Region:Middle East

Author(s):Rebecca

Product Code:KRAA9440

Pages:92

Published On:November 2025

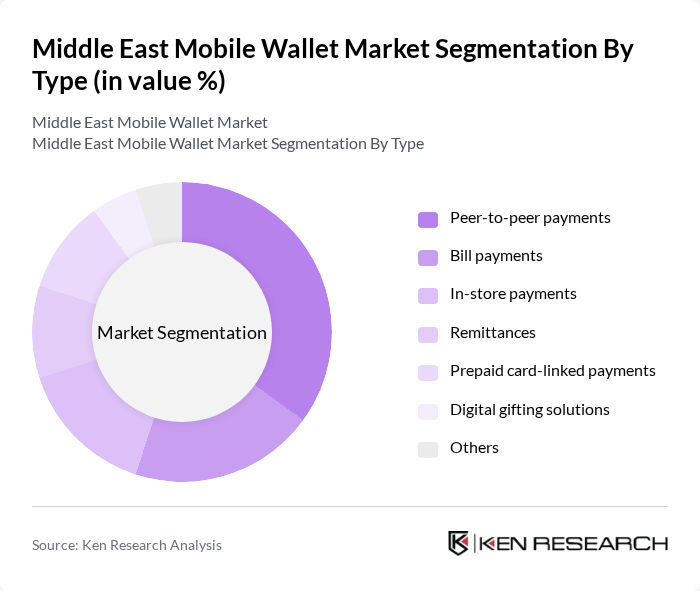

By Type:The market is segmented into various types, including peer-to-peer payments, bill payments, in-store payments, remittances, prepaid card-linked payments, digital gifting solutions, and others. Among these,peer-to-peer paymentshave emerged as the leading sub-segment, propelled by the increasing trend of social payments and the demand for fast, convenient money transfers among individuals. The integration of payment features into social media and messaging apps, along with the expansion of card-linked wallet ecosystems, has further fueled this growth, making peer-to-peer payments a preferred choice for many users .

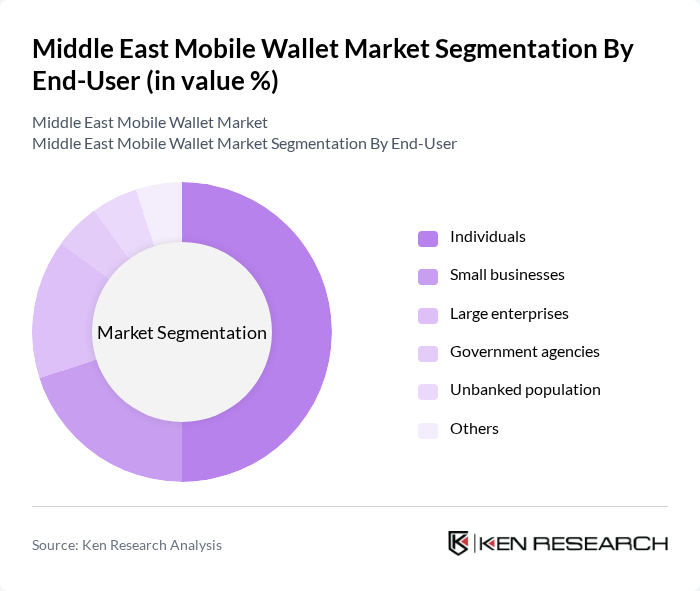

By End-User:The end-user segmentation includes individuals, small businesses, large enterprises, government agencies, the unbanked population, and others.Individualsrepresent the largest segment, as the convenience and accessibility of mobile wallets appeal to a broad demographic. The increasing number of smartphone users, the growing trend of online shopping, and the expansion of digital financial services have made mobile wallets an essential tool for personal finance management, leading to a significant rise in adoption among individual users .

The Middle East Mobile Wallet Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC Pay, PayFort (Amazon Payment Services), Fawry, Zain Cash, Mobily Pay, Etisalat Wallet, Samsung Pay, Apple Pay, Google Pay, RAKBANK (Ras Al Khaimah Bank), Al Rajhi Bank, Emirates NBD, QNB (Qatar National Bank), First Abu Dhabi Bank (FAB) – Payit Wallet, Bahrain Islamic Bank, YouGotaGift, Carrefour Pay, Mashreq Neo, CIB Smart Wallet (Commercial International Bank Egypt), NBE PhoneCash (National Bank of Egypt) contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East mobile wallet market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As contactless payment solutions gain traction, the integration of artificial intelligence for personalized services is expected to enhance user experiences. Additionally, the rise of fintech startups is likely to foster innovation, creating a competitive landscape that encourages the development of new features and services tailored to consumer needs, ultimately driving market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Peer-to-peer payments Bill payments In-store payments Remittances Prepaid card-linked payments Digital gifting solutions Others |

| By End-User | Individuals Small businesses Large enterprises Government agencies Unbanked population Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Bahrain, Oman, Kuwait, Qatar) Levant Region (Jordan, Lebanon, Iraq, Syria, Palestine) North Africa (Egypt, Morocco, Algeria, Tunisia) Others |

| By Technology | NFC (Near Field Communication) QR Code SMS-based payments Mobile app-based payments Prepaid card integration Others |

| By Application | Retail transactions E-commerce transactions Utility payments Travel and transportation Payroll solutions Digital gifting Others |

| By Investment Source | Venture capital Private equity Government funding Crowdfunding Corporate investment Others |

| By Policy Support | Government subsidies Tax incentives Regulatory support Open banking initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mobile Wallet Usage | 120 | Mobile Wallet Users, Tech-Savvy Consumers |

| Merchant Adoption of Mobile Payments | 80 | Small Business Owners, Retail Managers |

| Fintech Industry Insights | 60 | Fintech Executives, Product Managers |

| Regulatory Impact Assessment | 40 | Policy Makers, Regulatory Experts |

| Consumer Attitudes Towards Security | 70 | General Consumers, Security Analysts |

The Middle East Mobile Wallet Market is valued at approximately USD 7 billion, driven by the increasing adoption of smartphones, the growth of e-commerce, and the demand for cashless transactions, according to a five-year historical analysis.