Region:Global

Author(s):Dev

Product Code:KRAD0597

Pages:95

Published On:August 2025

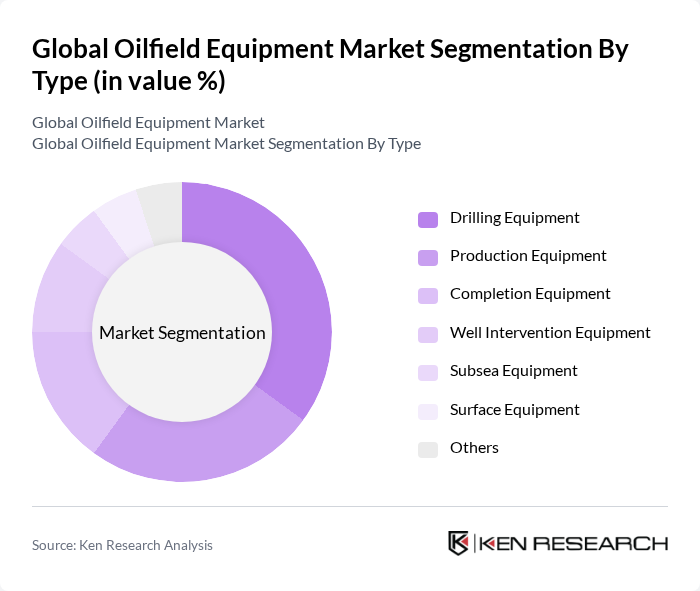

By Type:The market is segmented into various types of equipment, including drilling equipment, production equipment, completion equipment, well intervention equipment, subsea equipment, surface equipment, and others. Each of these segments plays a crucial role in oilfield operations across the drilling, completion, and production lifecycle. Drilling equipment remains a leading segment due to persistent global drilling programs (onshore and offshore), high rig utilization in core basins, and technology upgrades such as automated rigs and rotary steerable systems that support efficiency and well productivity improvements.

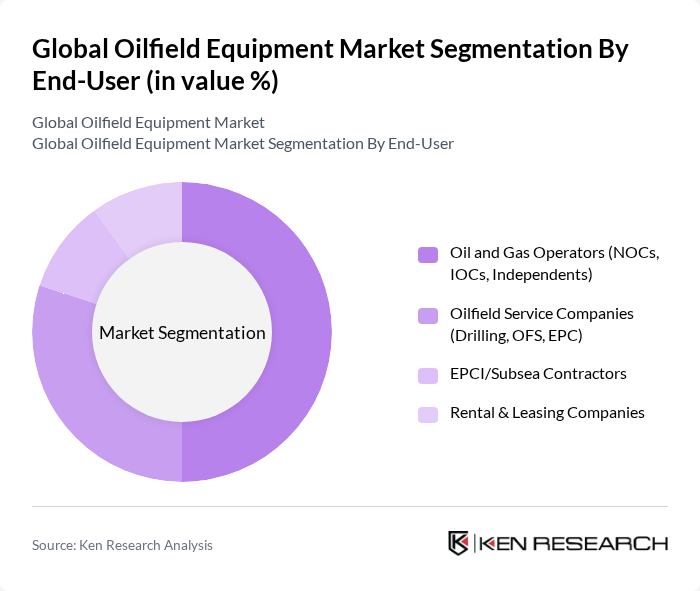

By End-User:The end-user segmentation includes oil and gas operators (NOCs, IOCs, Independents), oilfield service companies (Drilling, OFS, EPC), EPCI/subsea contractors, and rental & leasing companies. Oil and gas operators are the leading end-users, supported by steady upstream capital spending and field development programs, which drive demand for a broad suite of drilling, completion, production, and subsea equipment across land and offshore assets.

The Global Oilfield Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as SLB (Schlumberger Limited), Halliburton Company, Baker Hughes Company, NOV Inc. (formerly National Oilwell Varco, Inc.), Weatherford International plc, TechnipFMC plc, Aker Solutions ASA, Saipem S.p.A., Tenaris S.A., Subsea 7 S.A., Oceaneering International, Inc., Patterson-UTI Energy, Inc., Superior Energy Services, Inc., Nabors Industries Ltd., Transocean Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the oilfield equipment market appears promising, driven by ongoing technological advancements and a shift towards more sustainable practices. As companies increasingly adopt automation and artificial intelligence, operational efficiencies are expected to improve significantly. Furthermore, the integration of renewable energy sources into traditional oil operations is likely to create new avenues for growth, ensuring that the sector remains resilient amid evolving energy landscapes and regulatory frameworks.

| Segment | Sub-Segments |

|---|---|

| By Type | Drilling Equipment Production Equipment Completion Equipment Well Intervention Equipment Subsea Equipment Surface Equipment Others |

| By End-User | Oil and Gas Operators (NOCs, IOCs, Independents) Oilfield Service Companies (Drilling, OFS, EPC) EPCI/Subsea Contractors Rental & Leasing Companies |

| By Application | Onshore Operations Offshore Operations (Shallow, Deepwater, Ultra-deepwater) Unconventional Resources (Shale/Tight, CBM) Decommissioning & Plug and Abandonment |

| By Component | Drilling Rigs & Rig Components Pressure Control Equipment (BOPs, Wellheads, Xmas Trees) Tubulars & OCTG (Drill Pipe, Casing, Tubing) Lifting & Handling, Pumps, Valves, Compressors, Pipes & Fittings |

| By Sales Channel | Direct Sales (OEM to Operator/Service Company) Authorized Distributors/Agents Aftermarket/Spare Parts & MRO |

| By Distribution Mode | Domestic Distribution International Distribution |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oilfield Equipment Manufacturing | 120 | Product Managers, R&D Directors |

| Oil and Gas Exploration | 100 | Geologists, Exploration Managers |

| Drilling Services | 80 | Drilling Engineers, Operations Supervisors |

| Maintenance and Repair Services | 70 | Maintenance Managers, Field Technicians |

| Oilfield Safety Equipment | 60 | Safety Officers, Compliance Managers |

The Global Oilfield Equipment Market is valued at approximately USD 125130 billion, reflecting a recovery in equipment demand and upstream activity. This valuation aligns with industry estimates and indicates a robust market environment supported by technological advancements and increased investments.