Region:Global

Author(s):Rebecca

Product Code:KRAC2577

Pages:95

Published On:October 2025

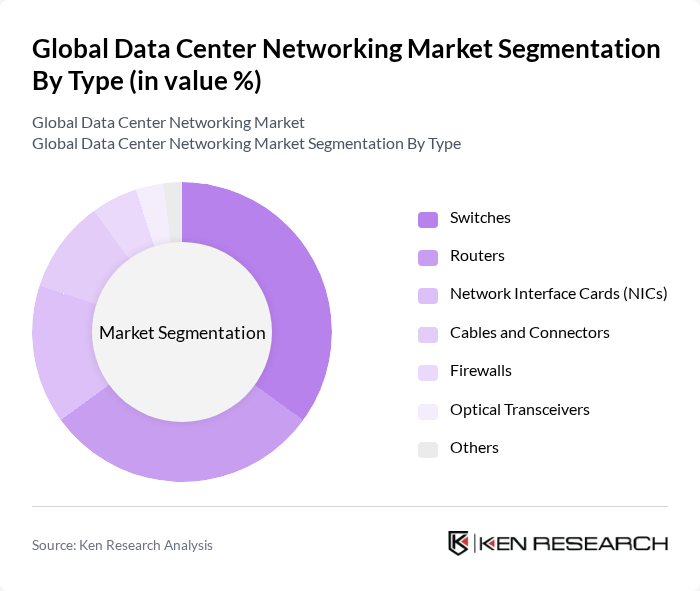

By Type:The market is segmented into various types, including Switches, Routers, Network Interface Cards (NICs), Cables and Connectors, Firewalls, Optical Transceivers, and Others. Among these, Switches and Routers are the most significant contributors, driven by the increasing need for efficient data traffic management and connectivity in data centers. The demand for high-speed data transfer and network reliability is pushing the adoption of advanced switching and routing technologies.

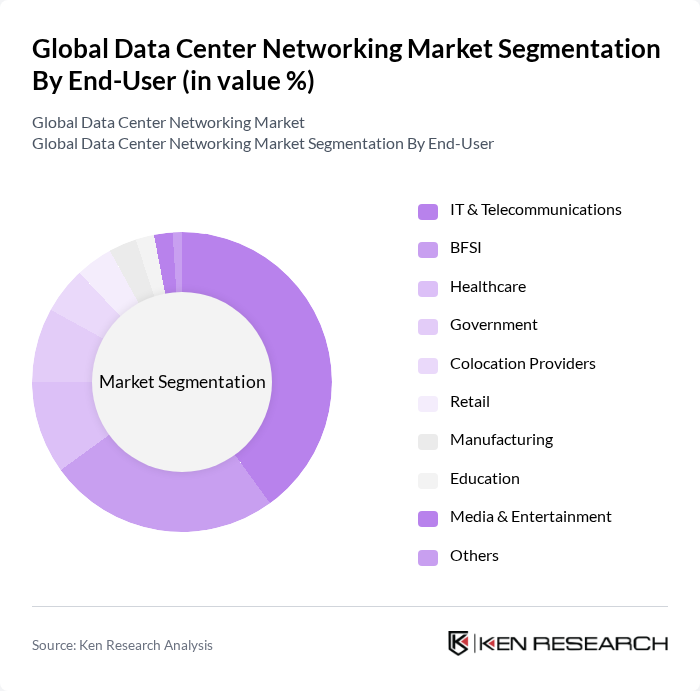

By End-User:The end-user segmentation includes IT & Telecommunications, BFSI, Healthcare, Government, Colocation Providers, Retail, Manufacturing, Education, Media & Entertainment, and Others. The IT & Telecommunications sector leads the market, driven by the increasing demand for data processing and storage solutions. The BFSI sector follows closely, as financial institutions require robust networking solutions to ensure data security and compliance.

The Global Data Center Networking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Inc., Arista Networks, Inc., Juniper Networks, Inc., Hewlett Packard Enterprise (HPE), Dell Technologies Inc., Extreme Networks, Inc., NVIDIA Corporation (formerly Mellanox Technologies), Huawei Technologies Co., Ltd., Netgear, Inc., Brocade Communications Systems, Inc. (now part of Broadcom Inc.), Cumulus Networks, Inc. (now part of NVIDIA Corporation), ZTE Corporation, Nokia Corporation, International Business Machines Corporation (IBM), VMware, Inc., Broadcom Inc., Fortinet, Inc., Palo Alto Networks, Inc., Amazon Web Services, Inc., Microsoft Corporation, Google LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the data center networking market is poised for transformative growth, driven by technological advancements and evolving business needs. As organizations increasingly adopt hybrid cloud solutions, the demand for integrated networking systems will rise. Furthermore, the emphasis on automation and AI-driven management tools will enhance operational efficiency, enabling data centers to adapt swiftly to changing demands. The focus on sustainability will also shape future investments, as companies seek to reduce their carbon footprint while optimizing performance.

| Segment | Sub-Segments |

|---|---|

| By Type | Switches Routers Network Interface Cards (NICs) Cables and Connectors Firewalls Optical Transceivers Others |

| By End-User | IT & Telecommunications BFSI Healthcare Government Colocation Providers Retail Manufacturing Education Media & Entertainment Others |

| By Application | Data Storage Data Processing Network Security Cloud Computing Edge Computing AI/ML Workloads Others |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Retail Wholesale E-commerce |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Colocation Data Centers | 40 | Data Center Managers, Operations Directors |

| Cloud Service Providers | 40 | Network Architects, IT Infrastructure Leads |

| Telecommunications Data Centers | 40 | Network Engineers, Technical Operations Managers |

| Enterprise Data Center Networking | 40 | IT Managers, Chief Technology Officers |

| Edge Computing Facilities | 40 | Product Development Managers, Systems Architects |

The Global Data Center Networking Market is valued at approximately USD 35 billion, reflecting a significant growth driven by the increasing demand for cloud services, big data analytics, and enhanced network security solutions.