Region:Global

Author(s):Geetanshi

Product Code:KRAA2761

Pages:82

Published On:August 2025

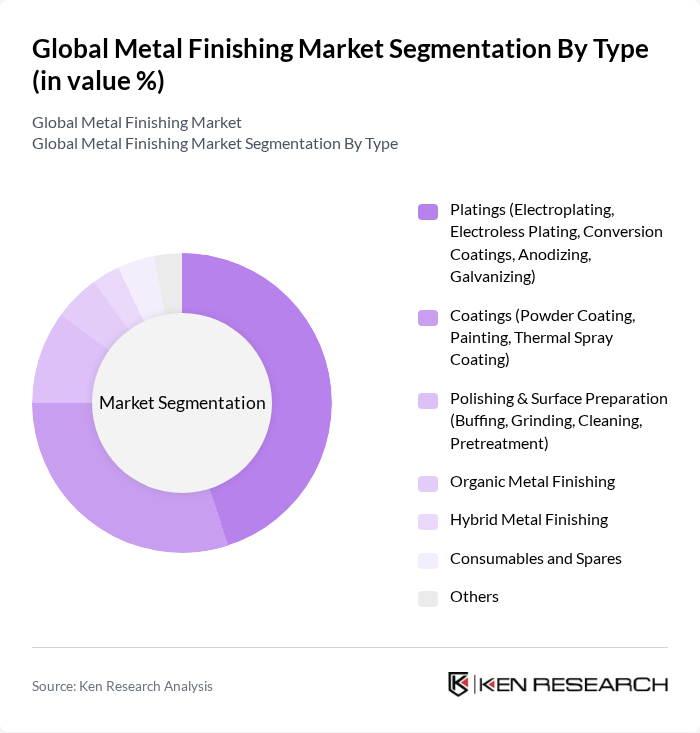

By Type:The metal finishing market is segmented into Platings, Coatings, Polishing & Surface Preparation, Organic Metal Finishing, Hybrid Metal Finishing, Consumables and Spares, and Others. Among these,Platings—including Electroplating, Electroless Plating, Conversion Coatings, Anodizing, and Galvanizing—dominate the market due to their extensive use in enhancing corrosion resistance, durability, and aesthetic appeal.Coatingssuch as Powder Coating, Painting, and Thermal Spray Coating are also significant, driven by the need for protective and decorative finishes across diverse industries .

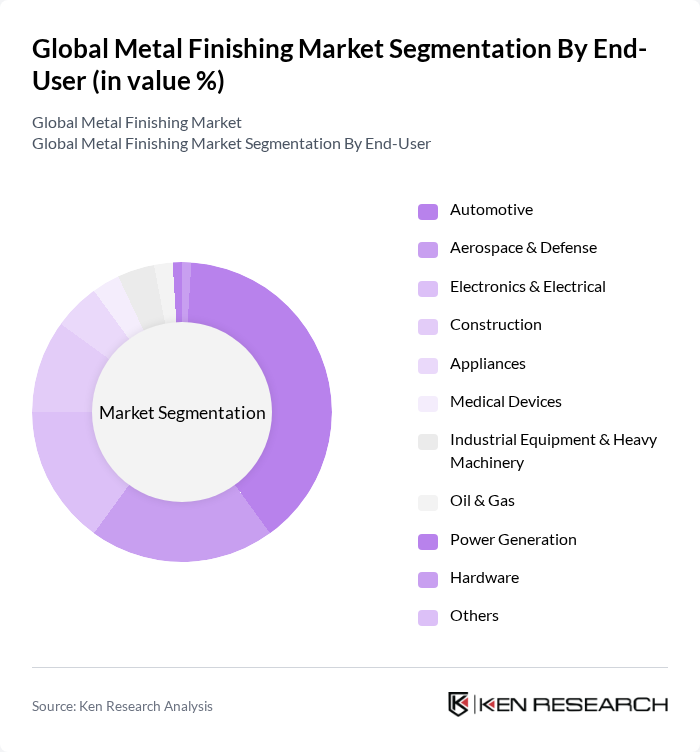

By End-User:The end-user segmentation of the metal finishing market includes Automotive, Aerospace & Defense, Electronics & Electrical, Construction, Appliances, Medical Devices, Industrial Equipment & Heavy Machinery, Oil & Gas, Power Generation, Hardware, and Others. TheAutomotivesector is the leading end-user, driven by the need for high-quality finishes that enhance vehicle durability and aesthetics. TheAerospace & Defensesector follows, requiring specialized coatings and finishes for safety and performance. Electronics & Electrical, Construction, and Appliances are also significant contributors to market demand .

The Global Metal Finishing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Atotech, Coventya, MacDermid Enthone, Chemetall (BASF Surface Treatment), Henkel AG & Co. KGaA, PPG Industries, Inc., The Sherwin-Williams Company, BASF SE, DuPont de Nemours, Inc., Akzo Nobel N.V., Eastman Chemical Company, Huntsman Corporation, 3M Company, KCH Services Inc., Tiodize Company, Inc., TIB Chemicals AG, and Honeywell International Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the metal finishing market appears promising, driven by technological advancements and increasing demand for sustainable practices. As industries continue to embrace automation and smart manufacturing, the integration of IoT technologies is expected to enhance operational efficiency. Furthermore, the growing emphasis on eco-friendly solutions will likely lead to the adoption of innovative finishing techniques, positioning companies to meet evolving consumer preferences and regulatory requirements effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Platings (Electroplating, Electroless Plating, Conversion Coatings, Anodizing, Galvanizing) Coatings (Powder Coating, Painting, Thermal Spray Coating) Polishing & Surface Preparation (Buffing, Grinding, Cleaning, Pretreatment) Organic Metal Finishing Hybrid Metal Finishing Consumables and Spares Others |

| By End-User | Automotive Aerospace & Defense Electronics & Electrical Construction Appliances Medical Devices Industrial Equipment & Heavy Machinery Oil & Gas Power Generation Hardware Others |

| By Application | Decorative Finishing Functional Finishing Protective Coatings Surface Preparation Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, U.K., France, Italy, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (Saudi Arabia, South Africa, Rest of MEA) Others |

| By Price Range | Low-End Mid-Range High-End |

| By Technology | Traditional Techniques Advanced Techniques (e.g., Nanotechnology, Green Technologies) Automated Processes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Metal Finishing | 120 | Production Managers, Quality Control Engineers |

| Aerospace Coating Processes | 90 | Manufacturing Engineers, Compliance Officers |

| Electronics Component Finishing | 60 | Product Development Managers, Supply Chain Analysts |

| Industrial Equipment Finishing | 80 | Operations Managers, Technical Directors |

| Consumer Goods Metal Finishing | 50 | Marketing Managers, R&D Specialists |

The Global Metal Finishing Market is valued at approximately USD 90 billion, driven by increasing demand across various industries such as automotive, aerospace, electronics, and construction, along with advancements in technology and sustainability initiatives.