Region:Global

Author(s):Geetanshi

Product Code:KRAC9357

Pages:85

Published On:November 2025

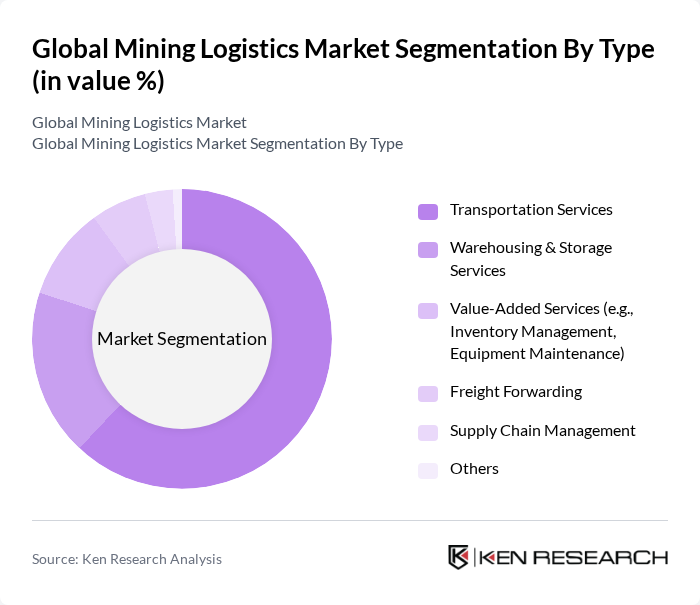

By Type:The market is segmented into various types, including Transportation Services, Warehousing & Storage Services, Value-Added Services, Freight Forwarding, Supply Chain Management, and Others. Each of these segments plays a crucial role in the overall logistics process, catering to different needs within the mining sector .

The Transportation Services segment is the dominant player in the market, accounting for the largest portion of overall logistics activities. This is largely due to the essential role transportation plays in moving raw materials from mining sites to processing plants and distribution centers. The increasing demand for efficient and timely delivery of mining products has led to a surge in investments in transportation infrastructure, including road, rail, and maritime options. As mining operations expand, the need for reliable transportation solutions continues to grow, solidifying this segment's leadership in the market .

By Application:The market is segmented into applications such as Iron Ore, Metals, Coal, Gold, and Others. Each application has unique logistics requirements based on the nature of the materials and the specific needs of the mining operations .

The Coal application segment leads the market, reflecting the high demand for coal in energy production and industrial processes. Logistics for coal require specialized handling and bulk transport solutions, often involving rail and maritime networks. As global energy needs and industrialization continue, the demand for coal logistics remains robust, reinforcing its position as the leading application in the mining logistics market .

The Global Mining Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, C.H. Robinson, XPO Logistics, CEVA Logistics, Agility Logistics, DSV, Expeditors International, Geodis, UPS Supply Chain Solutions, FedEx Logistics, YRC Worldwide (now Yellow Corporation), SNCF Logistics, Toll Group, Aurizon, TCDD Ta??mac?l?k A.?., Pacific National, Grupo México Transportes, Transnet Freight Rail contribute to innovation, geographic expansion, and service delivery in this space.

The future of the mining logistics market appears promising, driven by technological advancements and a growing emphasis on sustainability. As companies increasingly adopt digital solutions, the efficiency of logistics operations is expected to improve significantly. Furthermore, the shift towards sustainable practices will likely lead to the development of eco-friendly logistics solutions, aligning with global environmental goals. This evolution will create a more resilient and adaptive logistics framework within the mining sector, catering to emerging market demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Services Warehousing & Storage Services Value-Added Services (e.g., Inventory Management, Equipment Maintenance) Freight Forwarding Supply Chain Management Others |

| By Application | Iron Ore Metals Coal Gold Others |

| By Mode of Transport | Road Transport Rail Transport Maritime (Sea) Transport Air Transport Others |

| By Region | Asia Pacific North America Europe Latin America Middle East & Africa |

| By Service Type | Customs Clearance Packaging Services Inventory Management Others |

| By Technology | Tracking and Monitoring Systems Automated Logistics Solutions Data Analytics Tools Others |

| By Contract Type | Long-term Contracts Short-term Contracts Project-based Contracts Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mining Equipment Logistics | 100 | Logistics Coordinators, Supply Chain Managers |

| Mineral Transportation Services | 60 | Operations Managers, Fleet Managers |

| Coal Supply Chain Management | 50 | Procurement Managers, Logistics Analysts |

| Metals Distribution Networks | 55 | Distribution Managers, Sales Managers |

| Environmental Compliance in Logistics | 45 | Sustainability Officers, Compliance Managers |

The Global Mining Logistics Market is valued at approximately USD 33 billion, driven by increasing demand for minerals and metals, as well as the expansion of mining operations worldwide.