Region:Global

Author(s):Geetanshi

Product Code:KRAA0099

Pages:89

Published On:August 2025

By Type:The nitric acid market is segmented into concentrated nitric acid, dilute nitric acid, fuming nitric acid, and others. Concentrated nitric acid is the most widely used type due to its extensive applications in fertilizers, explosives, and the chemical industry. The demand for dilute nitric acid is also significant, particularly in chemical manufacturing and metal processing. Fuming nitric acid, while less common, is crucial for specialized applications such as the production of certain chemicals and pharmaceuticals. The "others" category includes niche products for specific industrial needs .

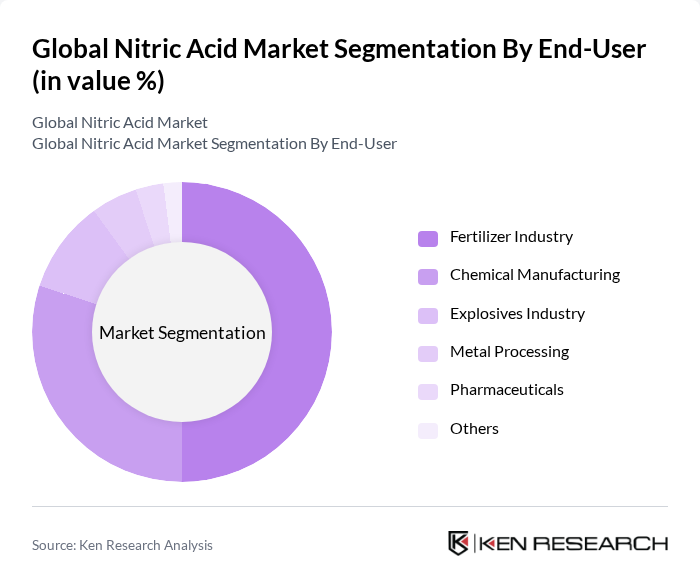

By End-User:The end-user segmentation includes the fertilizer industry, chemical manufacturing, explosives industry, metal processing, pharmaceuticals, and others. The fertilizer industry is the largest consumer of nitric acid, primarily for ammonium nitrate production. Chemical manufacturing represents a significant portion of the market, utilizing nitric acid in the synthesis of chemicals such as adipic acid and nitrobenzene. The explosives industry relies on nitric acid for the production of explosives, while metal processing and pharmaceuticals use it for specialized applications. The "others" category encompasses smaller industries, including dyes and specialty chemicals .

The Global Nitric Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Yara International ASA, CF Industries Holdings, Inc., Nutrien Ltd., OCI N.V., LSB Industries, Inc., EuroChem Group AG, KBR, Inc., Mitsubishi Chemical Group Corporation, Chemtrade Logistics Income Fund, Acron Group, Dyno Nobel (Incitec Pivot Limited), INEOS Group Holdings S.A., Air Products and Chemicals, Inc., Taminco Corporation (Eastman Chemical Company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the nitric acid market appears promising, driven by technological advancements and a growing emphasis on sustainability. As industries increasingly adopt green chemistry practices, the demand for eco-friendly production methods will rise. Additionally, emerging markets in Asia and Africa are expected to contribute significantly to nitric acid consumption, fueled by agricultural expansion and industrialization. These trends indicate a shift towards more sustainable and efficient production processes, positioning the nitric acid market for robust growth in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Concentrated Nitric Acid Dilute Nitric Acid Fuming Nitric Acid Others |

| By End-User | Fertilizer Industry Chemical Manufacturing Explosives Industry Metal Processing Pharmaceuticals Others |

| By Application | Ammonium Nitrate Production Adipic Acid Production Toluene Diisocyanate (TDI) Production Explosives Metal Treatment Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | North America (U.S., Canada, Mexico) Europe (Germany, France, U.K., Netherlands, Russia, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Rest of APAC) Middle East & Africa South America |

| By Production Method | Ostwald Process Catalytic Oxidation Others |

| By Packaging Type | Bulk Packaging Drums Cylinders Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Fertilizer Producers | 100 | Procurement Managers, Agronomists |

| Explosives Manufacturers | 60 | Production Supervisors, Safety Officers |

| Chemical Distributors | 50 | Sales Managers, Supply Chain Coordinators |

| Environmental Regulatory Bodies | 40 | Policy Analysts, Environmental Scientists |

| Research Institutions | 40 | Research Scientists, Market Analysts |

The Global Nitric Acid Market is valued at approximately USD 24 billion, driven by increasing demand for fertilizers, particularly ammonium nitrate, and its applications in various industries such as explosives and chemical manufacturing.