Region:Middle East

Author(s):Rebecca

Product Code:KRAC9781

Pages:91

Published On:November 2025

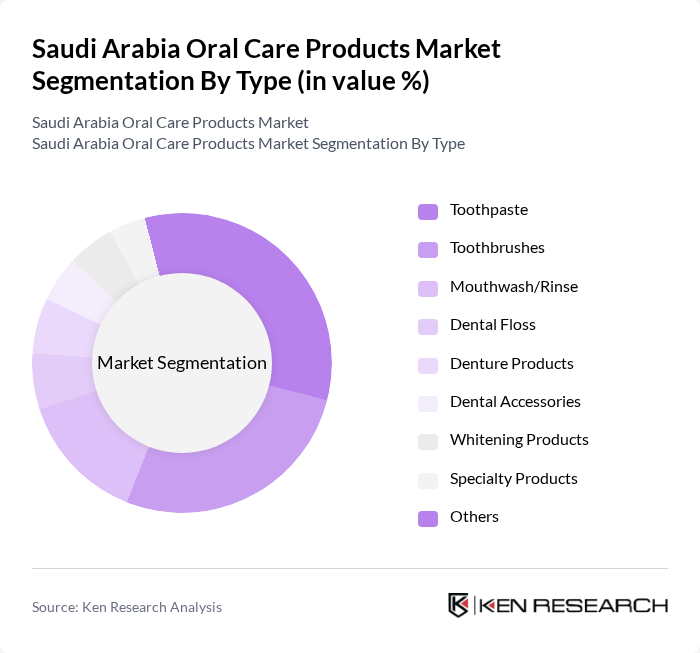

By Type:The oral care products market can be segmented into various types, including toothpaste, toothbrushes, mouthwash/rinse, dental floss, denture products, dental accessories, whitening products, specialty products, and others. Each of these segments caters to specific consumer needs and preferences, with toothpaste and toothbrushes being the most widely used products. The increasing focus on oral hygiene and the introduction of innovative products, such as herbal and sensitivity-specific formulations, are driving growth in these segments.

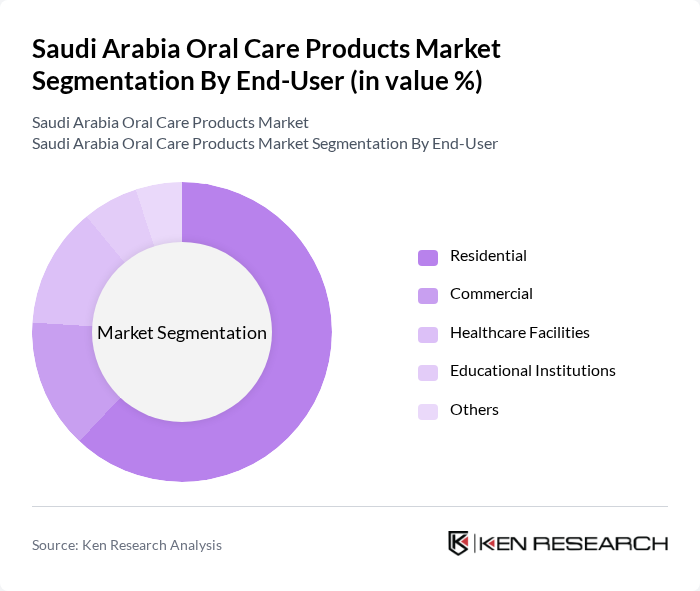

By End-User:The end-user segmentation includes residential, commercial, healthcare facilities, educational institutions, and others. The residential segment holds the largest share, driven by increasing consumer awareness about oral hygiene and the growing number of households investing in quality oral care products. The commercial segment, including hotels and restaurants, is also expanding as businesses recognize the importance of oral care in customer service. Healthcare facilities are seeing increased demand for specialized products, reflecting a broader focus on preventive care and professional dental services.

The Saudi Arabia Oral Care Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble (Oral-B, Crest), Colgate-Palmolive, Unilever (Signal, Pepsodent, Closeup), Johnson & Johnson (Listerine, Reach), GlaxoSmithKline (Sensodyne, Parodontax), Henkel (Theramed), Church & Dwight (Arm & Hammer), Reckitt Benckiser (Dentyl), GC Corporation, Lion Corporation, Sunstar Group (GUM), Dabur (Miswak, Herbal Toothpaste), Himalaya Wellness Company, Saudi German Health (local distributor/brand), and Al-Dawaa Pharmacies (private label, major local retailer) contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabian oral care products market is poised for significant transformation, driven by technological advancements and changing consumer preferences. The rise of e-commerce platforms is expected to enhance product accessibility, while the growing trend towards sustainability will influence product development. Additionally, the increasing collaboration between brands and dental professionals will likely lead to more effective marketing strategies, fostering consumer trust and encouraging the adoption of innovative oral care solutions tailored to individual needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Toothpaste Toothbrushes Manual Toothbrushes Electric Toothbrushes Battery-powered Toothbrushes Mouthwash/Rinse Medicated Mouthwash Non-medicated Mouthwash Dental Floss Denture Products Cleaners Fixatives Dental Accessories (e.g., tongue scrapers, oral irrigators, chewing gum, fresh breath strips) Whitening Products Specialty Products (e.g., children's oral care, sensitive teeth products) Others |

| By End-User | Residential Commercial Healthcare Facilities (e.g., dental clinics, hospitals) Educational Institutions Others |

| By Distribution Channel | Supermarkets/Hypermarkets Pharmacies and Drug Stores Online Retail Stores Convenience Stores Specialty Stores Others |

| By Price Range | Economy Mid-Range Premium Luxury Others |

| By Packaging Type | Tube Bottle Box Blister Pack Others |

| By Brand Type | Local Brands International Brands Private Labels Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Gender Income Level Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Oral Care Preferences | 120 | General Consumers, Health-Conscious Individuals |

| Dental Professional Insights | 60 | Dentists, Dental Hygienists |

| Retailer Perspectives on Oral Care Products | 40 | Pharmacy Managers, Supermarket Buyers |

| Market Trends in Oral Care | 50 | Market Analysts, Industry Experts |

| Consumer Attitudes towards Eco-Friendly Products | 70 | Environmentally Conscious Consumers, Millennials |

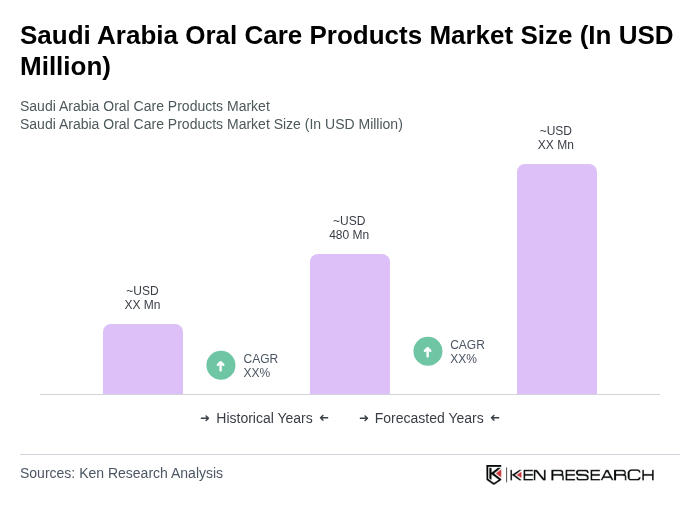

The Saudi Arabia Oral Care Products Market is valued at approximately USD 480 million, reflecting a significant growth driven by increased consumer awareness of oral hygiene, rising disposable incomes, and a higher prevalence of dental issues among the population.