Region:Global

Author(s):Dev

Product Code:KRAD0533

Pages:96

Published On:August 2025

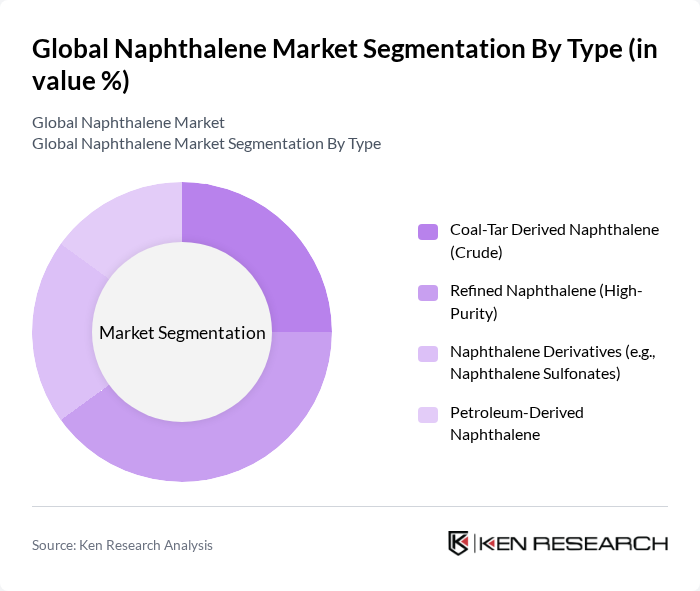

By Type:The naphthalene market can be segmented into four main types: Coal-Tar Derived Naphthalene (Crude), Refined Naphthalene (High-Purity), Naphthalene Derivatives (e.g., Naphthalene Sulfonates), and Petroleum-Derived Naphthalene. Among these, Refined Naphthalene (High-Purity) is the leading subsegment due to its extensive use in high-performance applications such as superplasticizers in construction and as a precursor in the production of phthalic anhydride; construction and textile value chains in Asia Pacific reinforce demand for refined grades and derivatives.

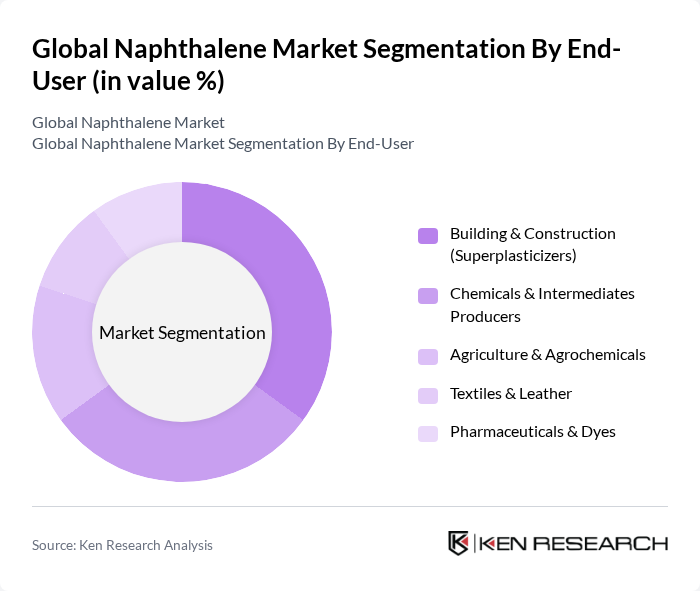

By End-User:The end-user segmentation includes Building & Construction (Superplasticizers), Chemicals & Intermediates Producers, Agriculture & Agrochemicals, Textiles & Leather, and Pharmaceuticals & Dyes. The Building & Construction sector is the dominant end-user, primarily due to the increasing demand for sulfonated naphthalene formaldehyde superplasticizers in concrete to enhance workability and reduce water content; this is supported by ongoing infrastructure development and the role of naphthalene in phthalic anhydride-based resins used in construction value chains.

The Global Naphthalene Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Rain Carbon Inc., Koppers Inc., Himadri Speciality Chemical Ltd., NalonChem (Yunnan Yunwei Company Limited), JFE Chemical Corporation, Nippon Steel Chemical & Material Co., Ltd., OCI Company Ltd., Coopers Creek Chemical Corporation, Deza, a.s. (Agrofert Group), China Steel Chemical Corporation, Shandong Weijiao Group Co., Ltd., SAIL R&D Centre (Coal Chemicals Division) — India, Rütgers Germany GmbH (Rain Carbon Germany), Eastman Chemical Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the naphthalene market appears promising, driven by increasing applications across various industries. Innovations in naphthalene derivatives are expected to enhance product performance, while the construction sector's growth will further boost demand. Additionally, the shift towards sustainable production methods will likely create new opportunities for manufacturers. As emerging markets expand, naphthalene's role in energy applications will also gain traction, positioning the market for significant advancements in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Coal-Tar Derived Naphthalene (Crude) Refined Naphthalene (High-Purity) Naphthalene Derivatives (e.g., Naphthalene Sulfonates) Petroleum-Derived Naphthalene |

| By End-User | Building & Construction (Superplasticizers) Chemicals & Intermediates Producers Agriculture & Agrochemicals Textiles & Leather Pharmaceuticals & Dyes |

| By Application | Phthalic Anhydride Naphthalene Sulfonates/Superplasticizers Low-Volatility Solvents Moth Repellents & Pesticides Surfactants & Wetting Agents |

| By Distribution Channel | Direct (Contract) Sales Distributors/Traders Online/Spot Platforms |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Medium Price High Price |

| By Others | Specialty High-Purity Grades Niche/Custom Derivatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Naphthalene Production Facilities | 120 | Plant Managers, Production Supervisors |

| End-User Industries (Dyes & Pigments) | 90 | Procurement Managers, Product Development Heads |

| Pharmaceutical Manufacturers | 60 | Quality Control Managers, R&D Directors |

| Research Institutions and Universities | 50 | Research Scientists, Academic Professors |

| Environmental Regulatory Bodies | 40 | Policy Analysts, Environmental Compliance Officers |

The Global Naphthalene Market is valued at approximately USD 1.6 billion, driven by the growth in construction and automotive industries that utilize naphthalene-based products for improved performance and durability.