Region:Middle East

Author(s):Shubham

Product Code:KRAC4945

Pages:88

Published On:October 2025

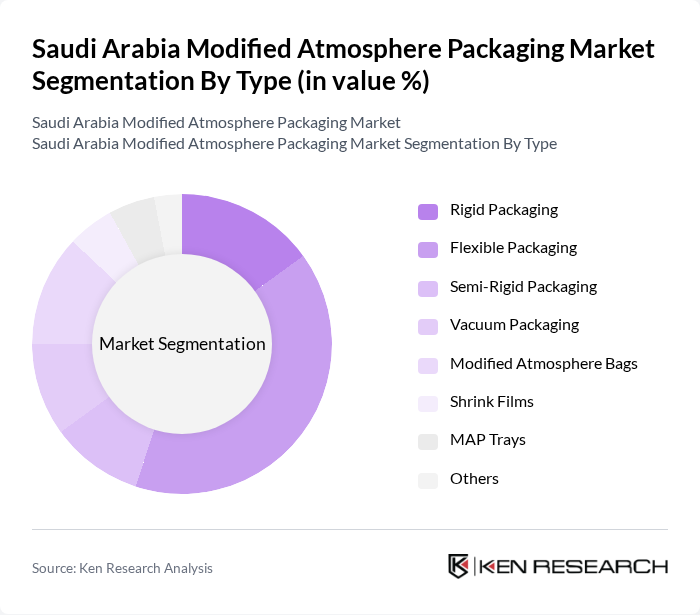

By Type:The market is segmented into various types of packaging solutions, including Rigid Packaging, Flexible Packaging, Semi-Rigid Packaging, Vacuum Packaging, Modified Atmosphere Bags, Shrink Films, MAP Trays, and Others. Flexible Packaging remains the leading sub-segment due to its versatility, lightweight nature, and cost-effectiveness, making it the preferred choice for both manufacturers and consumers. The growing adoption of flexible films and pouches is driven by their ability to maintain product freshness and reduce material usage .

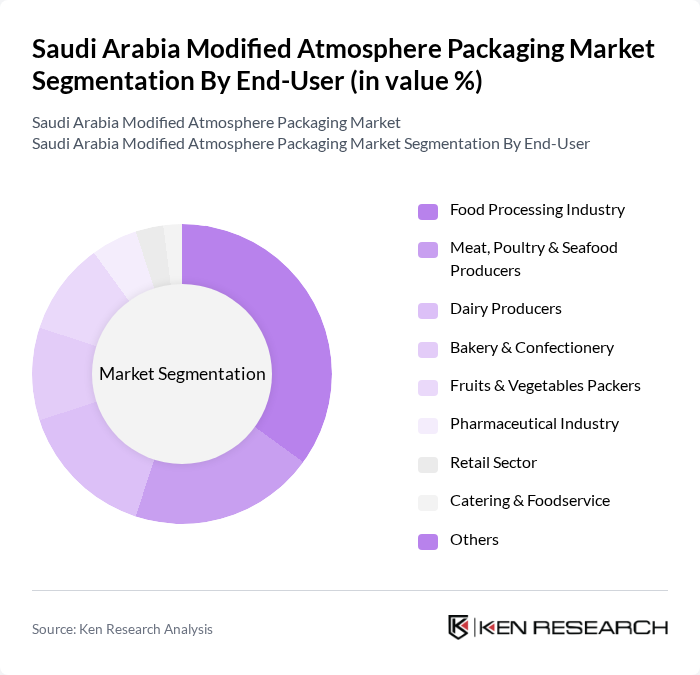

By End-User:The end-user segmentation includes the Food Processing Industry, Meat, Poultry & Seafood Producers, Dairy Producers, Bakery & Confectionery, Fruits & Vegetables Packers, Pharmaceutical Industry, Retail Sector, Catering & Foodservice, and Others. The Food Processing Industry is the dominant segment, propelled by the increasing demand for processed and packaged food products, urbanization, and the expansion of cold-chain logistics. Meat, poultry, and seafood producers also represent a significant share due to the need for extended shelf life and food safety .

The Saudi Arabia Modified Atmosphere Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Sealed Air Corporation, Berry Global, Inc., Mondi Group, Huhtamaki Oyj, Winpak Ltd., Coveris Holdings S.A., Constantia Flexibles, Schur Flexibles Group, Clondalkin Group, ProAmpac LLC, Intertape Polymer Group Inc., Novolex Holdings, Inc., Plastipak Holdings, Inc., Almarai Company, Napco National, Obeikan Flexible Packaging, Takween Advanced Industries, Savola Group, Arabian Packaging Co. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia modified atmosphere packaging market appears promising, driven by increasing consumer demand for food safety and sustainability. As the food and beverage sector continues to expand, innovations in packaging technology will likely play a pivotal role in enhancing product quality. Additionally, the government's focus on reducing food waste and promoting eco-friendly practices will further encourage the adoption of MAP solutions, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Rigid Packaging Flexible Packaging Semi-Rigid Packaging Vacuum Packaging Modified Atmosphere Bags Shrink Films MAP Trays Others |

| By End-User | Food Processing Industry Meat, Poultry & Seafood Producers Dairy Producers Bakery & Confectionery Fruits & Vegetables Packers Pharmaceutical Industry Retail Sector Catering & Foodservice Others |

| By Application | Fresh Produce Dairy Products Meat and Poultry Bakery Products Seafood Ready Meals Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Convenience Stores Direct Sales Others |

| By Material Type | Plastic (Polypropylene, Polyethylene, PET, etc.) Paper & Paperboard Metal (Aluminum, Tinplate) Glass Others |

| By Region | Central Region Eastern Region Western Region Southern Region Northern Region Others |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Processing Companies | 60 | Production Managers, Quality Assurance Officers |

| Retail Food Outlets | 50 | Store Managers, Category Buyers |

| Packaging Suppliers | 40 | Sales Directors, Product Development Managers |

| Consumer Insights | 70 | End Consumers, Food Enthusiasts |

| Logistics and Distribution Firms | 45 | Logistics Coordinators, Supply Chain Analysts |

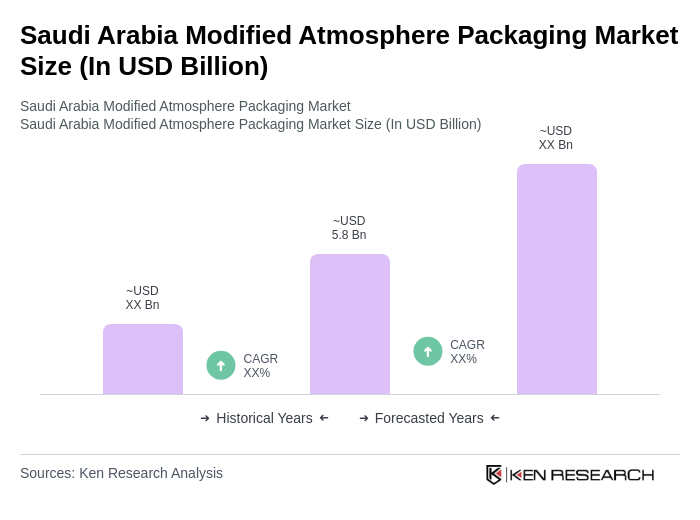

The Saudi Arabia Modified Atmosphere Packaging Market is valued at approximately USD 5.8 billion, driven by the increasing demand for packaged food products and advancements in packaging technologies that enhance product preservation and safety.