Region:Middle East

Author(s):Shubham

Product Code:KRAD1066

Pages:86

Published On:November 2025

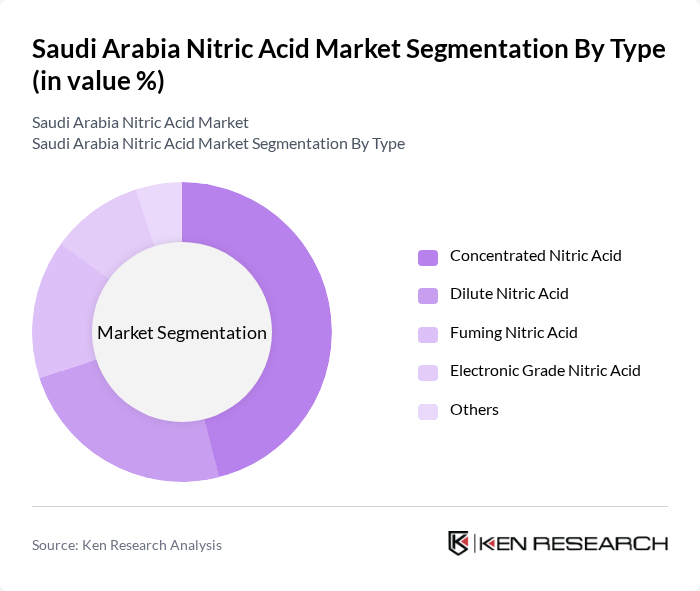

By Type:The market is segmented into concentrated nitric acid, dilute nitric acid, fuming nitric acid, electronic grade nitric acid, and others. Each type addresses specific industrial needs, with concentrated nitric acid being the most widely used due to its high purity and effectiveness in chemical synthesis, fertilizer production, and explosives manufacturing .

The concentrated nitric acid segment leads the market, driven by its extensive use in fertilizer production, explosives, and chemical synthesis. Its high purity and reactivity make it the preferred choice for industries with stringent quality requirements. The expansion of the agricultural sector and the rising need for high-efficiency fertilizers further accelerate demand for concentrated nitric acid .

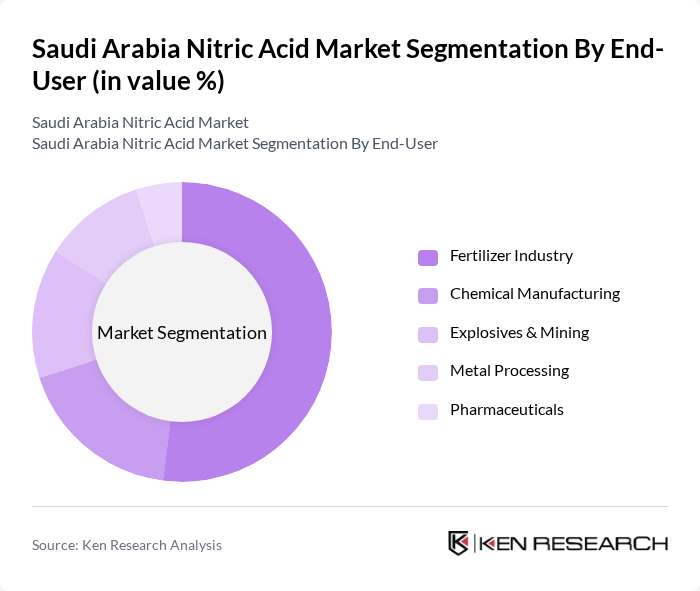

By End-User:The end-user segmentation includes the fertilizer industry, chemical manufacturing, explosives & mining, metal processing, pharmaceuticals, and others. Each sector utilizes nitric acid for specialized applications, with the fertilizer industry accounting for the largest share due to its role in ammonium nitrate production .

The fertilizer industry remains the leading end-user of nitric acid, primarily for ammonium nitrate production, which is essential for high-yield crop fertilizers. The sector’s dominance is reinforced by Saudi Arabia’s focus on agricultural productivity and food security. Chemical manufacturing and explosives & mining are also significant consumers, reflecting the broad industrial utility of nitric acid .

The Saudi Arabia Nitric Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Basic Industries Corporation (SABIC), Saudi Arabian Oil Company (Saudi Aramco), National Industrialization Company (Tasnee), Al-Jubail Petrochemical Company (JUPC), Arabian Chemical Company (ACC), Gulf Chemical and Metallurgical Industries Company (GCMIC), Saudi International Petrochemical Company (Sipchem), Advanced Petrochemical Company, Saudi Kayan Petrochemical Company, Yanbu National Petrochemical Company (Yansab), National Petrochemical Company (Petrochem), Al-Falak Chemical Company, Saudi Chemical Company, Arabian Amines Company, and Al-Muhaidib Group contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia nitric acid market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. As the government emphasizes green technology, producers are likely to invest in eco-friendly production methods, enhancing their competitive edge. Additionally, the growing pharmaceutical sector is expected to increase nitric acid usage, creating new avenues for growth. Strategic partnerships with local industries will further bolster market resilience, ensuring a robust future for nitric acid production in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Concentrated Nitric Acid Dilute Nitric Acid Fuming Nitric Acid Electronic Grade Nitric Acid Others |

| By End-User | Fertilizer Industry Chemical Manufacturing Explosives & Mining Metal Processing Pharmaceuticals Others |

| By Application | Ammonium Nitrate Production Nitrobenzene & Adipic Acid Synthesis Metal Etching & Cleaning Explosives Manufacturing Others |

| By Distribution Channel | Direct Sales Industrial Distributors Online Sales Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Production Method | Ostwald Process Catalytic Oxidation Others |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Fertilizer Producers | 60 | Procurement Managers, Production Supervisors |

| Explosives Manufacturers | 40 | Operations Managers, Safety Compliance Officers |

| Industrial Chemical Users | 50 | Supply Chain Managers, Quality Control Analysts |

| Research Institutions | 40 | Research Scientists, Laboratory Managers |

| Environmental Regulatory Bodies | 40 | Policy Analysts, Environmental Compliance Officers |

The Saudi Arabia Nitric Acid Market is valued at approximately USD 1.4 billion, driven by demand from the fertilizer industry and the expanding chemical manufacturing sector. This valuation is based on a five-year historical analysis of market trends.