Region:Global

Author(s):Dev

Product Code:KRAB0447

Pages:91

Published On:August 2025

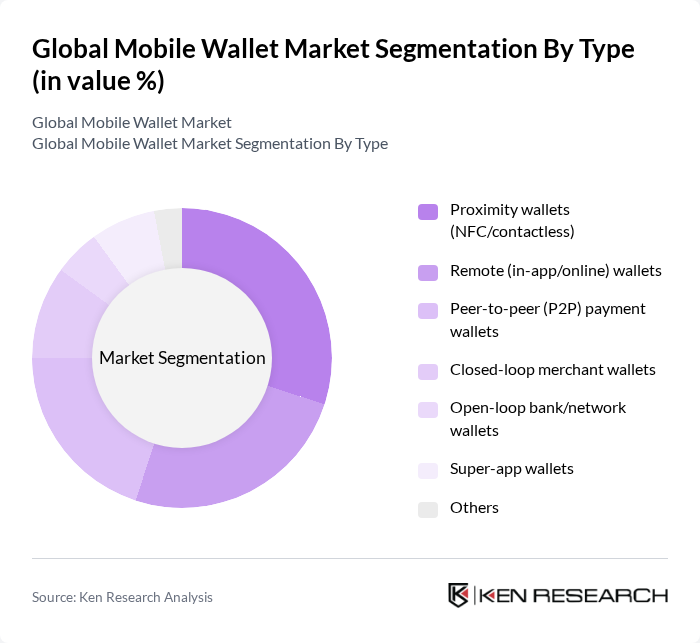

By Type:The mobile wallet market can be segmented into various types, including proximity wallets (NFC/contactless), remote (in-app/online) wallets, peer-to-peer (P2P) payment wallets, closed-loop merchant wallets, open-loop bank/network wallets, super-app wallets, and others. Each of these sub-segments caters to different consumer needs and preferences, contributing to the overall growth of the market .

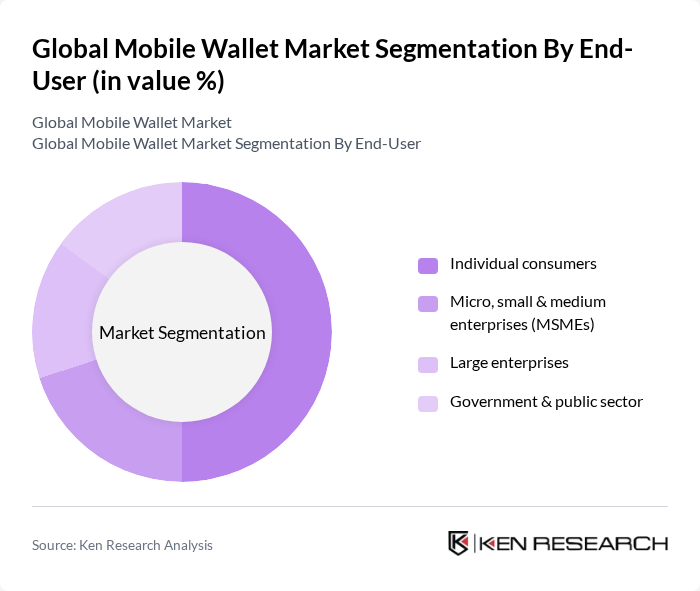

By End-User:The end-user segmentation includes individual consumers, micro, small & medium enterprises (MSMEs), large enterprises, and government & public sector. Each segment has unique requirements and usage patterns, influencing the overall dynamics of the mobile wallet market .

The Global Mobile Wallet Market is characterized by a dynamic mix of regional and international players. Leading participants such as Apple Pay (Apple Inc.), Google Pay (Google LLC), Samsung Wallet (Samsung Electronics Co., Ltd.), PayPal Holdings, Inc., Venmo (PayPal Holdings, Inc.), Alipay (Ant Group Co., Ltd.), WeChat Pay (Tencent Holdings Ltd.), Cash App (Block, Inc.), Revolut Ltd., Wise plc, Stripe, Inc., Adyen N.V., Paytm (One97 Communications Ltd.), PhonePe Pvt. Ltd., GrabPay (Grab Holdings Limited), GoPay (PT Dompet Anak Bangsa, GoTo Group), M-Pesa (Safaricom PLC & Vodafone Group), Orange Money (Orange S.A.), Mercado Pago (MercadoLibre, Inc.), Kakao Pay Corp. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the mobile wallet market appears promising, driven by technological advancements and evolving consumer preferences. As digital payment adoption continues to rise, mobile wallets are expected to integrate more seamlessly with various platforms, enhancing user experience. Additionally, the growing emphasis on security and regulatory compliance will shape the development of innovative features, ensuring that mobile wallets remain a preferred choice for consumers seeking convenience and safety in their financial transactions.

| Segment | Sub-Segments |

|---|---|

| By Type | Proximity wallets (NFC/contactless) Remote (in-app/online) wallets Peer-to-peer (P2P) payment wallets Closed-loop merchant wallets Open-loop bank/network wallets Super-app wallets Others |

| By End-User | Individual consumers Micro, small & medium enterprises (MSMEs) Large enterprises Government & public sector |

| By Payment Method | Card-on-file (credit/debit) tokenized payments Account-to-account (A2A)/bank transfers QR code payments NFC/contactless tap-to-pay Carrier billing Buy Now, Pay Later (BNPL) via wallet |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Industry Vertical | Retail & e-commerce Hospitality & food services Transportation & mobility Healthcare & insurance Utilities & bill payments Gaming & digital content |

| By Security Features | Device biometrics (fingerprint/FaceID) Multi-factor authentication (2FA/OTP) Network tokenization & EMVCo tokens End-to-end encryption Real-time fraud/risk scoring |

| By Pricing Model | Interchange/merchant discount rate (MDR) Per-transaction fee Subscription/SaaS fee Float/interest & ancillary revenue Freemium & incentives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mobile Wallet Usage | 150 | Regular Users, Occasional Users |

| Merchant Acceptance of Mobile Payments | 120 | Small Business Owners, Retail Managers |

| Financial Institutions' Perspectives | 90 | Banking Executives, Payment Solution Managers |

| Technological Integration Challenges | 80 | IT Managers, Digital Transformation Officers |

| Regulatory Impact on Mobile Wallets | 70 | Compliance Officers, Legal Advisors |

The Global Mobile Wallet Market is valued at approximately USD 195 billion, driven by factors such as rising smartphone penetration, rapid e-commerce growth, and increased adoption of contactless payments, enhancing security for both consumers and merchants.