Region:Middle East

Author(s):Geetanshi

Product Code:KRAE0700

Pages:85

Published On:December 2025

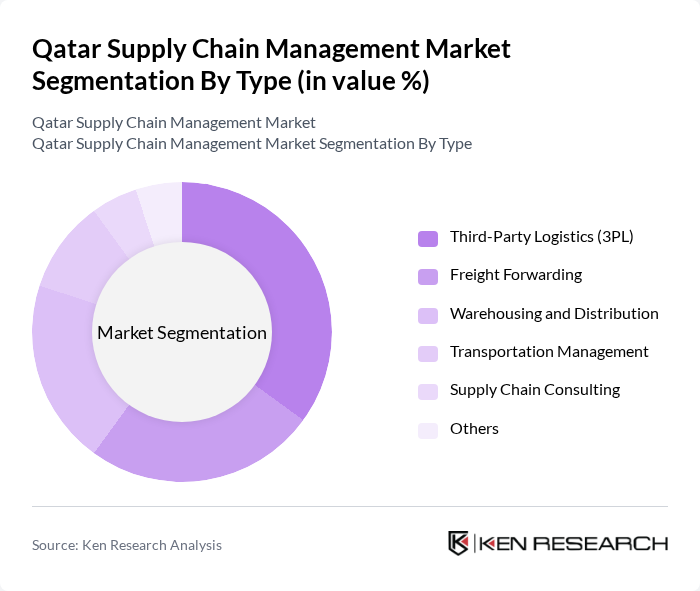

By Type:The market is segmented into various types, including Third-Party Logistics (3PL), Freight Forwarding, Warehousing and Distribution, Transportation Management, Supply Chain Consulting, and Others. Among these, Third-Party Logistics (3PL) is the leading segment, driven by the increasing demand for outsourcing logistics services. Companies are increasingly relying on 3PL providers to enhance operational efficiency and reduce costs, which is a significant trend in the market.

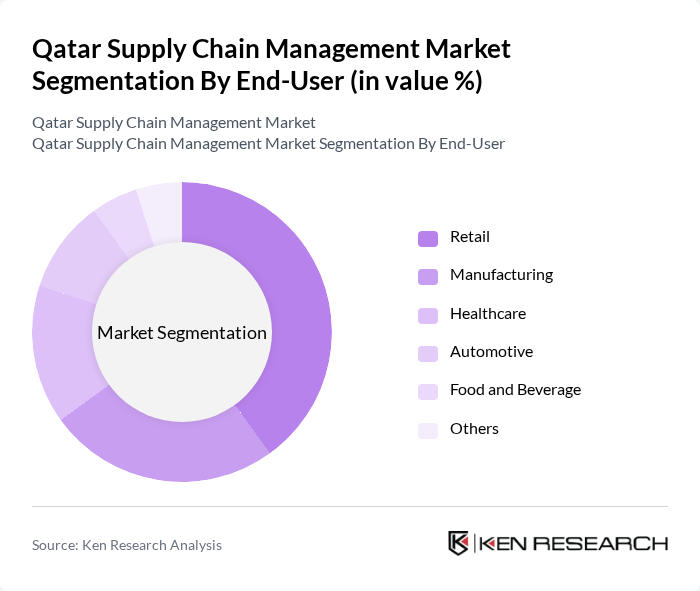

By End-User:The end-user segmentation includes Retail, Manufacturing, Healthcare, Automotive, Food and Beverage, and Others. The Retail sector is the dominant end-user, driven by the rapid growth of e-commerce and the need for efficient supply chain solutions to meet consumer demands. Retailers are increasingly adopting advanced logistics strategies to enhance customer satisfaction and streamline operations.

The Qatar Supply Chain Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Logistics, Gulf Warehousing Company, Agility Logistics, DB Schenker, Kuehne + Nagel, DHL Supply Chain, CEVA Logistics, Aramex, Al-Futtaim Logistics, Qatar Airways Cargo, Mena Logistics, Agility Public Warehousing Company, Al Jazeera International, Qatar National Import and Export Company, and Qatar Petroleum Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar supply chain management market appears promising, driven by ongoing government initiatives and technological advancements. As the nation continues to invest in infrastructure and digital solutions, companies are likely to adopt more integrated and automated systems. The focus on sustainability will also shape the market, encouraging businesses to implement eco-friendly practices. Overall, the combination of these factors is expected to enhance operational efficiency and competitiveness in the supply chain sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Third-Party Logistics (3PL) Freight Forwarding Warehousing and Distribution Transportation Management Supply Chain Consulting Others |

| By End-User | Retail Manufacturing Healthcare Automotive Food and Beverage Others |

| By Industry Vertical | Consumer Goods Electronics Pharmaceuticals Construction Others |

| By Service Type | Inbound Logistics Outbound Logistics Reverse Logistics Others |

| By Technology | Cloud-based Solutions IoT Integration Blockchain Technology Others |

| By Geographic Distribution | Urban Areas Rural Areas Industrial Zones Others |

| By Policy Support | Government Incentives Tax Benefits Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Supply Chain Management | 100 | Project Managers, Procurement Specialists |

| Retail Logistics Operations | 80 | Supply Chain Managers, Inventory Control Analysts |

| Oil & Gas Supply Chain Optimization | 70 | Logistics Coordinators, Operations Directors |

| Food and Beverage Distribution | 60 | Warehouse Managers, Quality Assurance Officers |

| Technology in Supply Chain | 90 | IT Managers, Digital Transformation Leads |

The Qatar Supply Chain Management Market is valued at approximately USD 10 billion, driven by strategic investments in infrastructure and the increasing demand for logistics services, particularly due to the rise of e-commerce and urbanization.