Region:Asia

Author(s):Dev

Product Code:KRAD3258

Pages:93

Published On:November 2025

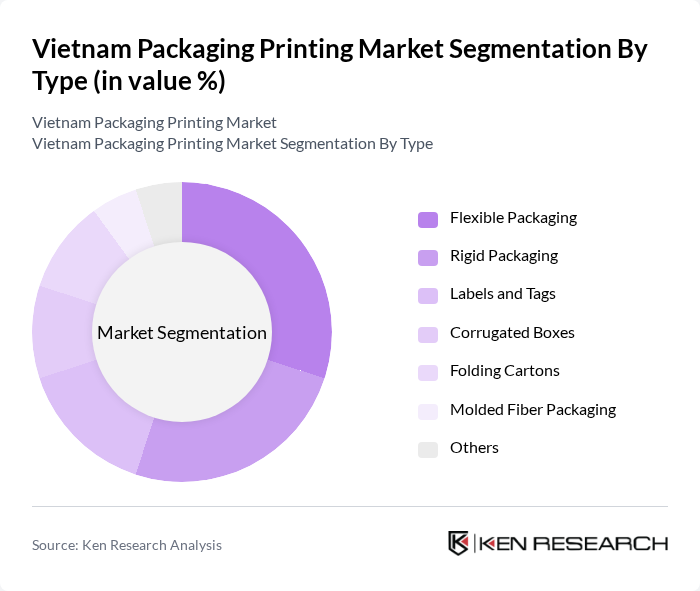

By Type:The market is segmented into flexible packaging, rigid packaging, labels and tags, corrugated boxes, folding cartons, molded fiber packaging, and others. Each subsegment addresses distinct requirements across consumer and business applications, with flexible packaging leading due to its versatility, lightweight properties, and cost-effectiveness. Flexible packaging is widely adopted in food and beverage, personal care, and pharmaceutical sectors, supporting freshness, shelf life, and convenience. The ongoing trend toward convenience and on-the-go consumption continues to propel demand for flexible packaging solutions .

Flexible packaging remains the leading subsegment, driven by its ability to preserve product freshness, extend shelf life, and offer lightweight, cost-effective solutions. The segment is particularly prominent in food and beverage applications, where convenience and portability are critical. The rise of micro-runs and personalization in digital printing further enhances the appeal of flexible packaging for manufacturers and consumers .

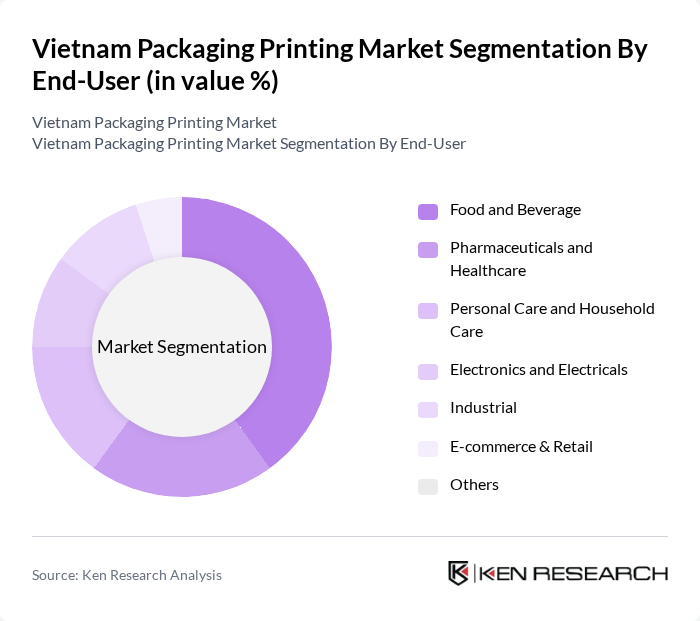

By End-User:End-user segmentation includes food and beverage, pharmaceuticals and healthcare, personal care and household care, electronics and electricals, industrial, e-commerce & retail, and others. Each sector has unique packaging requirements that shape market dynamics. The food and beverage sector is the dominant end-user, accounting for the largest share due to rising consumer preference for packaged food products, convenience, and the growth of online grocery shopping. Effective branding and product differentiation in a competitive market further drive demand for innovative packaging solutions in this sector .

The food and beverage sector is the leading end-user segment, supported by robust agricultural exports, processed-food consumption, and the expansion of aseptic technology for shelf-stable products. Online grocery shopping and the need for effective branding drive further innovation in packaging printing for this sector .

The Vietnam Packaging Printing Market features a dynamic mix of regional and international players. Leading participants such as Tetra Pak Vietnam, Amcor Vietnam, Huhtamaki (Vietnam) Ltd., Dong Hai Joint Stock Company of Bentre (Dohaco), Tan Tien Plastic Packaging JSC (Tapack), An Phat Holdings, Saigon Paper Corporation, Goldsun Packaging & Printing JSC, Liksin Corporation, Vina Kraft Paper Co., Ltd., Oji Interpack Vietnam Co., Ltd., SCG Packaging (Vietnam) Co., Ltd., Song Lam Trading & Packaging Production JSC, Sovi Packaging JSC, International Paper (Vietnam) Co., Ltd. drive innovation, geographic expansion, and service delivery in the market .

The Vietnam packaging printing market is expected to evolve significantly, driven by technological advancements and changing consumer preferences. The integration of smart packaging solutions, which enhance product tracking and consumer engagement, is anticipated to gain traction. Additionally, the focus on sustainability will likely lead to increased investments in eco-friendly materials and processes. As the e-commerce sector continues to expand, packaging solutions will need to adapt, emphasizing efficiency and customization to meet diverse consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Flexible Packaging Rigid Packaging Labels and Tags Corrugated Boxes Folding Cartons Molded Fiber Packaging Others |

| By End-User | Food and Beverage Pharmaceuticals and Healthcare Personal Care and Household Care Electronics and Electricals Industrial E-commerce & Retail Others |

| By Material | Plastic (PE, PP, PET, etc.) Paper & Paperboard (Corrugated Board, Kraft Paper, Carton Board) Metal Glass Molded Pulp Others |

| By Printing Technology | Flexographic Printing Gravure Printing Digital Printing Offset Printing Screen Printing Others |

| By Distribution Channel | Direct Sales Online Sales Retail Sales Distributors Others |

| By Region | Northern Vietnam (Red River Delta, Hanoi) Central Vietnam (South Central Coast) Southern Vietnam (Southeast, Ho Chi Minh City, Mekong River Delta) |

| By Application | Packaging for Food Products Packaging for Non-Food Products Industrial Packaging Retail Packaging Export Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Packaging | 120 | Packaging Managers, Quality Assurance Officers |

| Pharmaceutical Packaging Solutions | 100 | Regulatory Affairs Specialists, Production Managers |

| Consumer Goods Packaging Trends | 120 | Brand Managers, Marketing Directors |

| Eco-friendly Packaging Initiatives | 80 | Sustainability Coordinators, Product Development Managers |

| Labeling and Printing Technologies | 90 | Technical Directors, Operations Managers |

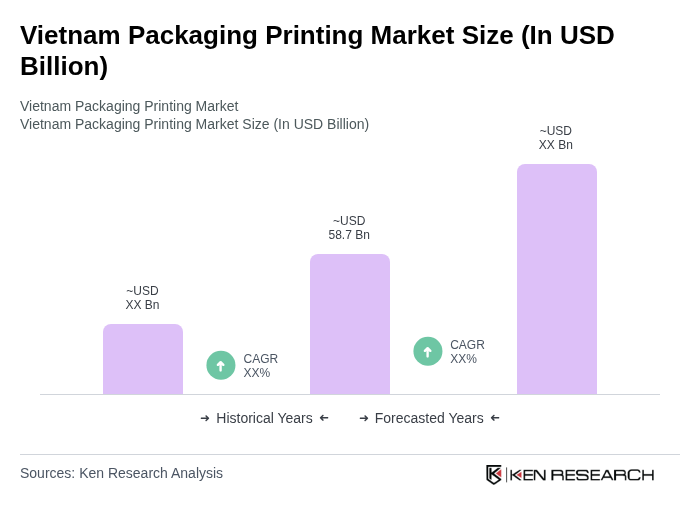

The Vietnam Packaging Printing Market is valued at approximately USD 58.7 billion, driven by increasing demand for packaged goods, particularly in the food and beverage sector, and the rapid growth of e-commerce.