Oman Medical Footwear Market Overview

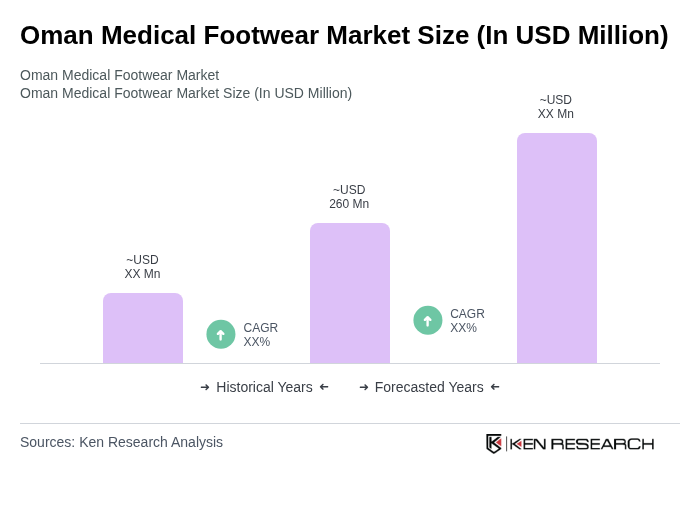

- The Oman Medical Footwear Market is valued at USD 260 million, based on recent analysis. Growth is driven by increasing awareness of foot health and rising demand for specialized medical and orthopedic footwear as part of broader wellness trends, aligned with growing healthcare expenditure and evolving consumer preferences for comfort and function. The broader Oman footwear market is also expanding due to improving retail infrastructure and rising interest in health-conscious footwear options.

- Key players in this market include global brands such as Nike, Adidas, and Puma, alongside local manufacturers like Salalah Footwear and Muscat Footwear. These companies drive market dynamics through product innovation and strong distribution networks in Oman’s footwear sector. Consumer demand in urban centers like Muscat is bolstered by greater access to diverse footwear categories that combine medical functionality and comfort.

- In 2024, the Omani government announced a strategic initiative to enhance local manufacturing capabilities in the medical footwear sector. This initiative includes incentives for companies to adopt sustainable practices and adhere to stringent quality standards, fostering a competitive environment that supports both local and international players.

Oman Medical Footwear Market Segmentation

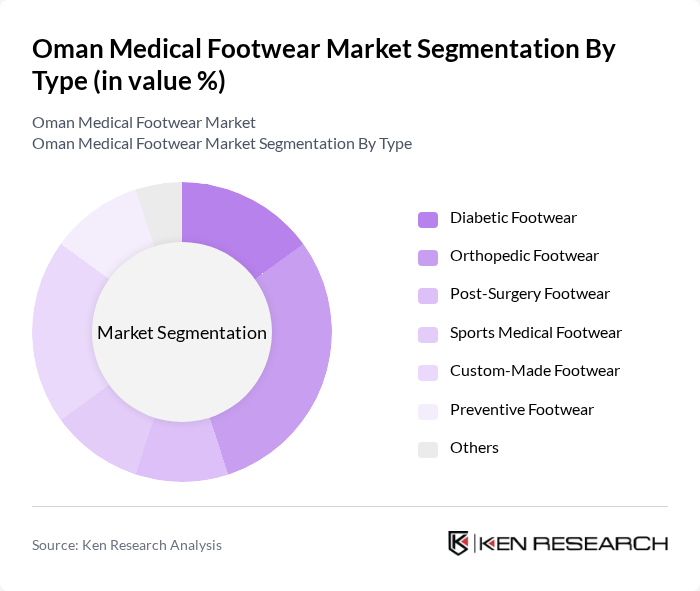

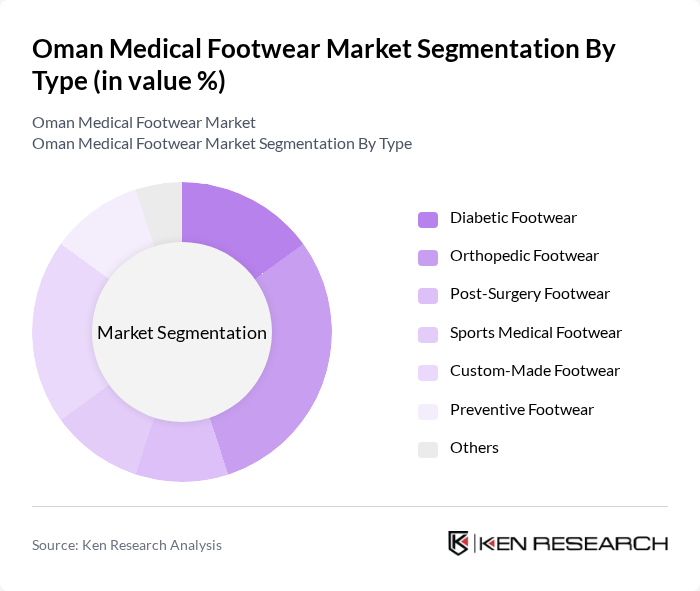

By Type:The medical footwear market is segmented into various types, including diabetic footwear, orthopedic footwear, post-surgery footwear, sports medical footwear, custom-made footwear, preventive footwear, and others. Among these, orthopedic footwear is currently the dominant segment due to the increasing prevalence of foot-related ailments and the growing awareness of the importance of proper foot support. Consumers are increasingly seeking specialized footwear that provides comfort and addresses specific medical needs, driving the demand for orthopedic solutions.

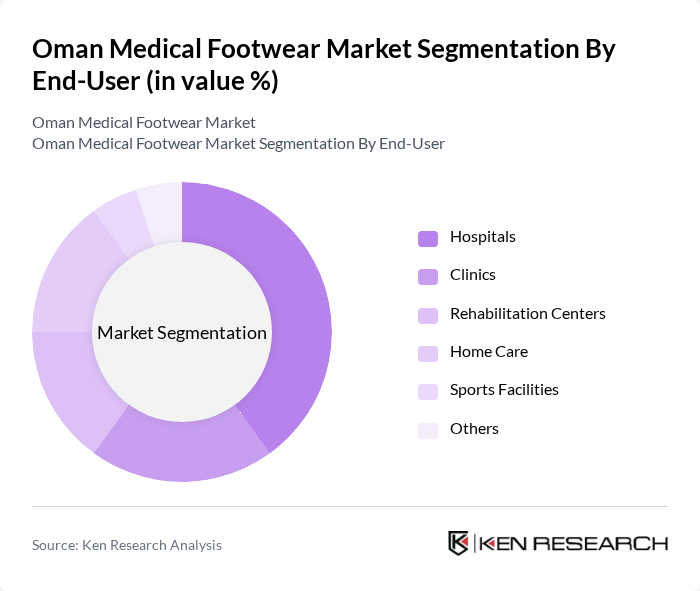

By End-User:The end-user segmentation includes hospitals, clinics, rehabilitation centers, home care, sports facilities, and others. Hospitals are the leading end-user segment, driven by the increasing number of patients requiring specialized footwear for recovery and rehabilitation. The demand for medical footwear in hospitals is further supported by the growing focus on patient comfort and the need for footwear that aids in recovery from various medical conditions.

Oman Medical Footwear Market Competitive Landscape

The Oman Medical Footwear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Khamis Footwear, Al Shanfari Group, Muscat Medical Supplies, Oman Medical Products, Al Mufeed Medical Supplies, Al Harthy Medical Equipment, Al Jazeera Medical Supplies, Al Fawaz Group, Al Muna Medical Supplies, Al Noor Medical Supplies, Al Mufeed Footwear, Al Muthanna Medical Supplies, Al Mufeed Orthopedic Footwear, Al Ameen Medical Supplies, Al Mufeed Healthcare contribute to innovation, geographic expansion, and service delivery in this space.

Oman Medical Footwear Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Foot-Related Health Issues:The rise in foot-related health issues, such as diabetes and arthritis, is significant in Oman, with approximately 1.3 million adults affected by diabetes as of future. This condition often leads to complications requiring specialized footwear. The World Health Organization reported that 30% of diabetic patients experience foot problems, driving demand for medical footwear. As healthcare awareness increases, the need for appropriate footwear solutions becomes critical, propelling market growth.

- Rising Awareness About the Importance of Medical Footwear:Awareness campaigns by healthcare professionals and organizations have increased understanding of the benefits of medical footwear. In Oman, over 65% of healthcare providers emphasize the importance of proper footwear in preventing complications. This growing awareness is reflected in the increasing sales of medical footwear, with a reported 18% rise in demand in future. As consumers become more informed, the market for specialized footwear is expected to expand significantly.

- Technological Advancements in Footwear Design and Materials:Innovations in footwear technology, such as the use of breathable materials and ergonomic designs, are enhancing the comfort and effectiveness of medical footwear. In future, the introduction of 3D printing technology in footwear manufacturing has reduced production costs by 25%, making specialized footwear more accessible. These advancements not only improve product quality but also attract a broader consumer base, further stimulating market growth in Oman.

Market Challenges

- High Cost of Specialized Medical Footwear:The high cost associated with specialized medical footwear remains a significant barrier to market growth. Prices for quality medical footwear can range from OMR 55 to OMR 160, which is prohibitive for many consumers, especially in lower-income segments. This financial constraint limits access to necessary products, hindering overall market expansion. As a result, many potential users may opt for cheaper, less effective alternatives, impacting health outcomes.

- Limited Availability of Products in Rural Areas:Access to medical footwear is particularly challenging in rural regions of Oman, where healthcare infrastructure is less developed. Approximately 32% of the population resides in these areas, often lacking specialized stores or healthcare providers to recommend appropriate footwear. This limited availability restricts consumer choice and awareness, resulting in lower sales and market penetration in these regions, which poses a challenge for manufacturers and retailers alike.

Oman Medical Footwear Market Future Outlook

The Oman medical footwear market is poised for significant growth, driven by increasing health awareness and technological advancements. As the population ages, the demand for specialized footwear will likely rise, particularly among older adults who require comfort and support. Additionally, the expansion of e-commerce platforms will enhance product accessibility, allowing consumers in remote areas to purchase medical footwear easily. Collaborations with healthcare providers will further promote awareness and adoption, creating a more robust market landscape in the coming years.

Market Opportunities

- Expansion of E-Commerce Platforms for Medical Footwear:The growth of e-commerce in Oman presents a significant opportunity for medical footwear brands. With over 1.6 million online shoppers in future, brands can reach a wider audience, particularly in underserved rural areas. This shift towards online retail can enhance product visibility and accessibility, driving sales and fostering consumer engagement in the medical footwear sector.

- Customization and Personalization of Footwear:There is a growing trend towards customization in the footwear industry, with consumers increasingly seeking personalized solutions. Offering tailored medical footwear can meet individual needs, enhancing comfort and satisfaction. In future, 45% of consumers expressed interest in customized options, indicating a lucrative market segment. This opportunity allows manufacturers to differentiate their products and cater to specific health requirements, driving market growth.