Region:Global

Author(s):Dev

Product Code:KRAD0448

Pages:80

Published On:August 2025

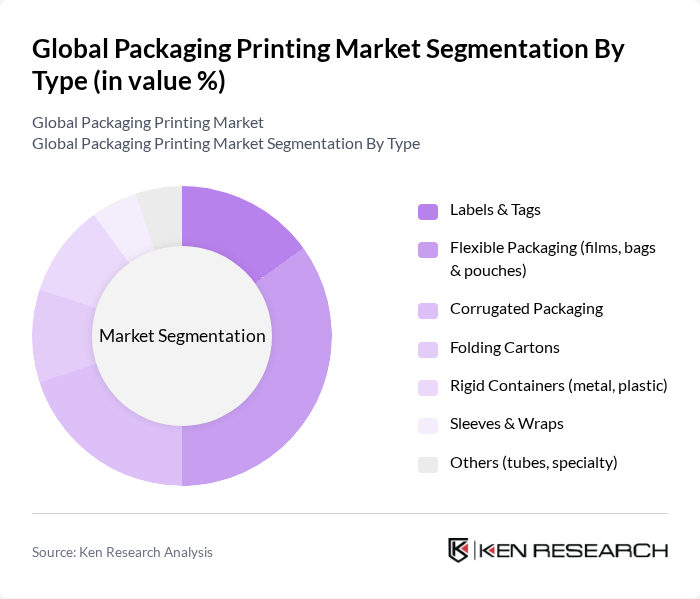

By Type:The packaging printing market is segmented into various types, including Labels & Tags, Flexible Packaging (films, bags & pouches), Corrugated Packaging, Folding Cartons, Rigid Containers (metal, plastic), Sleeves & Wraps, and Others (tubes, specialty). Among these, Flexible Packaging has emerged as a dominant segment due to its versatility, lightweight nature, and ability to extend product shelf life. The increasing demand for convenience and ready-to-eat food products, coupled with advances in high-barrier mono-material structures and digital/flexo short runs, has further propelled the growth of this segment.

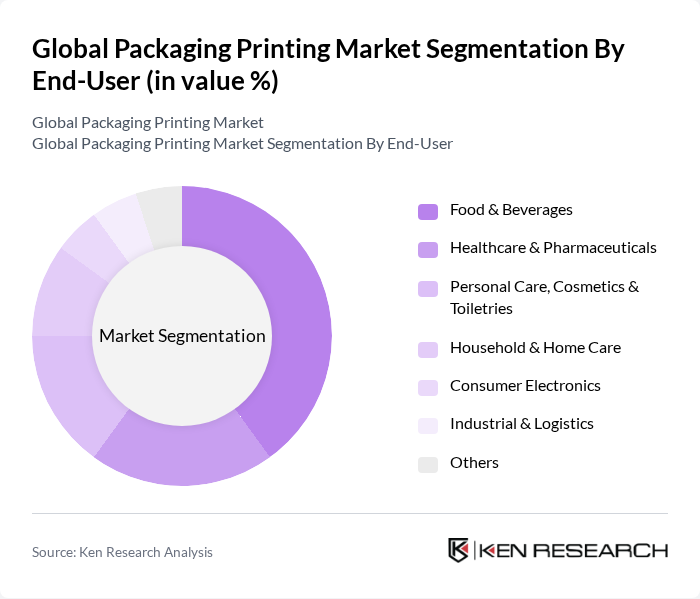

By End-User:The end-user segmentation of the packaging printing market includes Food & Beverages, Healthcare & Pharmaceuticals, Personal Care, Cosmetics & Toiletries, Household & Home Care, Consumer Electronics, Industrial & Logistics, and Others. The Food & Beverages segment holds a significant share due to the increasing demand for packaged foods, beverages, and private-label offerings; growth in e-commerce and direct-to-consumer has expanded needs for labels, corrugated, and digitally personalized packaging. Pharmaceutical and personal care applications continue to adopt serialized, compliant, and premiumized printing features, supporting higher-value print technologies.

The Global Packaging Printing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Mondi plc, DS Smith Plc, Smurfit Kappa Group plc, WestRock Company, International Paper Company, Graphic Packaging Holding Company, Huhtamaki Oyj, Sealed Air Corporation, Berry Global, Inc., Ball Corporation, Crown Holdings, Inc., Tetra Pak International S.A., Avery Dennison Corporation, CCL Industries Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the packaging printing market appears promising, driven by technological innovations and a growing emphasis on sustainability. As digital printing technologies advance, companies will increasingly adopt these solutions to meet consumer demands for customization and eco-friendly options. Additionally, the integration of smart packaging solutions will enhance product tracking and consumer engagement, further propelling market growth. The focus on sustainable practices will likely lead to new partnerships and collaborations, fostering innovation and expanding market reach.

| Segment | Sub-Segments |

|---|---|

| By Type | Labels & Tags Flexible Packaging (films, bags & pouches) Corrugated Packaging Folding Cartons Rigid Containers (metal, plastic) Sleeves & Wraps Others (tubes, specialty) |

| By End-User | Food & Beverages Healthcare & Pharmaceuticals Personal Care, Cosmetics & Toiletries Household & Home Care Consumer Electronics Industrial & Logistics Others |

| By Material | Paper & Paperboard Plastics (PE, PP, PET, others) Metal (aluminum, steel) Glass Bioplastics & Compostables Others |

| By Printing Technology | Flexographic Printing Gravure Printing Digital Printing (inkjet, electrophotography) Offset Lithography Screen Printing Hybrid & Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Distribution Channel | Direct (OEM to Brand Owner/Converter) Converters & Trade Printers Distributors/Resellers Online Procurement Platforms Retail/Print Shops Others |

| By Price Range | Economy Mid-range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Flexible Packaging Printing | 110 | Production Managers, Quality Control Supervisors |

| Label Printing for Consumer Goods | 90 | Brand Managers, Marketing Directors |

| Corrugated Packaging Solutions | 70 | Supply Chain Managers, Operations Directors |

| Digital Printing Technologies | 100 | Technical Directors, R&D Managers |

| Sustainable Packaging Initiatives | 60 | Sustainability Officers, Product Development Managers |

The Global Packaging Printing Market is valued at approximately USD 420 billion, reflecting sustained demand driven by e-commerce, FMCG, and retail channels, alongside a growing preference for sustainable packaging solutions.