Region:Global

Author(s):Dev

Product Code:KRAB0467

Pages:89

Published On:August 2025

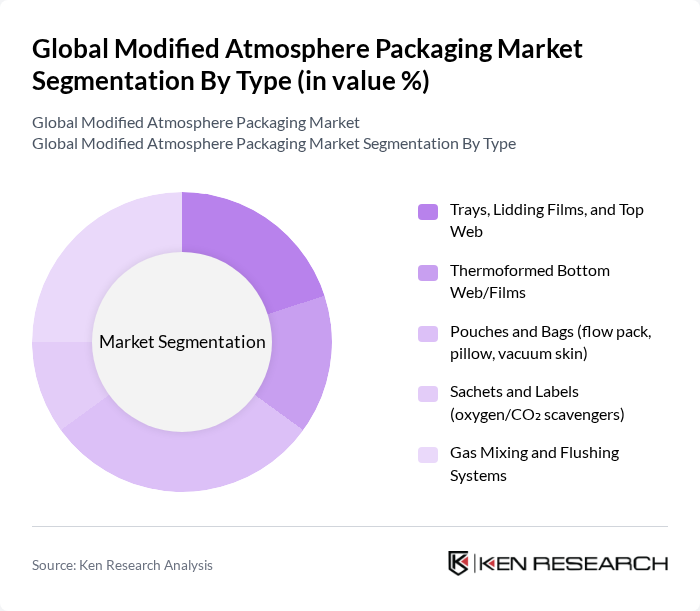

By Type:The market is segmented into trays, lidding films, thermoformed bottom webs, pouches and bags, sachets and labels, and gas mixing and flushing systems. Among these,pouches and bagsare gaining traction due to versatility, lightweight formats, and compatibility with high-speed flow-pack and VFFS systems, supporting ready-to-eat and snack categories while maintaining modified atmospheres for extended freshness.

By End-User:The end-user segmentation includes meat, poultry, seafood, fruits and vegetables, bakery and confectionery, dairy and cheese, and ready meals and convenience foods. Themeat, poultry, and seafoodsegment is particularly dominant because MAP slows aerobic microbial growth and oxidation, helping maintain color, texture, and safety across fresh and processed meats; strong global protein consumption and cold-chain expansion further support MAP penetration in this segment.

The Global Modified Atmosphere Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Sealed Air Corporation, Berry Global, Inc., Mondi Group, Smurfit Kappa Group, LINPAC Packaging (Klöckner Pentaplast), Coveris, Huhtamaki Oyj, Schur Flexibles Group, Winpak Ltd., Constantia Flexibles, ProAmpac LLC, AptarGroup, Inc., Tetra Pak International S.A., Ilpra S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the modified atmosphere packaging market appears promising, driven by increasing consumer awareness of food safety and sustainability. As the demand for fresh and minimally processed foods continues to rise, companies are likely to invest in innovative packaging solutions that enhance product longevity. Additionally, advancements in biodegradable materials and smart packaging technologies are expected to gain traction, aligning with consumer preferences for environmentally friendly options. This evolution will likely reshape the competitive landscape, fostering growth and innovation in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Trays, Lidding Films, and Top Web Thermoformed Bottom Web/Films Pouches and Bags (flow pack, pillow, vacuum skin) Sachets and Labels (oxygen/CO? scavengers) Gas Mixing and Flushing Systems |

| By End-User | Meat, Poultry, and Seafood Fruits and Vegetables Bakery and Confectionery Dairy and Cheese Ready Meals and Convenience Foods Pharmaceuticals and Medical Devices |

| By Material | Plastics (PE, PP, PET, PA/EVOH multilayer) Paper & Paperboard (barrier-coated) Metals (aluminum trays/foils) Bioplastics and Compostable Films |

| By Application | Fresh Produce (whole and cut) Fresh and Processed Meat Seafood Bakery and Snacks Dairy and Cheese Ready-to-Eat/Heat Meals |

| By Distribution Channel | B2B Direct (food processors, packers) Distributors/Converters Online Procurement Platforms Retail Private Label Partnerships |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Processing Industry | 120 | Production Managers, Quality Assurance Specialists |

| Retail Grocery Sector | 90 | Store Managers, Category Buyers |

| Logistics and Distribution | 70 | Logistics Coordinators, Supply Chain Analysts |

| Food Safety and Compliance | 60 | Regulatory Affairs Managers, Compliance Officers |

| Research and Development in Packaging | 50 | R&D Managers, Innovation Leads |

The Global Modified Atmosphere Packaging Market is valued at approximately USD 20 billion, reflecting strong demand driven by its effectiveness in extending the shelf life and maintaining the freshness of perishable foods.