Region:Global

Author(s):Dev

Product Code:KRAD0347

Pages:81

Published On:August 2025

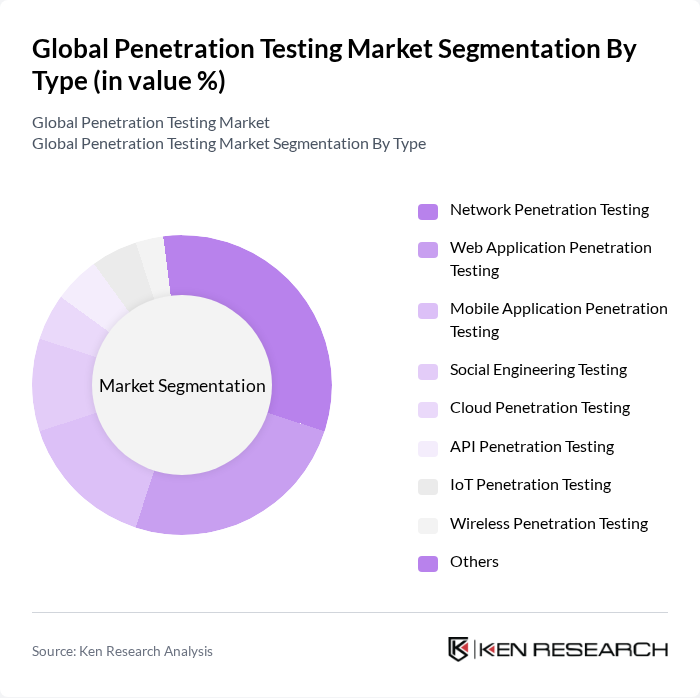

By Type:The penetration testing market is segmented into Network Penetration Testing, Web Application Penetration Testing, Mobile Application Penetration Testing, Social Engineering Testing, Cloud Penetration Testing, API Penetration Testing, IoT Penetration Testing, Wireless Penetration Testing, and Others. Network Penetration Testing remains the leading sub-segment, driven by the growing number of network vulnerabilities and the critical need for organizations to secure their networks against unauthorized access and data breaches. The increasing complexity of enterprise networks and the proliferation of remote work have further elevated the importance of network-focused assessments .

By End-User:The market is also segmented by end-user categories, including Large Enterprises, Small & Medium Enterprises (SMEs), Government & Defense, Healthcare, Retail & E-commerce, IT & Telecom, BFSI, Education, and Others. The BFSI sector is a major end-user segment, driven by stringent regulatory requirements and the critical need for safeguarding sensitive financial data against cyber threats. Large enterprises and government & defense also represent significant demand, reflecting the high value of their digital assets and the increasing sophistication of targeted attacks .

The Global Penetration Testing Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Security, Rapid7, Inc., Tenable, Inc., Trustwave Holdings, Inc., Qualys, Inc., Check Point Software Technologies Ltd., McAfee, LLC, Veracode, Inc., Synopsys, Inc., Coalfire Systems, Inc., Secureworks Corp., NCC Group plc, A-LIGN, Bishop Fox, Offensive Security contribute to innovation, geographic expansion, and service delivery in this space.

The future of the penetration testing market is poised for significant evolution, driven by technological advancements and increasing cybersecurity awareness. Organizations are expected to adopt continuous testing methodologies, integrating security into their development processes. Additionally, the rise of AI and machine learning will enhance the efficiency of penetration testing, enabling faster identification of vulnerabilities. As businesses prioritize cybersecurity, the demand for innovative solutions and skilled professionals will continue to grow, shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Penetration Testing Web Application Penetration Testing Mobile Application Penetration Testing Social Engineering Testing Cloud Penetration Testing API Penetration Testing IoT Penetration Testing Wireless Penetration Testing Others |

| By End-User | Large Enterprises Small & Medium Enterprises (SMEs) Government & Defense Healthcare Retail & E-commerce IT & Telecom BFSI Education Others |

| By Industry Vertical | BFSI Manufacturing Energy & Utilities Transportation & Logistics Media & Entertainment Healthcare Government Others |

| By Service Model | On-Premises Cloud-Based Hybrid |

| By Deployment Type | Managed Services Professional Services |

| By Geography | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Subscription-Based Pay-Per-Use Project-Based |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Penetration Testing | 100 | IT Security Managers, Compliance Officers |

| Healthcare Cybersecurity Assessments | 80 | Network Security Analysts, Risk Management Directors |

| Retail Sector Vulnerability Assessments | 60 | IT Managers, Cybersecurity Consultants |

| Government Agency Security Testing | 50 | Information Security Officers, IT Auditors |

| Technology Sector Penetration Testing | 90 | DevOps Engineers, Security Architects |

The Global Penetration Testing Market is valued at approximately USD 2.45 billion, reflecting significant growth driven by increasing cyber threats, regulatory requirements, and the adoption of advanced technologies like AI and cloud computing.