Region:Global

Author(s):Rebecca

Product Code:KRAD0269

Pages:100

Published On:August 2025

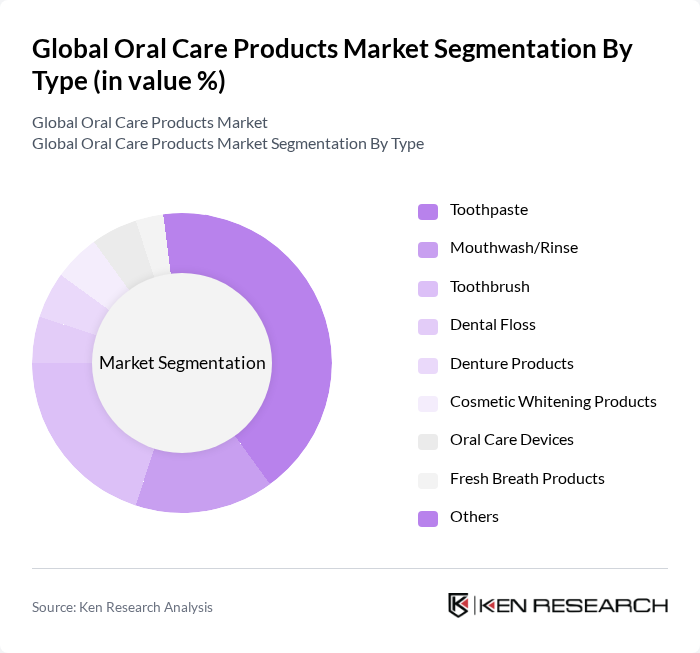

By Type:The oral care products market is segmented into various types, including toothpaste, mouthwash/rinse, toothbrush, dental floss, denture products, cosmetic whitening products, oral care devices, fresh breath products, and others. Among these, toothpaste remains the dominant segment due to its essential role in daily oral hygiene routines. The increasing focus on preventive dental care and the introduction of specialized formulations, such as herbal and whitening toothpaste, have further fueled its growth. The market is also witnessing increased demand for electric toothbrushes, smart oral care devices, and whitening solutions, reflecting a shift toward premium and technologically advanced products .

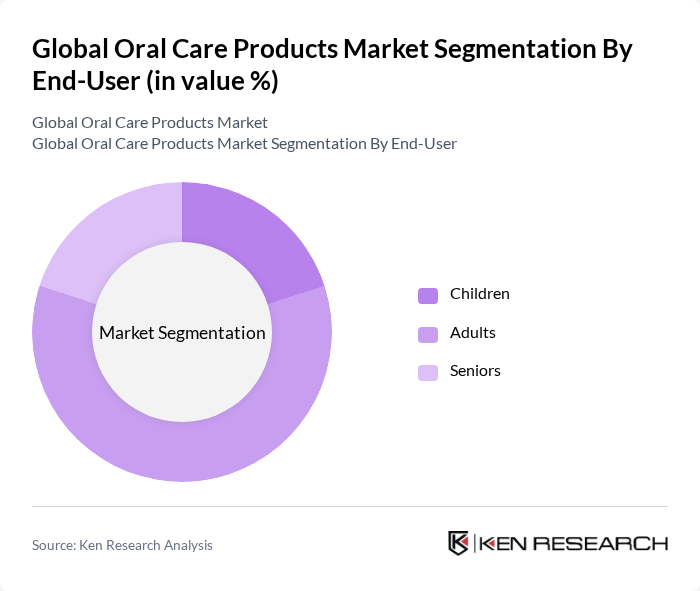

By End-User:The market is segmented by end-user into children, adults, and seniors. Adults represent the largest segment, driven by a growing awareness of oral health and the increasing prevalence of dental issues. This demographic is more likely to invest in premium oral care products, including specialized toothpaste and advanced toothbrushes, to maintain their oral hygiene and overall health. The rising incidence of dental caries and periodontal diseases among adults, combined with greater disposable income and willingness to spend on preventive care, further supports this trend .

The Global Oral Care Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble Co., Colgate-Palmolive Company, Unilever PLC, Johnson & Johnson, GlaxoSmithKline PLC, Henkel AG & Co. KGaA, Church & Dwight Co., Inc., Kimberly-Clark Corporation, Reckitt Benckiser Group PLC, Sunstar Group, Lion Corporation, Amway Corporation, 3M Company, Oral-B (a subsidiary of Procter & Gamble), Colgate-Palmolive (India) Limited, Dabur India Ltd., Himalaya Wellness Company, GC Corporation, Perrigo Company plc, Dr. Fresh LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the oral care market appears promising, driven by evolving consumer preferences and technological advancements. The demand for natural and organic ingredients is expected to surge, with a projected 25% increase in sales of products featuring these components in future. Additionally, the rise of personalized oral care solutions, such as tailored toothpaste and subscription services, is anticipated to reshape the market landscape, catering to individual consumer needs and preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Toothpaste Mouthwash/Rinse Toothbrush Dental Floss Denture Products Cosmetic Whitening Products Oral Care Devices (e.g., Oral Irrigators, Tongue Scrapers) Fresh Breath Products (e.g., Chewing Gum, Strips, Sprays) Others |

| By End-User | Children Adults Seniors |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Stores Pharmacies and Drug Stores Convenience Stores Direct Sales Others |

| By Product Formulation | Fluoride-based Non-fluoride Herbal/Natural |

| By Packaging Type | Tube Bottle Sachet Blister Pack |

| By Price Range | Economy Mid-range Premium |

| By Brand Type | National Brands Private Labels Generic Brands |

| By Region | North America (U.S., Canada, Mexico) Europe (UK, Germany, France, Italy, Spain, Rest of Europe) Asia Pacific (China, Japan, India, South Korea, Australia, Rest of Asia Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (South Africa, Saudi Arabia, UAE, Rest of MEA) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Oral Care Product Usage | 150 | General Consumers, Health-Conscious Individuals |

| Dental Professional Insights | 100 | Dentists, Dental Hygienists |

| Retailer Perspectives on Oral Care Trends | 80 | Pharmacy Managers, Supermarket Buyers |

| Market Trends in Eco-Friendly Oral Care | 70 | Sustainability Advocates, Eco-Conscious Consumers |

| Innovations in Oral Care Products | 90 | Product Development Managers, Marketing Executives |

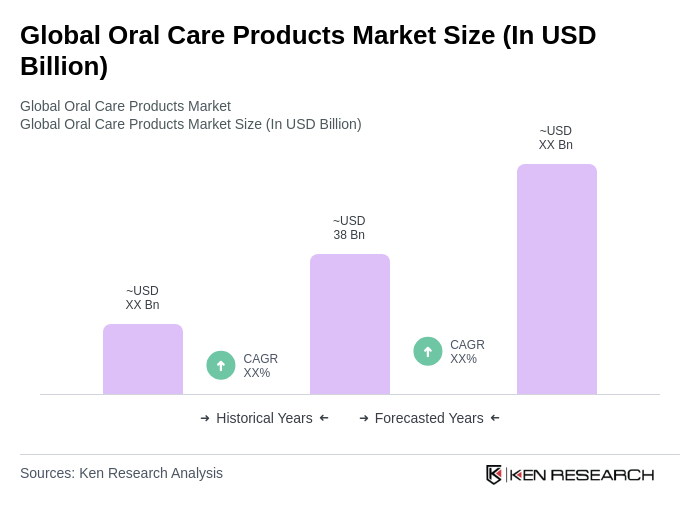

The Global Oral Care Products Market is valued at approximately USD 38 billion, driven by increasing consumer awareness of oral hygiene, the prevalence of dental diseases, and demand for innovative products like electric toothbrushes and advanced toothpaste formulations.