Global Modern Trade Retail Market Overview

- The Global Modern Trade Retail Market is valued at USD 5.3 trillion, based on a five-year historical analysis. This growth is primarily driven by increasing urbanization, rising disposable incomes, the proliferation of e-commerce, and the adoption of omnichannel retail strategies. The expansion of retail formats—including hypermarkets, supermarkets, and online platforms—has significantly contributed to the market's growth. Sustainability initiatives, technology integration such as artificial intelligence and automation, and the demand for personalized shopping experiences are also shaping the sector's evolution .

- Key players in this market include the United States, China, and Germany, which dominate due to their large consumer bases, advanced retail infrastructure, and high levels of investment in technology. The United States is recognized for its diverse retail formats and high retail sales, China leads in e-commerce adoption and digital retail innovation, and Germany is noted for its robust supermarket and discount store chains .

- In 2023, the European Union implemented the Digital Services Act (Regulation (EU) 2022/2065) issued by the European Parliament and the Council. This regulation mandates that all e-commerce platforms provide clear information regarding product pricing, delivery times, and return policies, aiming to enhance consumer protection, foster transparency, and build consumer trust in the rapidly growing online shopping sector .

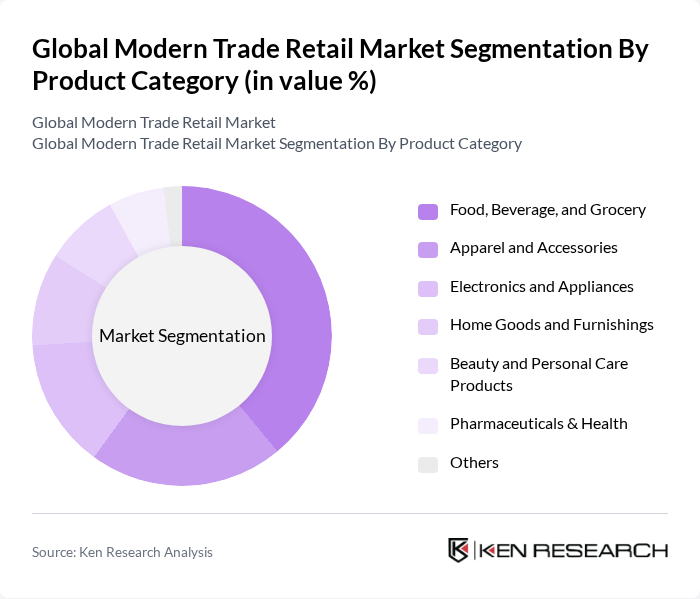

Global Modern Trade Retail Market Segmentation

By Type:The market is segmented into hypermarkets, supermarkets, convenience stores, discount stores, specialty stores, department stores, online retail, and others. Each segment caters to distinct consumer needs and preferences. Hypermarkets and supermarkets remain dominant for grocery and household goods, while online retail continues to gain significant traction due to convenience, expanded product selection, and digital payment options. The adoption of omnichannel models—integrating physical and digital experiences—is a key trend, enabling retailers to reach broader audiences and enhance customer engagement .

By Product Category:The market is further segmented by product categories, including food, beverage, and grocery; apparel and accessories; electronics and appliances; home goods and furnishings; beauty and personal care products; pharmaceuticals & health; and others. The food, beverage, and grocery segment remains the largest, driven by essential consumer demand and the expansion of modern grocery retail formats. Electronics and apparel are also significant, supported by rising online sales and increased consumer spending on lifestyle products .

Global Modern Trade Retail Market Competitive Landscape

The Global Modern Trade Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Walmart Inc., Amazon.com, Inc., Costco Wholesale Corporation, The Kroger Co., Aldi Einkauf GmbH & Co. oHG, Tesco PLC, Carrefour S.A., Target Corporation, Metro AG, Ahold Delhaize, Seven & I Holdings Co., Ltd., Lidl Stiftung & Co. KG, Walgreens Boots Alliance, Inc., Schwarz Group, Alibaba Group Holding Limited, E.Leclerc, Sainsbury's Supermarkets Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Global Modern Trade Retail Market Industry Analysis

Growth Drivers

- Increasing Urbanization:Urbanization is a significant driver of the modern trade retail market, with the United Nations projecting that in future, approximately 56% of the global population will reside in urban areas. This shift leads to higher foot traffic in retail spaces, increasing demand for organized retail formats. In cities, the average household income is approximately $74,000, compared to $52,000 in rural areas, further boosting spending on retail goods and services.

- Rise in Disposable Income:The global rise in disposable income is a crucial factor for modern trade retail growth. According to the World Bank, global GDP per capita is approximately $13,000 in recent periods, indicating increased consumer purchasing power. This economic uplift allows consumers to spend more on non-essential goods, driving demand for modern retail formats. In emerging markets, disposable income growth is projected at 6% annually, significantly impacting retail consumption patterns.

- Technological Advancements in Retail:Technological innovations are transforming the retail landscape, with global retail technology spending expected to exceed $350 billion in future. Technologies such as AI, machine learning, and mobile payment systems enhance customer experiences and streamline operations. Retailers adopting these technologies report a 22% increase in customer engagement and a 16% reduction in operational costs, making them more competitive in the modern trade sector.

Market Challenges

- Intense Competition:The modern trade retail market faces intense competition, with over 1.5 million retail establishments globally. Major players like Walmart and Amazon dominate, capturing significant market shares. This competitive landscape pressures smaller retailers to innovate and differentiate their offerings. In future, it is estimated that 32% of small retailers may struggle to survive due to this fierce competition, leading to potential market consolidation.

- Supply Chain Disruptions:Supply chain disruptions pose a significant challenge to the modern trade retail market. The COVID-19 pandemic highlighted vulnerabilities, with 78% of retailers reporting delays in product availability. In future, ongoing geopolitical tensions and climate change are expected to exacerbate these issues, leading to increased costs and inventory shortages. Retailers may face a 12% rise in logistics costs, impacting profitability and pricing strategies.

Global Modern Trade Retail Market Future Outlook

The future of the modern trade retail market appears promising, driven by technological advancements and evolving consumer preferences. Retailers are increasingly adopting omnichannel strategies, integrating online and offline experiences to enhance customer engagement. Additionally, the focus on sustainability is expected to shape product offerings, with 72% of consumers indicating a preference for eco-friendly products. As these trends continue to evolve, retailers must adapt to remain competitive and meet changing consumer demands effectively.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets present significant growth opportunities for modern trade retailers. With a combined population of over 3 billion, regions like Southeast Asia and Africa are experiencing rapid urbanization and rising disposable incomes. Retailers entering these markets can tap into a growing consumer base, with an estimated $1.2 trillion in retail spending potential in future, significantly enhancing their market presence.

- E-commerce Integration:The integration of e-commerce into traditional retail is a vital opportunity for growth. In future, global e-commerce sales are projected to reach $7 trillion, representing a 22% increase from previous years. Retailers that effectively combine online and offline channels can enhance customer experiences and drive sales. This trend is particularly relevant as 82% of consumers now prefer shopping across multiple platforms, necessitating a seamless omnichannel approach.