Region:Global

Author(s):Dev

Product Code:KRAC0383

Pages:90

Published On:August 2025

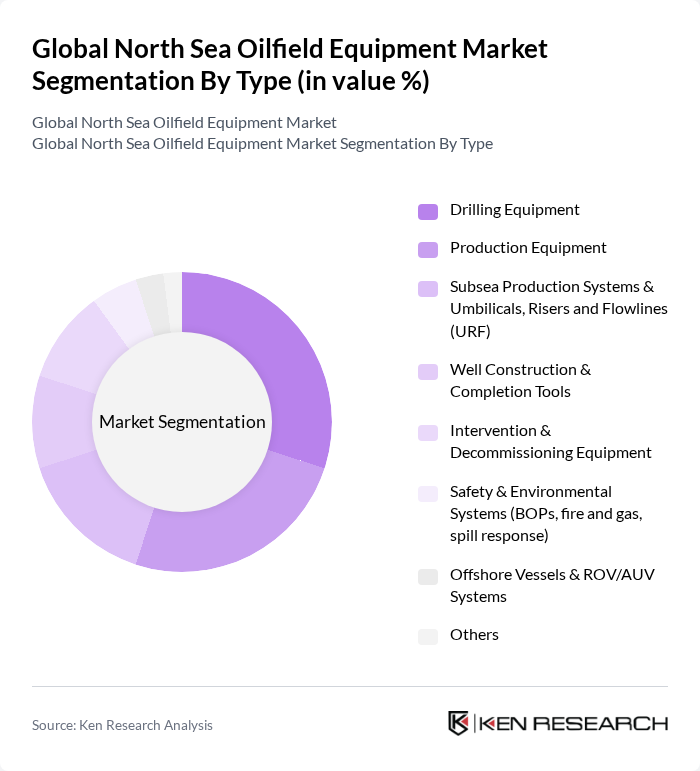

By Type:The market is segmented into various types of equipment essential for oilfield operations. The subsegments include:

The Drilling Equipment subsegment is currently dominating the market due to the increasing number of offshore drilling projects and the need for advanced drilling technologies to enhance efficiency and safety. The demand for high-performance drilling rigs and tools is driven by the exploration of new oil fields and the need to optimize production from existing fields. Additionally, advancements in drilling techniques, such as horizontal and deep-water drilling, are further propelling this subsegment's growth. Regional market coverage identifies drilling and production equipment as core categories in the North Sea, with increased adoption of automated drilling systems and ROV-enabled operations supporting efficiency gains.

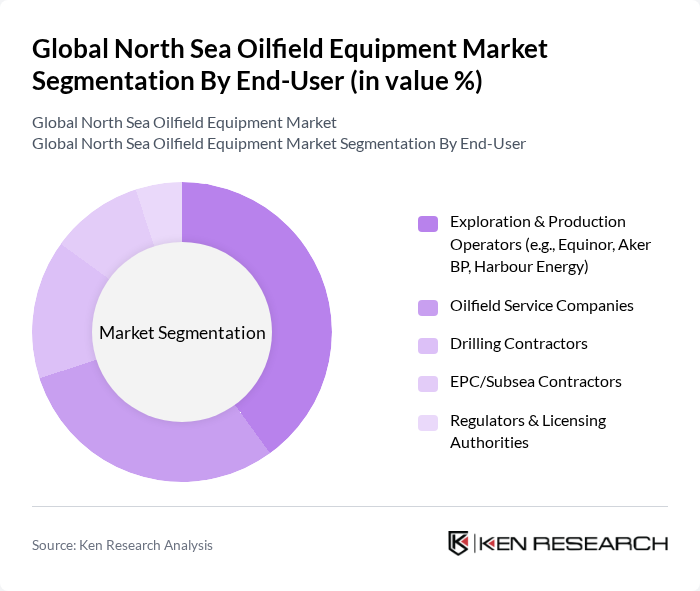

By End-User:The market is segmented based on the end-users of oilfield equipment. The subsegments include:

The Exploration & Production Operators subsegment leads the market due to their significant investments in offshore projects and the continuous need for advanced equipment to enhance production efficiency. These operators are increasingly focusing on technological innovations and sustainable practices to optimize their operations, which drives the demand for specialized oilfield equipment. The competitive landscape among these operators further fuels the growth of this subsegment. In the North Sea, operators prioritize subsea tie-backs, brownfield upgrades, and electrification/readiness to meet emissions targets, which sustains capital and opex demand for equipment and services.

The Global North Sea Oilfield Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as SLB (Schlumberger Limited), Halliburton Company, Baker Hughes Company, NOV Inc. (formerly National Oilwell Varco), Weatherford International plc, TechnipFMC plc, Aker Solutions ASA, Subsea 7 S.A., Oceaneering International, Inc., Saipem S.p.A., KBR, Inc., John Wood Group PLC, Equinor ASA, Aker BP ASA, Harbour Energy plc, Vår Energi ASA, Transocean Ltd., Valaris Limited, Seadrill Limited, Archer Limited, Expro Group Holdings N.V., Tenaris S.A., Vallourec S.A., TGS ASA, PGS ASA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the North Sea oilfield equipment market is poised for transformation, driven by a shift towards integrating renewable energy sources and enhancing operational efficiencies. Companies are increasingly investing in automation and digital technologies, which are expected to streamline operations and reduce costs. Additionally, the focus on sustainable practices will likely lead to innovations in equipment design and functionality, ensuring compliance with evolving environmental standards while meeting the growing energy demands of the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Drilling Equipment Production Equipment Subsea Production Systems & Umbilicals, Risers and Flowlines (URF) Well Construction & Completion Tools Intervention & Decommissioning Equipment Safety & Environmental Systems (BOPs, fire and gas, spill response) Offshore Vessels & ROV/AUV Systems Others |

| By End-User | Exploration & Production Operators (e.g., Equinor, Aker BP, Harbour Energy) Oilfield Service Companies Drilling Contractors EPC/Subsea Contractors Regulators & Licensing Authorities |

| By Application | Offshore Exploration & Appraisal Offshore Development Drilling Offshore Production & Processing Subsea Tie-backs & Brownfield Upgrades Asset Integrity, Intervention & Decommissioning |

| By Component | Pressure Control (BOPs, wellheads, trees) Flow Assurance (pumps, compressors, heaters, insulation) Valves & Actuation Control & Monitoring (DCS/SCADA, subsea control modules) Mooring, Rig & Lifting Systems Power & Electrical (subsea power distribution, cables) |

| By Sales Channel | Direct Sales to Operators OEMs to Service/EPC Contractors Framework Agreements & Long-term Supply Contracts |

| By Distribution Mode | Project-based (EPCI/EPC) Spot/Aftermarket & Maintenance, Repair and Operations (MRO) |

| By Price Range | Standardized/Commodity Equipment Mid-Range/Configured-to-Order High-Spec/Engineered-to-Order (HP/HT, deepwater) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Drilling Equipment Suppliers | 120 | Sales Directors, Product Managers |

| Completion Services Providers | 80 | Operations Managers, Technical Engineers |

| Production Equipment Manufacturers | 90 | Procurement Officers, R&D Managers |

| Offshore Installation Contractors | 70 | Project Managers, Safety Officers |

| Regulatory Bodies and Industry Associations | 60 | Policy Analysts, Compliance Officers |

The Global North Sea Oilfield Equipment Market is valued at approximately USD 4 billion, based on a five-year historical analysis. This valuation reflects ongoing demand driven by mature-field life extension, infill drilling, and subsea tie-backs in the UK Continental Shelf (UKCS) and Norwegian Continental Shelf (NCS).