Region:Middle East

Author(s):Geetanshi

Product Code:KRAA0065

Pages:100

Published On:December 2025

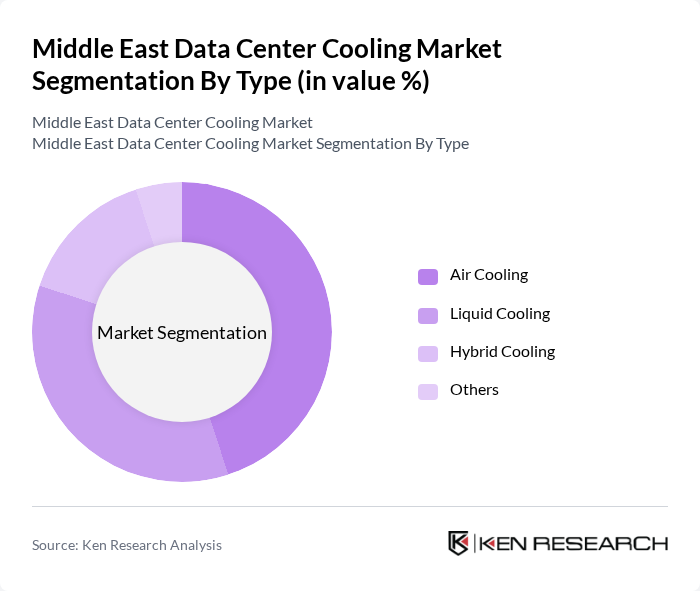

By Type:The market is segmented into various types of cooling solutions, including air cooling, liquid cooling, hybrid cooling, and others. Among these, air cooling is the most widely adopted due to its cost-effectiveness and ease of implementation. However, liquid cooling is gaining traction as data centers require more efficient cooling solutions to manage higher heat loads from advanced computing technologies. The hybrid cooling segment is also emerging as a popular choice, combining the benefits of both air and liquid cooling systems.

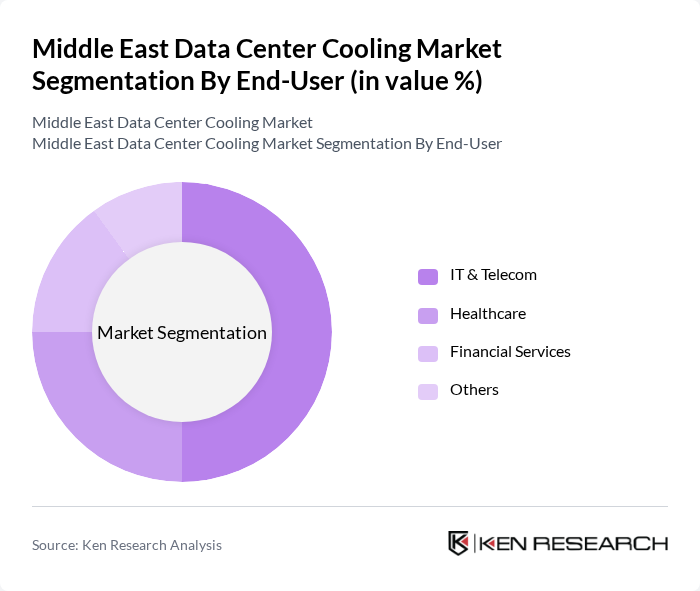

By End-User:The end-user segmentation includes IT & Telecom, Healthcare, Financial Services, and others. The IT & Telecom sector dominates the market due to the increasing demand for data processing and storage capabilities. This sector's rapid growth is driven by the proliferation of cloud services and the need for efficient data management solutions. The healthcare sector is also witnessing significant growth as hospitals and medical facilities invest in data centers to manage patient information and support telemedicine initiatives.

The Middle East Data Center Cooling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schneider Electric, Vertiv, STULZ, Rittal, Airedale International, Emerson Electric, Johnson Controls, Mitsubishi Electric, Daikin, Trane Technologies, Honeywell, Siemens, Black Box Network Services, CoolIT Systems, Arctic Cooling contribute to innovation, geographic expansion, and service delivery in this space.

Emerging technologies such as liquid immersion cooling and AI-driven thermal management are increasingly being adopted, offering considerable energy savings of approximately **40%**. Sustainability trends are also gaining traction, with the UAE aiming for **Net Zero 2050** and renewable-powered cooling systems featured in up to **40%** of new projects. The demand for digital transformation and AI infrastructure continues to grow, with capacity expected to triple from **1 GW** to **3.3 GW** in the future, indicating a robust future for the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Air Cooling Liquid Cooling Hybrid Cooling Others |

| By End-User | IT & Telecom Healthcare Financial Services Others |

| By Region | UAE Saudi Arabia Qatar Others |

| By Technology | Chilled Water Systems Direct Expansion Systems Evaporative Cooling Systems Others |

| By Application | Data Centers Telecommunication Facilities Server Farms Others |

| By Investment Source | Private Investments Public Funding International Investments Others |

| By Policy Support | Government Grants Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Data Center Operations | 100 | Data Center Managers, IT Infrastructure Directors |

| Cloud Service Providers | 80 | Cloud Operations Managers, Technical Architects |

| Telecommunications Data Centers | 70 | Network Operations Managers, Facility Engineers |

| Colocation Facilities | 60 | Sales Managers, Facility Managers |

| Energy Efficiency Consultants | 50 | Energy Auditors, Sustainability Consultants |

The Middle East Data Center Cooling Market is valued at approximately USD 0.2 billion, driven by rapid digitalization, smart city initiatives, and government cloud-first strategies, which are increasing the demand for data center expansion and advanced cooling solutions.