Region:Global

Author(s):Geetanshi

Product Code:KRAC9549

Pages:89

Published On:November 2025

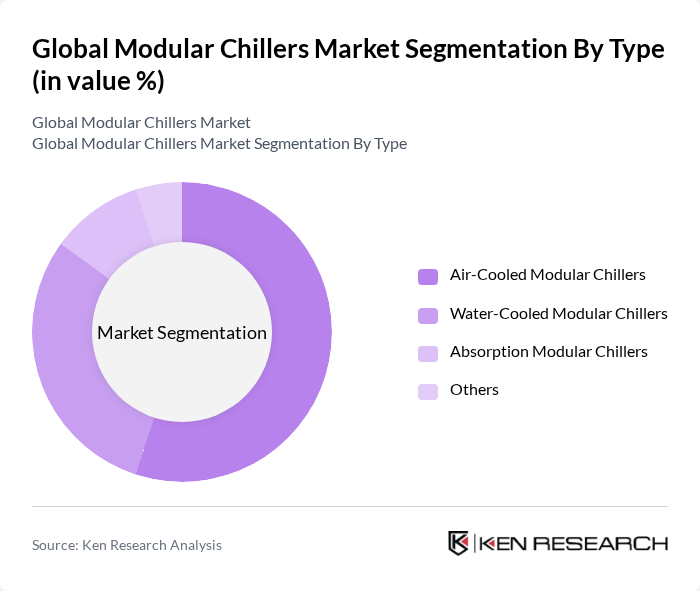

By Type:The modular chillers market is segmented into Air-Cooled Modular Chillers, Water-Cooled Modular Chillers, Absorption Modular Chillers, and Others.Air-Cooled Modular Chillershold the largest market share, driven by their ease of installation, lower maintenance costs, and suitability for commercial buildings and industrial applications where space and energy efficiency are critical.Water-Cooled Modular Chillersare preferred for large-scale industrial settings due to their higher cooling efficiency and ability to handle greater loads.Absorption Modular Chillersare gaining traction in niche applications focused on sustainability and waste heat utilization. The "Others" category includes hybrid and specialized modular chiller solutions designed for unique operational requirements .

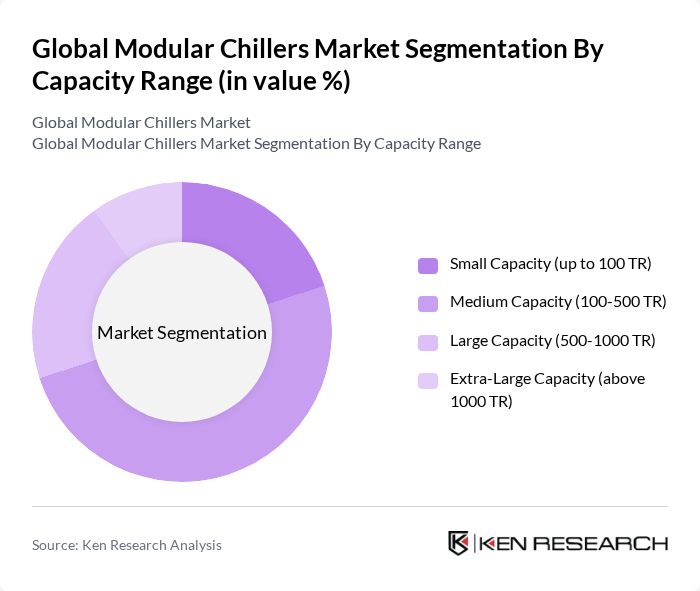

By Capacity Range:The market is also segmented by capacity range: Small Capacity (up to 100 TR), Medium Capacity (100-500 TR), Large Capacity (500-1000 TR), and Extra-Large Capacity (above 1000 TR). TheMedium Capacitysegment leads the market, reflecting strong demand from commercial buildings and industrial applications requiring efficient, scalable cooling solutions. Modular systems in this range offer optimal flexibility for expanding operations and adapting to varying load requirements. Small capacity chillers are favored in residential and small commercial projects, while large and extra-large capacity chillers serve mission-critical industrial and infrastructure projects .

The Global Modular Chillers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trane Technologies plc, Carrier Global Corporation, Johnson Controls International plc, Daikin Industries, Ltd., Mitsubishi Electric Corporation, Lennox International Inc., York International Corporation (Johnson Controls brand), Bosch Thermotechnology, Hitachi, Ltd., GEA Group AG, Aermec S.p.A., Climaveneta S.p.A. (Mitsubishi Electric Hydronics & IT Cooling Systems S.p.A.), Swegon Group AB, KKT Chillers, Blue Star Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the modular chillers market appears promising, driven by increasing energy efficiency demands and technological advancements. As urbanization accelerates, the need for scalable and efficient cooling solutions will intensify. Additionally, the integration of smart technologies and IoT capabilities is expected to enhance system performance and user experience. Companies that invest in innovation and sustainability will likely capture significant market share, positioning themselves favorably in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Air-Cooled Modular Chillers Water-Cooled Modular Chillers Absorption Modular Chillers Others |

| By Capacity Range | Small Capacity (up to 100 TR) Medium Capacity (100-500 TR) Large Capacity (500-1000 TR) Extra-Large Capacity (above 1000 TR) |

| By End-User | Commercial Buildings (Offices, Retail, Hospitals, Educational Facilities) Industrial (Manufacturing, Data Centers, Food Processing, Pharmaceuticals) Residential Government & Utilities |

| By Application | HVAC Systems Process Cooling Refrigeration Others |

| By Region | North America (United States, Canada) Europe (Germany, France, Italy, United Kingdom, Spain, Russia, Rest of Europe) Asia-Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia-Pacific) Latin America (Mexico, Brazil, Rest of Latin America) Middle East & Africa (Saudi Arabia, South Africa, United Arab Emirates, Rest of Middle East & Africa) |

| By Energy Source | Electric Gas Hybrid Others |

| By Control System | Manual Control Automated Control Smart Control Others |

| By Market Segment | New Installations Replacement Maintenance Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Applications | 100 | Facility Managers, Building Engineers |

| Industrial Process Cooling | 80 | Operations Managers, Plant Engineers |

| Residential HVAC Systems | 60 | Homeowners, HVAC Contractors |

| Energy Efficiency Programs | 50 | Energy Auditors, Sustainability Consultants |

| Chiller Technology Innovations | 40 | R&D Managers, Product Development Engineers |

The Global Modular Chillers Market is valued at approximately USD 3.5 billion, driven by the increasing demand for energy-efficient cooling solutions across various sectors, including commercial, industrial, and residential applications.