Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9092

Pages:81

Published On:November 2025

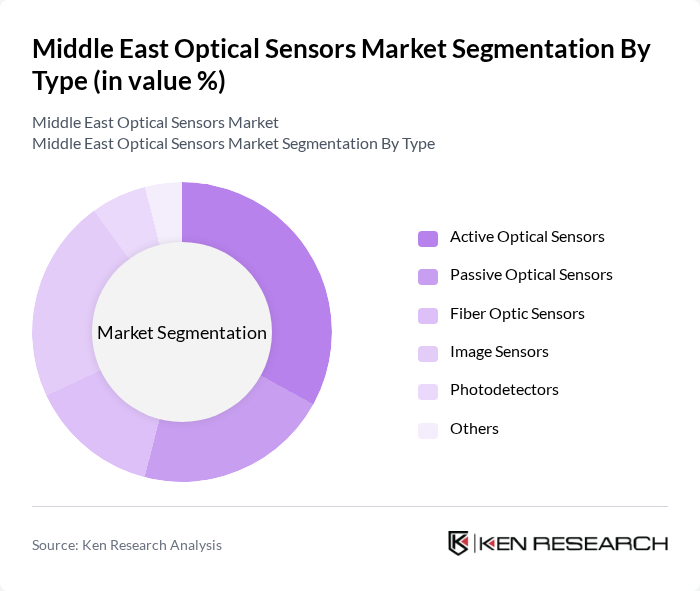

By Type:The optical sensors market is segmented into Active Optical Sensors, Passive Optical Sensors, Fiber Optic Sensors, Image Sensors, Photodetectors, and Others.Active Optical Sensorscontinue to lead the market due to their extensive use in automotive safety systems, industrial automation, and environmental monitoring. The surge in smart city deployments and automation in manufacturing is driving this segment. The adoption ofImage Sensorsis also rising, particularly in security, surveillance, and healthcare imaging, reflecting the region’s focus on digital transformation and public safety .

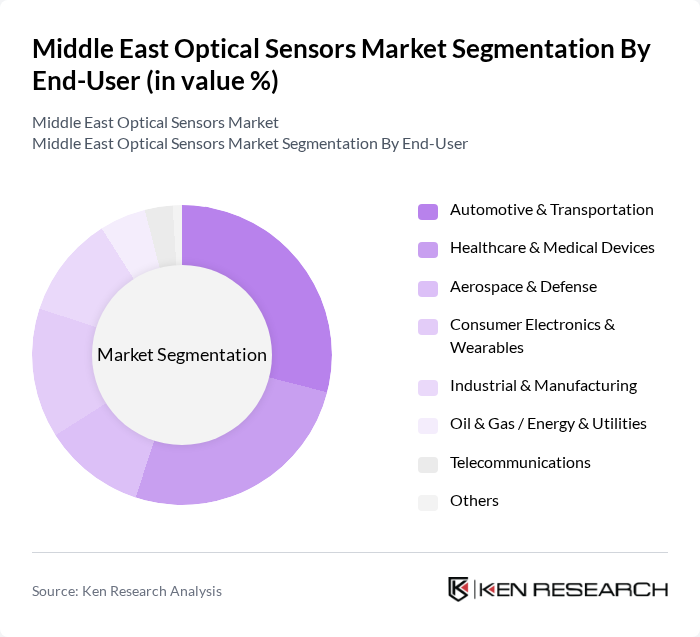

By End-User:The market is segmented by end-users, including Automotive & Transportation, Healthcare & Medical Devices, Aerospace & Defense, Consumer Electronics & Wearables, Industrial & Manufacturing, Oil & Gas / Energy & Utilities, Telecommunications, and Others.Automotive & Transportationremains the leading end-user, propelled by the integration of optical sensors in ADAS, LiDAR, and vehicle safety systems. TheHealthcaresector is experiencing robust growth, driven by the adoption of optical sensors in diagnostic imaging, patient monitoring, and minimally invasive procedures. Industrial automation and smart manufacturing also contribute significantly to market demand .

The Middle East Optical Sensors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Honeywell International Inc., Texas Instruments Incorporated, STMicroelectronics N.V., Omron Corporation, Panasonic Corporation, Bosch Sensortec GmbH, Analog Devices, Inc., Teledyne Technologies Incorporated, Microchip Technology Inc., Vishay Intertechnology, Inc., Infineon Technologies AG, Broadcom Inc., NXP Semiconductors N.V., Renesas Electronics Corporation, ams-OSRAM AG, Hamamatsu Photonics K.K., ON Semiconductor (onsemi), ROHM Semiconductor, Yokogawa Electric Corporation, Thorlabs, Inc., Leviton Manufacturing Co., Inc., Finisar (now part of II-VI Incorporated), Lumentum Holdings Inc., Huber+Suhner AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the optical sensors market in the Middle East appears promising, driven by technological advancements and increasing investments in smart infrastructure. As industries continue to embrace automation and smart technologies, the demand for optical sensors is expected to rise significantly. Furthermore, government initiatives aimed at fostering innovation will likely create a conducive environment for market expansion, enabling companies to leverage new opportunities and enhance operational efficiencies in various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Active Optical Sensors Passive Optical Sensors Fiber Optic Sensors Image Sensors Photodetectors Others |

| By End-User | Automotive & Transportation Healthcare & Medical Devices Aerospace & Defense Consumer Electronics & Wearables Industrial & Manufacturing Oil & Gas / Energy & Utilities Telecommunications Others |

| By Application | Industrial Automation & Process Control Environmental Monitoring Security & Surveillance Smart Homes & Buildings Pipeline & Infrastructure Monitoring Data Communication Medical Diagnostics & Imaging Others |

| By Technology | Optical Imaging Spectroscopy Lidar Optical Coherence Tomography Distributed Acoustic Sensing (DAS) Optical Time Domain Reflectometry (OTDR) Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Iraq, Syria, Palestine) North Africa (Egypt, Morocco, Algeria, Tunisia, Libya) Others |

| By Investment Source | Private Investments Government Funding International Aid Venture Capital Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Optical Sensors | 100 | Product Managers, R&D Engineers |

| Healthcare Imaging Sensors | 60 | Medical Device Manufacturers, Biomedical Engineers |

| Industrial Automation Sensors | 70 | Operations Managers, Automation Specialists |

| Security and Surveillance Sensors | 50 | Security System Integrators, Technology Consultants |

| Consumer Electronics Sensors | 40 | Product Development Managers, Market Analysts |

The Middle East Optical Sensors Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the demand for advanced sensing technologies across various sectors, including automotive, healthcare, and industrial automation.