Region:Global

Author(s):Rebecca

Product Code:KRAD0209

Pages:93

Published On:August 2025

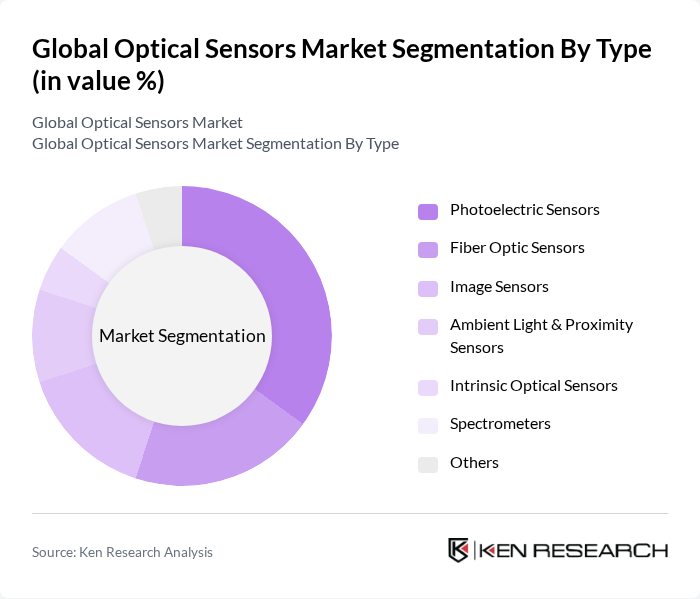

By Type:The optical sensors market is segmented into Photoelectric Sensors, Fiber Optic Sensors, Image Sensors, Ambient Light & Proximity Sensors, Intrinsic Optical Sensors, Spectrometers, and Others. Among these,Photoelectric Sensorslead the market due to their extensive use in industrial automation, robotics, and safety systems. The growing demand for automation, real-time sensing, and precise measurement in manufacturing and logistics continues to drive the growth of this segment.Fiber Optic Sensorsare also gaining traction, especially in medical diagnostics and environmental monitoring, owing to their high sensitivity and reliability.

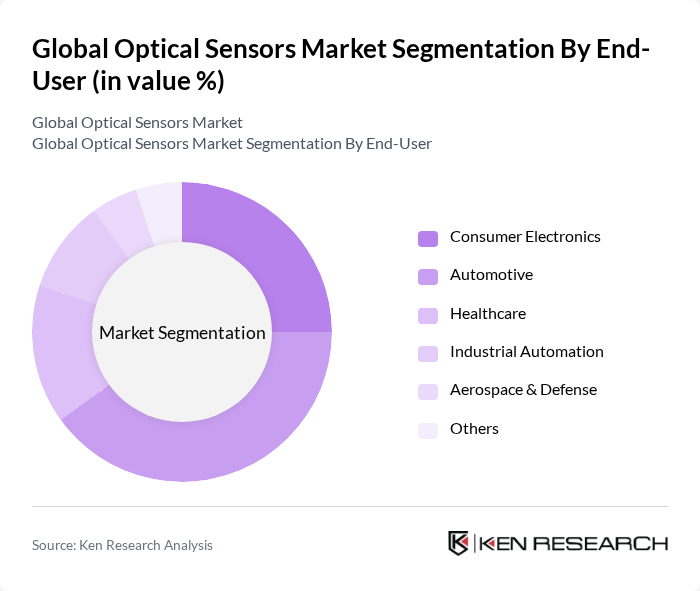

By End-User:The market is segmented by end-user applications, including Consumer Electronics, Automotive, Healthcare, Industrial Automation, Aerospace & Defense, and Others. TheAutomotive sectoris the leading end-user, propelled by the integration of optical sensors in advanced driver-assistance systems (ADAS), autonomous vehicles, and safety features such as adaptive headlights and collision detection.Consumer Electronicsalso represent a significant share, with optical sensors used in smartphones, wearable devices, and smart home products. TheHealthcare sectoris rapidly growing, driven by the adoption of optical sensors in medical diagnostics, imaging, and wearable health monitors.

The Global Optical Sensors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Texas Instruments Incorporated, STMicroelectronics N.V., Analog Devices, Inc., Hamamatsu Photonics K.K., ON Semiconductor Corporation, Vishay Intertechnology, Inc., Sony Corporation, Omron Corporation, Microchip Technology Incorporated, Panasonic Corporation, Broadcom Inc., Qorvo, Inc., Infineon Technologies AG, Teledyne Technologies Incorporated, First Sensor AG, ams-OSRAM AG, TOSHIBA CORPORATION, Renesas Electronics Corporation, ROHM CO., LTD., Rockwell Automation, Inc., SICK AG, Honeywell International Inc., ifm electronic gmbh, KEYENCE CORPORATION, Cisco Systems, Inc., Amphenol Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the optical sensors market appears promising, driven by the integration of advanced technologies and increasing applications across various sectors. The rise of smart cities and the Internet of Things (IoT) is expected to create significant demand for optical sensors, enhancing urban infrastructure and connectivity. Additionally, the focus on environmental monitoring will likely lead to innovative sensor solutions, positioning the market for robust growth in the coming years as industries adapt to evolving technological landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | Photoelectric Sensors Fiber Optic Sensors Image Sensors Ambient Light & Proximity Sensors Intrinsic Optical Sensors Spectrometers Others |

| By End-User | Consumer Electronics Automotive Healthcare Industrial Automation Aerospace & Defense Others |

| By Application | Environmental Monitoring Security and Surveillance Smart Home Devices Medical Diagnostics Industrial Process Control Others |

| By Component | Sensors Optical Filters Lenses Light Sources (LEDs, Lasers) Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Others |

| By Price Range | Low-End Mid-Range High-End |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Optical Sensors | 100 | Product Managers, Automotive Engineers |

| Healthcare Imaging Sensors | 80 | Medical Device Developers, Radiologists |

| Industrial Automation Sensors | 90 | Factory Managers, Automation Specialists |

| Consumer Electronics Sensors | 60 | Product Designers, Electronics Engineers |

| Environmental Monitoring Sensors | 50 | Environmental Scientists, Regulatory Compliance Officers |

The Global Optical Sensors Market is valued at approximately USD 29.2 billion, reflecting significant growth driven by advancements in sensing technologies across various sectors, including automotive, healthcare, and industrial automation.