Region:Global

Author(s):Shubham

Product Code:KRAA2627

Pages:94

Published On:August 2025

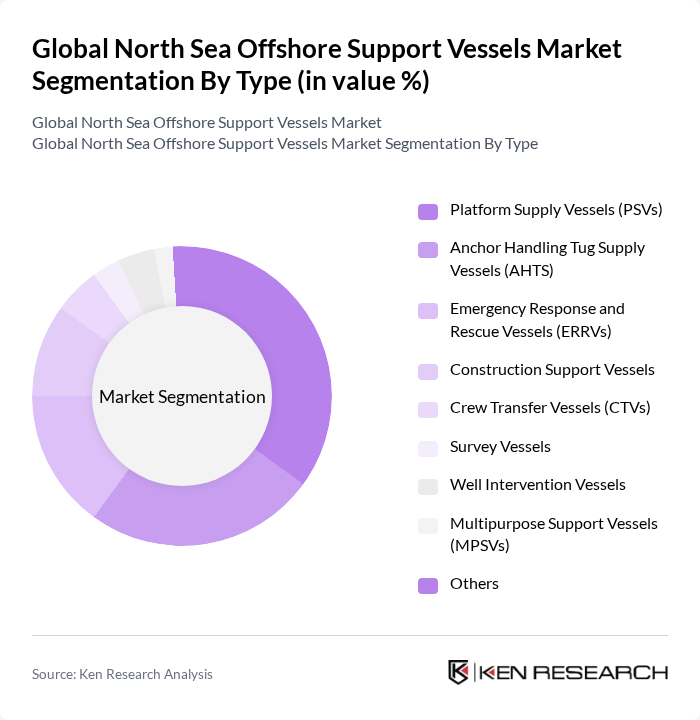

By Type:The market is segmented into various types of vessels, including Platform Supply Vessels (PSVs), Anchor Handling Tug Supply Vessels (AHTS), Emergency Response and Rescue Vessels (ERRVs), Construction Support Vessels, Crew Transfer Vessels (CTVs), Survey Vessels, Well Intervention Vessels, Multipurpose Support Vessels (MPSVs), and Others. Among these, Platform Supply Vessels (PSVs) are the most dominant due to their critical role in transporting supplies and equipment to offshore installations, which is essential for the operational efficiency of oil and gas exploration and production activities. The increasing number of offshore projects, both in traditional energy and renewables, has further solidified the demand for PSVs, making them a key player in the market.

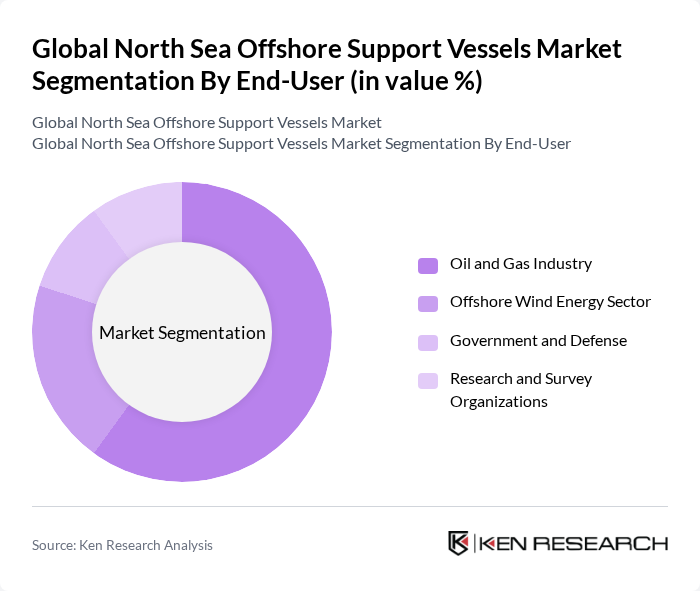

By End-User:The end-user segmentation includes the Oil and Gas Industry, Offshore Wind Energy Sector, Government and Defense, and Research and Survey Organizations. The Oil and Gas Industry is the leading segment, driven by the continuous exploration and production activities in the North Sea. The demand for offshore support vessels is significantly influenced by the need for efficient logistics and supply chain management in oil and gas operations, which require specialized vessels for various tasks, including transportation, maintenance, and emergency response. The offshore wind energy sector is also rapidly expanding, increasing demand for crew transfer and construction support vessels.

The Global North Sea Offshore Support Vessels Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tidewater Inc., Bourbon Corporation SA, SEACOR Marine LLC, Vard Holdings Limited, GulfMark Offshore Inc., Maersk Supply Service, Solstad Offshore ASA, Edda Wind ASA, Swire Pacific Offshore, Atlantic Towing Limited, DOF ASA, North Star Shipping, P&O Maritime Logistics, Siem Offshore Inc., Havila Shipping ASA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the North Sea offshore support vessels market is poised for significant transformation, driven by the increasing integration of digital technologies and a heightened focus on sustainability. As companies adopt advanced data analytics and automation, operational efficiencies are expected to improve, reducing costs and enhancing service delivery. Furthermore, the growing emphasis on eco-friendly practices will likely lead to the development of greener vessels, aligning with global environmental goals and attracting new investments in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Platform Supply Vessels (PSVs) Anchor Handling Tug Supply Vessels (AHTS) Emergency Response and Rescue Vessels (ERRVs) Construction Support Vessels Crew Transfer Vessels (CTVs) Survey Vessels Well Intervention Vessels Multipurpose Support Vessels (MPSVs) Others |

| By End-User | Oil and Gas Industry Offshore Wind Energy Sector Government and Defense Research and Survey Organizations |

| By Application | Offshore Oil and Gas Operations Offshore Wind Farm Support Marine Research and Surveying Emergency Response and Rescue Operations |

| By Vessel Size | Small Vessels Medium Vessels Large Vessels |

| By Ownership Type | Owned Fleet Charter Fleet |

| By Region | Norway United Kingdom Netherlands Denmark Others |

| By Service Type | Crew Transportation Cargo Transport Maintenance and Repair Services Emergency Response Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Offshore Support Vessel Operations | 100 | Fleet Managers, Operations Directors |

| Maintenance and Repair Services | 60 | Technical Managers, Maintenance Supervisors |

| Logistics and Supply Chain Management | 50 | Logistics Coordinators, Supply Chain Analysts |

| Environmental Compliance and Safety | 40 | Safety Officers, Environmental Managers |

| Market Trends and Innovations | 45 | Industry Analysts, Research and Development Heads |

The Global North Sea Offshore Support Vessels Market is valued at approximately USD 3.5 billion, driven by the increasing demand for offshore oil and gas exploration, renewable energy projects, and advancements in vessel technology.