Region:Asia

Author(s):Geetanshi

Product Code:KRAD5882

Pages:83

Published On:December 2025

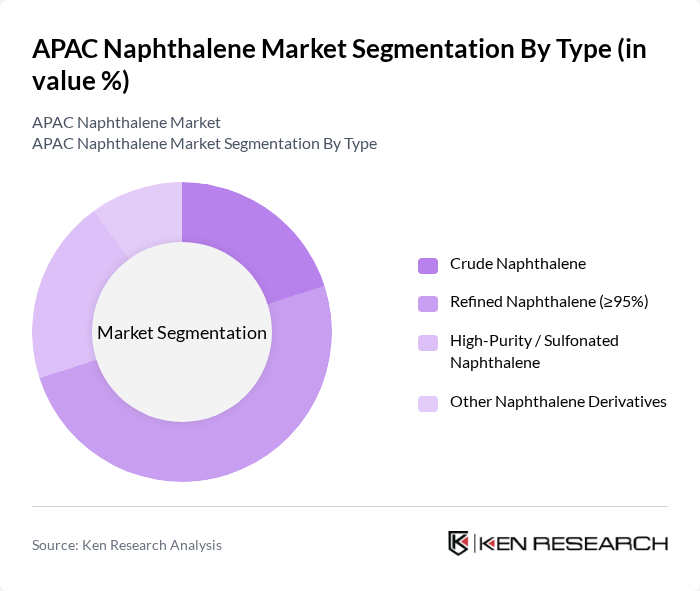

By Type:The market is segmented into four main types: Crude Naphthalene, Refined Naphthalene (?95%), High-Purity / Sulfonated Naphthalene, and Other Naphthalene Derivatives. Among these, Refined Naphthalene (?95%) is the leading subsegment due to its high purity and extensive use in the production of phthalic anhydride and naphthalene sulfonates, particularly for construction chemicals and resins. The demand for high-purity naphthalene is driven by its applications in textile auxiliaries, dispersants, and high-performance concrete admixtures, where consistent quality, low impurity levels, and reliable performance are critical for downstream processing and end-use properties.

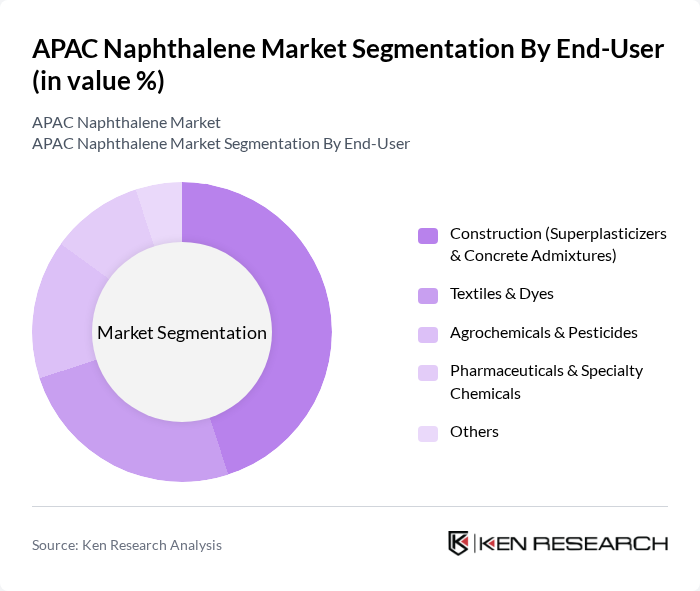

By End-User:The end-user segments include Construction (Superplasticizers & Concrete Admixtures), Textiles & Dyes, Agrochemicals & Pesticides, Pharmaceuticals & Specialty Chemicals, and Others. The Construction segment is the dominant end-user, primarily due to the increasing demand for superplasticizers and water-reducing admixtures in high?strength and high?workability concrete for buildings, transport infrastructure, and industrial facilities. The growth in infrastructure projects, affordable housing, and urban development across the APAC region—especially in China, India, and Southeast Asia—has significantly boosted the consumption of naphthalene-based products in this sector, while textiles, dyes, and agrochemicals remain important secondary outlets for naphthalene intermediates.

The APAC Naphthalene Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rain Industries Limited, Epsilon Carbon Private Limited, DEZA a.s., JFE Chemical Corporation, Nippon Steel Chemical & Material Co., Ltd., China Steel Chemical Corporation, Himadri Speciality Chemical Ltd., Puyang Shenghong Chemical Co., Ltd., Baowu Carbon Material Technology Co., Ltd., Dong-Suh Chemical Ind. Co., Ltd., PCC Rokita SA, Koppers Inc., Química del Nalón S.A., CARBOTECH AC GmbH, Gautam Zen International contribute to innovation, geographic expansion, and service delivery in this space.

The APAC naphthalene market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. As manufacturers increasingly adopt eco-friendly production methods, the demand for green naphthalene products is expected to rise. Additionally, the expansion into emerging markets, particularly in Southeast Asia, will provide new growth avenues. Companies that invest in research and development will likely lead the market, capitalizing on innovative applications and enhanced product offerings to meet evolving consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Crude Naphthalene Refined Naphthalene (?95%) High?Purity / Sulfonated Naphthalene Other Naphthalene Derivatives |

| By End-User | Construction (Superplasticizers & Concrete Admixtures) Textiles & Dyes Agrochemicals & Pesticides Pharmaceuticals & Specialty Chemicals Others |

| By Region | China Japan India South Korea ASEAN Rest of APAC |

| By Application | Phthalic Anhydride Naphthalene Sulfonates (including Superplasticizers) Azo Dyes & Pigments Low?Volatility Solvents & Oils Moth Repellents & Others |

| By Distribution Channel | Direct Sales (Producer to End User) Distributors & Traders Online / E?Tendering Platforms Others |

| By Packaging Type | Bulk (Tankers & ISO Containers) Drums Bags Others |

| By Pricing Model | Contract / Formula?Based Pricing (Indexed to Coal Tar) Spot Market Pricing Long?Term Off?take Agreements Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 45 | Product Managers, R&D Directors |

| Dyes and Pigments Sector | 40 | Procurement Managers, Production Supervisors |

| Plastics Manufacturing | 42 | Operations Managers, Quality Control Analysts |

| Industrial Solvents Market | 41 | Supply Chain Managers, Technical Sales Representatives |

| Research and Development in Chemicals | 40 | Research Scientists, Innovation Managers |

The APAC Naphthalene Market is valued at approximately USD 3.4 billion, driven by increasing demand in various applications such as construction, textiles, agrochemicals, and dyes, particularly in countries like China and India.