Region:Global

Author(s):Dev

Product Code:KRAA1488

Pages:93

Published On:August 2025

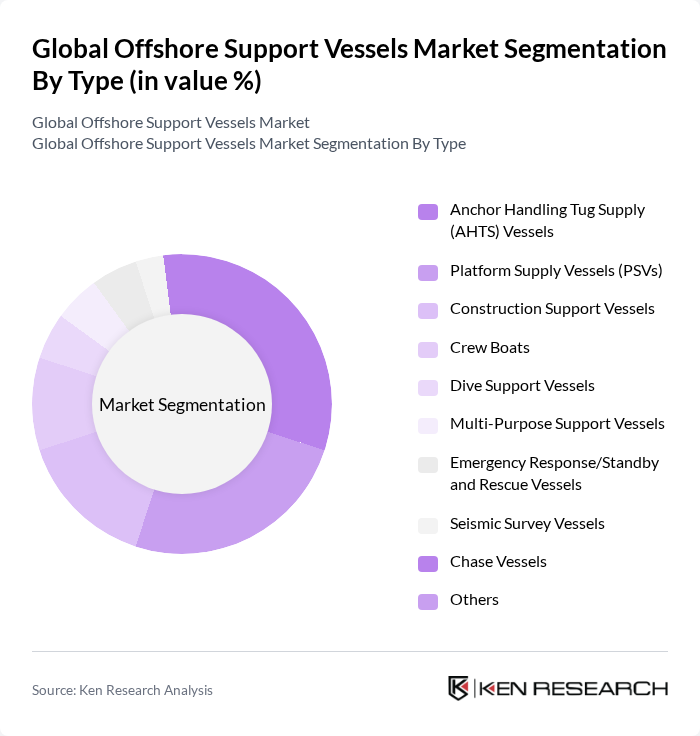

By Type:The market is segmented into various types of offshore support vessels, each serving distinct operational needs. The primary subsegments include Anchor Handling Tug Supply (AHTS) Vessels, Platform Supply Vessels (PSVs), Construction Support Vessels, Crew Boats, Dive Support Vessels, Multi-Purpose Support Vessels, Emergency Response/Standby and Rescue Vessels, Seismic Survey Vessels, Chase Vessels, and Others. Among these, the AHTS vessels are particularly dominant due to their critical role in anchoring and towing operations in offshore oil and gas projects. The market is also witnessing a shift toward multi-purpose and high-specification vessels to support increasingly complex offshore activities .

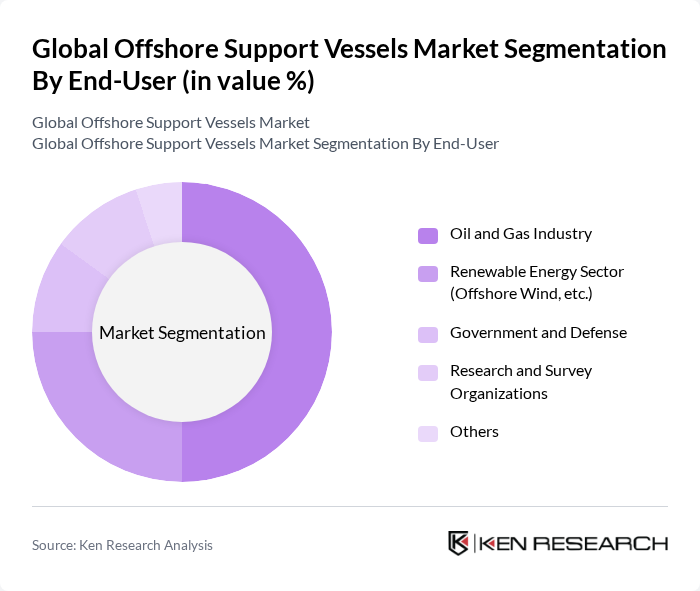

By End-User:The offshore support vessels market is primarily driven by the oil and gas industry, which remains the largest end-user segment. Other significant end-users include the renewable energy sector, particularly offshore wind, government and defense operations, and research and survey organizations. The oil and gas sector's demand for exploration and production activities continues to fuel the need for specialized vessels, while the renewable energy sector is rapidly growing due to increasing investments in sustainable energy sources and the expansion of offshore wind projects .

The Global Offshore Support Vessels Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tidewater Inc., Hornbeck Offshore Services, Inc., SEACOR Marine Holdings Inc., GulfMark Offshore, Inc., BOURBON Corporation, Swire Pacific Offshore Operations (Pte) Ltd, Maersk Supply Service A/S, VARD Group AS, DOF ASA, Solstad Offshore ASA, Edda Wind ASA, Zamil Offshore Services Company, Atlantic Towing Limited, Island Offshore Management AS, Siem Offshore Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the offshore support vessels market appears promising, driven by technological advancements and a shift towards sustainable practices. As the demand for offshore oil and gas exploration continues to rise, coupled with the growth of renewable energy projects, the market is expected to adapt. Companies are likely to invest in hybrid and electric vessels, enhancing operational efficiency while meeting environmental standards. Strategic partnerships will also play a crucial role in navigating regulatory challenges and expanding market reach.

| Segment | Sub-Segments |

|---|---|

| By Type | Anchor Handling Tug Supply (AHTS) Vessels Platform Supply Vessels (PSVs) Construction Support Vessels Crew Boats Dive Support Vessels Multi-Purpose Support Vessels Emergency Response/Standby and Rescue Vessels Seismic Survey Vessels Chase Vessels Others |

| By End-User | Oil and Gas Industry Renewable Energy Sector (Offshore Wind, etc.) Government and Defense Research and Survey Organizations Others |

| By Region | North America Europe Asia-Pacific Middle East and Africa Latin America |

| By Application | Offshore Oil and Gas Exploration Offshore Wind Farm Installation & Maintenance Subsea Construction Maintenance and Repair Services Decommissioning Activities Emergency Response & Rescue Others |

| By Vessel Size | Small Vessels (<60m) Medium Vessels (60–90m) Large Vessels (>90m) |

| By Ownership Type | Owned Fleet Chartered Fleet |

| By Service Type | Crew Transportation Cargo & Supply Transport Subsea Services Survey & Research Support Emergency & Rescue Operations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Exploration Support | 100 | Project Managers, Operations Directors |

| Renewable Energy Support Vessels | 60 | Fleet Managers, Environmental Compliance Officers |

| Marine Construction Support | 50 | Site Supervisors, Engineering Managers |

| Logistics and Supply Chain Management | 70 | Logistics Coordinators, Procurement Specialists |

| Vessel Maintenance and Repair Services | 40 | Maintenance Managers, Technical Directors |

The Global Offshore Support Vessels Market is valued at approximately USD 46 billion, driven by increasing demand for offshore oil and gas exploration and investments in renewable energy projects, particularly offshore wind farms.