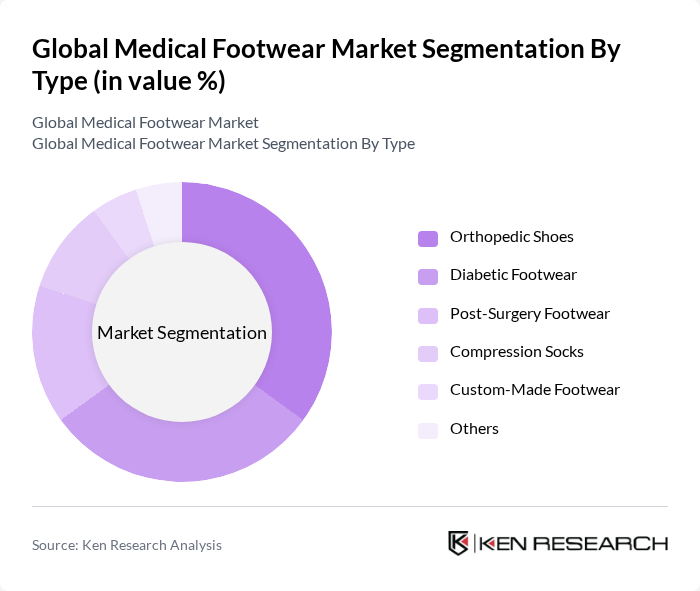

By Type:The market is segmented into various types of medical footwear, including diabetic footwear, orthopedic footwear, post-surgery footwear, sports medical footwear, and others. Among these, diabetic footwear is currently the leading sub-segment due to the rising incidence of diabetes globally, which necessitates specialized footwear to prevent complications. Orthopedic footwear also holds a significant share, driven by the increasing awareness of foot health and the need for comfort and support in footwear.

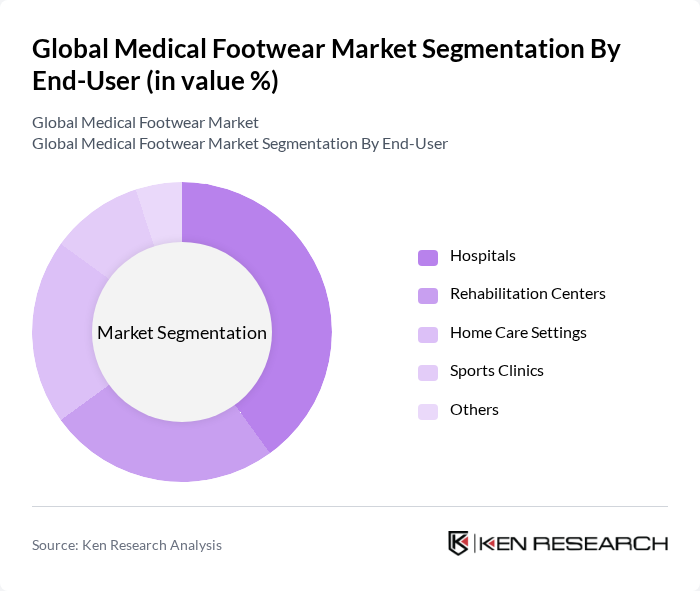

By End-User:The end-user segmentation includes hospitals, rehabilitation centers, home care settings, and others. Hospitals are the dominant end-user segment, as they require medical footwear for patients undergoing treatment and recovery. Rehabilitation centers also play a crucial role, as they provide specialized footwear to aid in recovery and rehabilitation processes. The growing trend of home healthcare is also contributing to the demand for medical footwear in home care settings.

The Global Medical Footwear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dr. Comfort, New Balance, Orthofeet, Aetrex, Propet, Vionic, Skechers, Hush Puppies, Adidas, Nike, Reebok, ASICS, Saucony, Merrell, Clarks contribute to innovation, geographic expansion, and service delivery in this space.

The future of the medical footwear market appears promising, driven by increasing health awareness and technological innovations. As more consumers recognize the importance of foot health, demand for specialized footwear is expected to rise. Additionally, the integration of smart technology and sustainable materials will likely attract environmentally conscious consumers. Companies that adapt to these trends and focus on customization will be well-positioned to capture a larger share of the market, particularly in emerging economies where health infrastructure is improving.

| Segment | Sub-Segments |

|---|---|

| By Type | Diabetic Footwear Orthopedic Footwear Post-Surgery Footwear Sports Medical Footwear Others |

| By End-User | Hospitals Rehabilitation Centers Home Care Settings Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Material | Leather Synthetic Textile Others |

| By Gender | Male Female Unisex |

| By Age Group | Children Adults Seniors |

| By Price Range | Budget Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Footwear Retailers | 120 | Store Managers, Product Buyers |

| Healthcare Providers (Podiatrists) | 100 | Podiatrists, Orthopedic Surgeons |

| Medical Footwear Manufacturers | 80 | Production Managers, R&D Heads |

| Patients with Foot Conditions | 110 | Diabetic Patients, Elderly Individuals |

| Healthcare Policy Makers | 70 | Health Administrators, Policy Analysts |

The Global Medical Footwear Market is valued at approximately USD 10 billion, driven by factors such as the rising prevalence of chronic diseases, increased awareness of foot health, and advancements in ergonomic designs and materials.