Region:Global

Author(s):Rebecca

Product Code:KRAA2890

Pages:91

Published On:August 2025

Equipment Market.png)

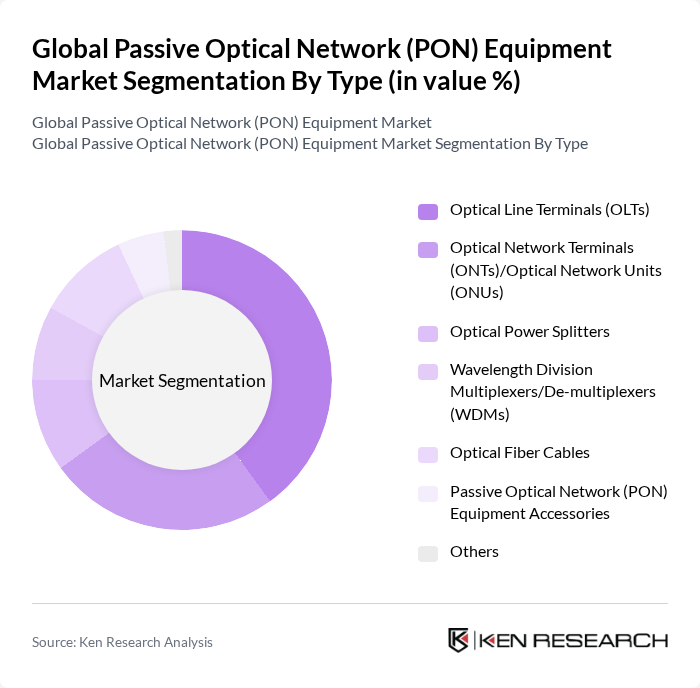

By Type:The segmentation by type includes various components essential for the functioning of passive optical networks. The dominant sub-segment in this category is Optical Line Terminals (OLTs), which serve as the central point in a PON architecture, managing data traffic and ensuring efficient communication between the service provider and end-users. The increasing demand for high-speed internet and the expansion of fiber optic networks have significantly boosted the adoption of OLTs, making them a critical component in the market. OLTs are pivotal in supporting FTTH (Fiber-to-the-Home) and next-generation broadband services, enabling scalable and efficient last-mile connectivity.

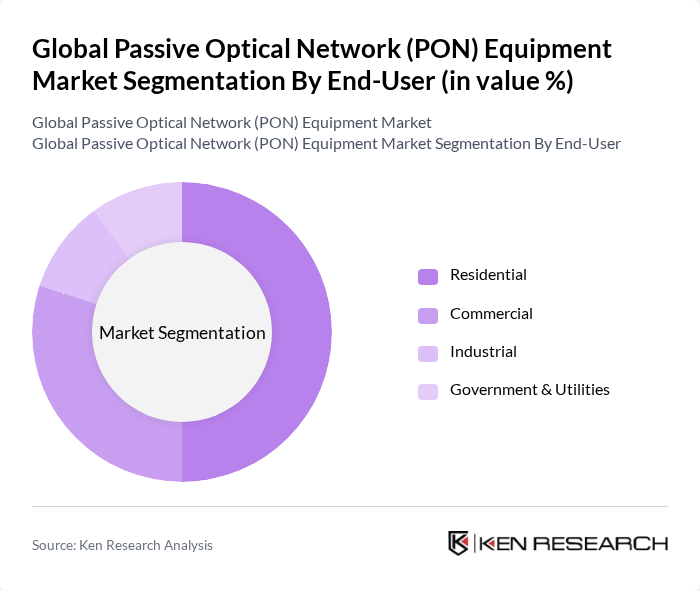

By End-User:The end-user segmentation highlights the various sectors utilizing passive optical network equipment. The residential segment is the leading sub-segment, driven by the increasing demand for high-speed internet and the proliferation of smart home devices. As more households seek reliable and fast internet connections, service providers are investing heavily in PON technologies to meet consumer expectations, thereby solidifying the residential segment's dominance in the market. Commercial and industrial sectors are also expanding their adoption of PON equipment to support data centers, enterprise connectivity, and smart infrastructure.

The Global Passive Optical Network (PON) Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Huawei Technologies Co., Ltd., Nokia Corporation, Cisco Systems, Inc., ZTE Corporation, ADTRAN, Inc., Calix, Inc., FiberHome Technologies Group, DASAN Zhone Solutions, Inc., Mitsubishi Electric Corporation, NEC Corporation, CommScope Holding Company, Inc., Infinera Corporation, Ciena Corporation, Tellabs, Inc., ARRIS International plc, Allied Telesis Holdings K.K., Sumitomo Electric Industries, Ltd., Iskratel, d.o.o., Zyxel Communications Corp., Fujitsu Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the PON equipment market appears promising, driven by technological advancements and increasing investments in digital infrastructure. As governments prioritize broadband access, particularly in underserved areas, the demand for PON solutions is expected to rise. Additionally, the integration of AI and machine learning in network management will enhance operational efficiency, making PON systems more attractive to service providers. This evolving landscape will likely foster innovation and create new opportunities for market players.

| Segment | Sub-Segments |

|---|---|

| By Type | Optical Line Terminals (OLTs) Optical Network Terminals (ONTs)/Optical Network Units (ONUs) Optical Power Splitters Wavelength Division Multiplexers/De-multiplexers (WDMs) Optical Fiber Cables Passive Optical Network (PON) Equipment Accessories Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | FTTH (Fiber to the Home) FTTB (Fiber to the Building) FTTC (Fiber to the Curb) Mobile Backhaul Enterprise Connectivity |

| By Component | Hardware Software Services |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Pricing Model | Subscription-Based One-Time Purchase Leasing |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Service Providers | 100 | Network Engineers, Operations Managers |

| Residential Fiber Optic Users | 60 | Homeowners, IT Managers |

| Commercial PON Deployments | 50 | Facility Managers, IT Directors |

| Government and Regulatory Bodies | 40 | Policy Makers, Regulatory Analysts |

| PON Equipment Manufacturers | 40 | Product Managers, Sales Directors |

The Global Passive Optical Network (PON) Equipment Market is valued at approximately USD 15.5 billion, driven by the increasing demand for high-speed internet connectivity and the expansion of fiber optic networks across various sectors.