Region:Global

Author(s):Shubham

Product Code:KRAA2641

Pages:99

Published On:August 2025

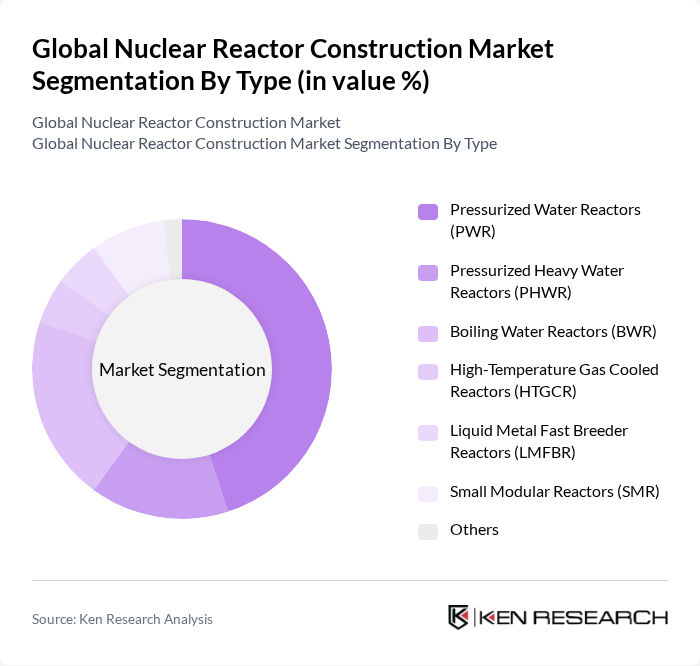

By Type:The market is segmented into various reactor types, each catering to different energy needs and technological advancements. The dominant sub-segment isPressurized Water Reactors (PWR), which are widely used due to their efficiency and safety features. Other types, such asBoiling Water Reactors (BWR)andSmall Modular Reactors (SMR), are gaining traction as they offer flexibility, scalability, and lower initial investment costs. The diversity in reactor types supports tailored solutions for specific energy demands, with Asia and Europe showing increased interest in advanced and modular reactor designs.

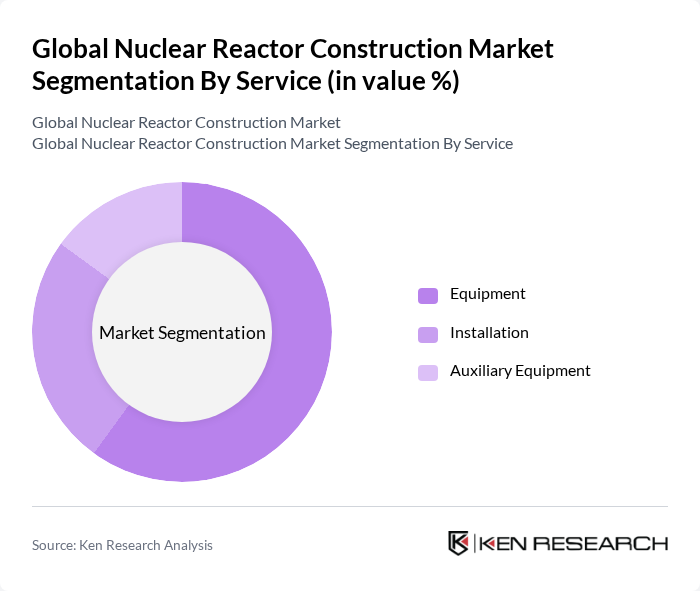

By Service:The service segment includes various offerings essential for the construction and operation of nuclear reactors.Equipment servicesdominate this segment, encompassing the supply of critical components and systems necessary for reactor functionality.Installation servicesare also significant, ensuring that reactors are set up according to stringent safety and operational standards.Auxiliary equipment servicessupport the main systems, enhancing overall reactor efficiency and safety. The integration of digital technologies and remote monitoring solutions is increasingly shaping service delivery in the sector.

The Global Nuclear Reactor Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Framatome S.A.S. (formerly Areva S.A.), Westinghouse Electric Company LLC, GE Hitachi Nuclear Energy (General Electric Company & Hitachi, Ltd. JV), Mitsubishi Heavy Industries, Ltd., Rosatom State Atomic Energy Corporation, China National Nuclear Corporation (CNNC), Korea Electric Power Corporation (KEPCO) / KEPCO Engineering & Construction Company, Inc., Babcock & Wilcox Enterprises, Inc., Doosan Enerbility Co., Ltd., Fluor Corporation, Jacobs Solutions Inc. (formerly Jacobs Engineering Group Inc.), SNC-Lavalin Group Inc. (including Candu Energy Inc.), AECOM, NuScale Power, LLC, TerraPower, LLC, Shanghai Electric Group Company Limited, Larsen & Toubro Limited, Bilfinger SE, Dongfang Electric Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the nuclear reactor construction market appears promising, driven by a global shift towards sustainable energy solutions and the urgent need to address climate change. As countries strive to meet carbon reduction targets, nuclear energy is increasingly viewed as a critical component of the energy mix. Innovations in reactor technology and waste management are expected to enhance safety and efficiency, while international collaboration on nuclear research will further accelerate advancements in the sector, fostering a more robust and resilient nuclear energy landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Pressurized Water Reactors (PWR) Pressurized Heavy Water Reactors (PHWR) Boiling Water Reactors (BWR) High-Temperature Gas Cooled Reactors (HTGCR) Liquid Metal Fast Breeder Reactors (LMFBR) Small Modular Reactors (SMR) Others |

| By Service | Equipment Installation Auxiliary Equipment |

| By End-User | Utilities Government Industrial Research Institutions |

| By Region | North America (United States, Canada, Mexico) Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others) Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others) Latin America (Brazil, Mexico, Others) Middle East & Africa |

| By Application | Electricity Generation Research and Development Medical Isotope Production Desalination |

| By Investment Source | Public Sector Funding Private Investments International Aid Joint Ventures |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Regulatory Support |

| By Project Stage | Planning Construction Commissioning Operational Decommissioning |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nuclear Reactor Construction Projects | 100 | Project Managers, Site Engineers |

| Regulatory Compliance and Safety | 60 | Regulatory Officials, Safety Inspectors |

| Energy Policy and Investment | 50 | Policy Makers, Investment Analysts |

| Technology and Innovation in Nuclear Energy | 40 | R&D Managers, Technology Experts |

| Public Perception and Community Engagement | 40 | Community Leaders, Public Relations Officers |

The Global Nuclear Reactor Construction Market is valued at approximately USD 53 billion, driven by increasing demand for clean energy solutions, government policies supporting nuclear energy, and advancements in reactor technology.